The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello Community,

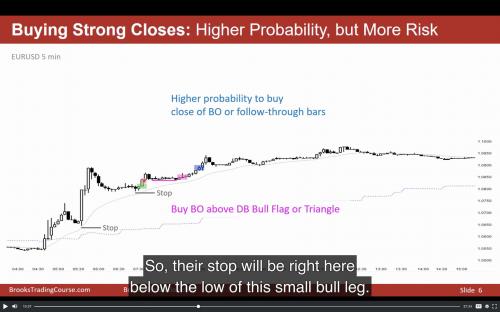

In this video at 10:26, Al says "Once you get a series of bull bars -3, 4, 5 consecutive bull bars, even though they'er strong, traders will raise their stop up to below the most recent bull breakout. So, their stop will be right here below the low of this small bull leg."

My question is, Is not the pink line "below the most recent bull breakout" after you get a these series of bull bars ?

Here is interpretation.

- If the 3 consecutive bull bars as BO above DB Bull Flag (about 7:00) are reliable BO to put stop, the "3, 4, 5 bull bars" are also reliable BO.

- Once price gets below the pink price, it doesn't looks like Always In Long for me. I think I'm going to trade like TR, or stop trading for while.

- I do use gray stop about 5:30 if I buy top of 3 bull bars about 7:00. That is correct stop for me.

- In this video at 9:26, Al explains where the stop should be placed and I understand all except first one which is most close to the stop (see attached image). That is skank stop for me...

- Ok, let's say the "3, 4, 5 consecutive bull bars" are not most recent BO but current. But if so how could this ↑ is happen? What context (or momentum) am I missing?

I tend to use tighter stop like as beginners do and get killed like a skank in good entry trade, so I need to know the difference between these two stops (Gray at 7:00 and Pink Line) to fix this inadequate and survive.

Thank you.

Once price gets below the pink price, it doesn't looks like Always In Long for me. I think I'm going to trade like TR, or stop trading for while.

I think this is where you went wrong. The MKT remains AIL until you get below a major low so going below your pink line does not change the PA to TR PA and therefore the stop should never be there.

I do use gray stop about 5:30 if I buy top of 3 bull bars about 7:00. That is correct stop for me.

This is exactly what Al explains.

in this video at 9:26, Al explains where the stop should be placed and I understand all except first one which is most close to the stop (see attached image). That is skank stop for me...

Sorry, not sure what stop you are referring to...

I tend to use tighter stop like as beginners do and get killed like a skank in good entry trade, so I need to know the difference between these two stops (Gray at 7:00 and Pink Line) to fix this inadequate and survive.

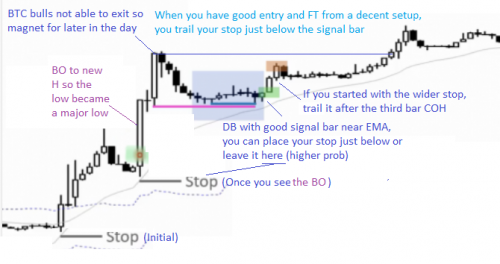

Once you get a BO, you trail your stop. So if you bought the 5:30 BO, your initial stop was below the leg starting around 4:30 but once your see the 1 bar BO, you move your stop to just below it. Due to the strenght of the bar, only with one bar you can move the stop.

Then you buy the 7:00 BO, so your initial stop should be below 5:30 BO but, after the third medium size and closing-on-the-high bar, you can trail your stop just below the first bar of the BO.

Thank you for your reply.

I think my problem is that I can't tell the difference between major low and minor low. (I am looking for the videos to get a better understanding)

3 bull bars around 7:00 is strong enough to buy and raise your stop.

But, "3, 4, 5 bull bars" around 8:30 is strong only enough to buy and not to raise your stop.

Am I correct? If so, How can I tell? Which PA or hallmarks should I focus on? Bar size? maybe?

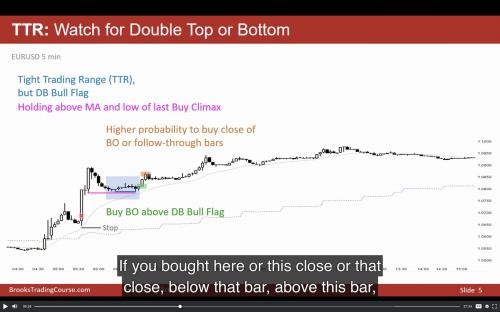

Sorry, I attached new image.

If I bought the red pointed price, should I put stop gray level?

I would place stop bottom of Bull leg 4:00 and raise my stop after the bar closed on high with big body as you mentioned.

Al didn't go detail at this time so I guess If Al meant,

"If you bought above the bull bar at Micro Wedge Bottom": the stop looks like a skank

"If you bought after you see price is going up strongly": the stop seems correct

I am not sure it's big deal or not, I just to want to know the better and profitable way to trade.

think my problem is that I can't tell the difference between major low and minor low. (I am looking for the videos to get a better understanding)

Major and minor lows are explained in video 45B.

3 bull bars around 7:00 is strong enough to buy and raise your stop.

But, "3, 4, 5 bull bars" around 8:30 is strong only enough to buy and not to raise your stop.

Am I correct? If so, How can I tell? Which PA or hallmarks should I focus on? Bar size? maybe?

After 3 strong bull bars I would move the stop tho it does not become a major low until you get a new high. You have a strong magnet above yet if the MKT went below your BO bottom I would exit and reassess (see picture below).

If I bought the red pointed price, should I put stop gray level?

I would place stop bottom of Bull leg 4:00 and raise my stop after the bar closed on high with big body as you mentioned.

Yes, your should trail your stop after the BO:

Al didn't go detail at this time so I guess If Al meant,

"If you bought above the bull bar at Micro Wedge Bottom": the stop looks like a skank

"If you bought after you see price is going up strongly": the stop seems correct

Yes, a skunk stop is simply tightening your stop (out of fear) before you should.

Thank you for explaining in detail. It's easy for me to follow. and the video is great.

I think now I figured out why I was confusing.

I was simply (only) thinking that creating new high is the key to raise your stop, and the "3, 4, 5 bull bars" looks like strong enough to put stop below due to the BO made new HH (not sure it's before blue buy), but 3 bull bars 7:00 does not. And also I saw pink price as the beginning of the strong rally.

You gave me a new perspective. Thank you so much.