The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

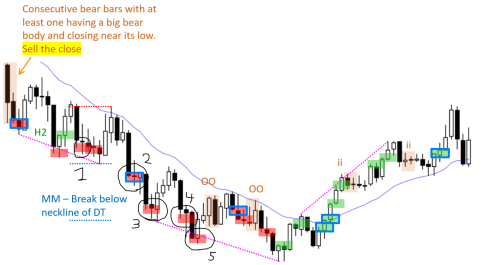

Below is my version of the Daily Setups chart from 7/27/21. I have circled in black five shorts I thought would be reasonable swing trades, but Al did not mark them on his version. My general premise behind selling each of these was that the day had been in a bear channel, so selling below strong bear bars closing on their lows was acceptable.

For my first sell in question, I see it was a third push down in a wedge that was forming so I'm assuming this is why this trade should be avoided, but from my observation, Al will sometimes mark trades like this as being reasonable, so I'm unsure when this is and isn't an acceptable trade. I'm uncertain why the remaining four trades I circled are not reasonable. Could someone please explain what I'm missing? Thanks!

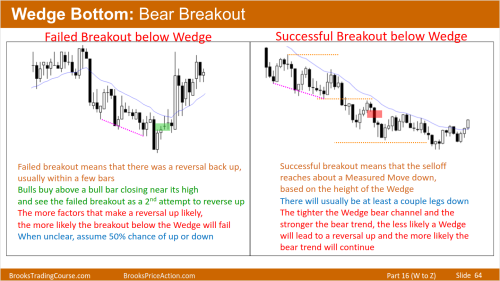

Looks like a bear leg in TR, bull are making money with limit orders, so market could revert soon, besides the trades 3, 4 and 5 are around a Measure Move. Trade 2 is reasonable in my opinion, consecutive bear bars breaking a trading range (follow-through bar is a doji, but it is a bear bar, which is the minimum for always in short case), in hindsight it gave two legs, 10 bars and 2x times actual risk. But the trade 2 could have failed too, remember: when price break a wedge, 50% chance the breakout will fail and revert, 50% the breakout will be successful and have follow-through from a measure move. Since we have a decent bar for always in short, it is logical expect a successful breakout.

Hi,

Regarding the 1st black circled trade, Al said something along the line that he would not take (sell in this case) the trade when it possiblely develop into 3rd push of a W. In this case, we had good buying pressure from the pullback of both 1st and 2nd push. Bulls has been buying forming consercutive big bull bars closing on high so that posibilitive was very real.

I’m not really sure about the other black circled trades, but seeing continueing accumulation of buying pressure, I think it was better to sell the pull back rather than STC since it was not a strong bear trend.

The double top at MA between 1 and 2 would have been a reasonable entry though.

Thanks for the detailed response Water Buffalo! Great explanation and that makes sense for Trades 1 & 2. But I'm still confused about why Trades 3-5 are not reasonable. Do you have any thoughts on these?

Hi PeanutTrader,

I’m not really sure because my focus is on trading the open so things into middle of the day is less clear to me. However, a few things might help:

- Constantly thinking what kind of the day this is. At point 3, we’ve seen buying pressure, BO bellow W, DD FT, BLD FT. Doesn’t look like strong trend. Not a selling for any reason type of day. Not very high probability to STC.

- 3 was not even a STC setup. It was 4 bars BO with 2 DD in the middle.

- At 4-5, the market maintained the same context, with added buying pressure on the leg up from 3. So still not a good STC near the low of the day. Also we had just had a L1 setup triggered. Trend tend to be weaker overtime, so higher probability to take L2 next.

STC: Sell The Close bear trend so traders will sell the close of bear bar closing near its low or sell below bear bar that closes near its low

Hope it help! Cheers!

Like Marx and Water Buffalo pointed out, the pullbacks are too frequent and too much although not 5 bars. Looks like a bear in leg in what will become a TR. If it does, you'd be better placed to sell high, meaning either on pullbacks or reversals from those pullbacks.

3 is near MM target, so traders expect profit taking. Better to wait before selling.

4 is a big bear bar, you're risking a lot on a trade that might not have a lot of profit potential remaining. Better to avoid. This is still the most reasonable among the 3 although I would not take it.

5 is a short below a terrible bar and near the bottom. Traders are not expecting below a bear channel and would look to scalp hoping for a pullback.

Also note, that the market is not strongly bearish but didn't have 3 bars with highs above the EMA. Traders expect the market to have 3 highs above the EMA and a close above the EMA.

Does that clarify your doubt?