The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

I see 16 18 24 formed a W bottom (16 is not an obvious choice for W first push but I’ve seen Al marked a similar W couples of time before). Therefore, it’s a possible BL BO W PB to MA, isn’t it?

I also see it as an ET. Is this right?

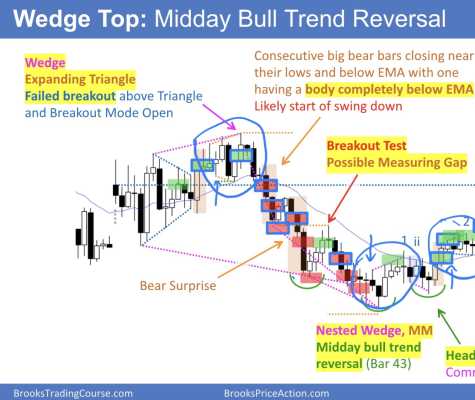

Also we are having a W top 4 17 18 and W top 12 17 18, but the small DD 23 is a pause which make me thinking 21-25 is a possible end of the 2LSD which I think is valid anticipation since small sideway 2LSD correction is a sign of strong bull trend (am I correct in saying this? And correct in applying this in this particular instance?)

Lastly, 25 BLB CNH so it’s a strong signal bar. However, this signal bar wasn’t marked:

Any idea anyone?

I'm guessing you bought 25 and now want to know why it didn't work?

1) It was in the upper 1/3rd of a trading range so low probability.

2) If you do buy, it can't be for a scalp, this had to be a bet on big BO of range because buying into top of TRs is very very low probability so you need to up the reward and bet on the BO:

Possible Management:

- Exit immediately if not working, like below 27.

- If the range is very big, like already almost ATR of average day, then little probability of BO to the downside for MM, so can be willing to scale in lower, even at bottom of TR.

3) You saw a W 16,18,24 but that's really fudging the price action to justify that TL. It needs to look like a push down and a good bull bar like that, even though it had a tail, isn't going to convince many bulls that there's a TL there. Al didn't mark it.

4) It was actually nested wedges (Al marked them) 2,16,20 and 12,16,20 into top of TR reduces probability of higher prices even further.

5) Al didn't mark 25 buy because the signal bar was 24 big bear so not many bulls would have entered anyways.

----------------

Have more questions? Let's chat in realtime:

https://bit.ly/3cGrh2

Hi Carpét,

Thanks for your answer.

I'm guessing you bought 25 and now want to know why it didn't work?

I’m just looking for the reason why it was not marked as a reasonable swing.

1) It was in the upper 1/3rd of a trading range so low probability.

At this point in time, I think it was still a possible BO PB to MA. Why we should see this as top trading range, not even considering possible pull back to MA?

3) You saw a W 16,18,24 but that's really fudging the price action to justify that TL

That makes sense but I saw Al marked W similarly from time to time. What do you think of the following examples?

4) It was actually nested wedges (Al marked them) 2,16,20 and 12,16,20 into top of TR reduces probability of higher prices even further.

Yes, and what I want to ask about this is:

> but the small DD 23 is a pause which make me thinking 21-25 is a possible end of the 2LSD which I think is valid anticipation since small sideway 2LSD correction is a sign of strong bull trend (am I correct in saying this? And correct in applying this in this particular instance?)

into top of TR reduces probability of higher prices even further.

Again, why at this point in time we should see this as top trading range, not possible pull back to MA?

5) Al didn't mark 25 buy because the signal bar was 24 big bear so not many bulls would have entered anyways.

I also saw Al did this many times:

Another resource for Al's thoughts on this day:

Brooks Price Action - 02-15-2022 Tuesday

Limit order market on b25, therefore a stop order wasn't marked.

Notice gaps closed on b24, one is the close of b2. Can you find the other?

In trends gaps stay open, in ranges they close as they did here. Look at the bar closes and ignore the wicks when finding gaps

Gaps were closed so less likely for trend. That makes sense. Thanks!