The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

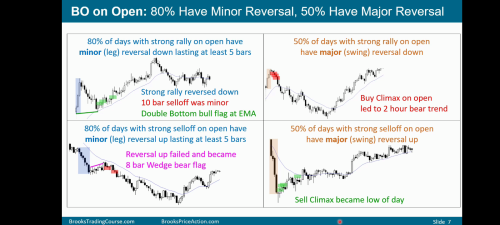

This could be 80% opening BO have reversals, 20% no reversals.

Of the 80% reversals, 50% are major/50% minor

This could be 80% opening BO have reversals, 20% no reversals.

Of the 80% reversals, 50% are major/50% minor

50% of days with strong rally reverse (major reversal). From those that don't get the major reversal, 80% have a minor reversal.

* What clues are evidence to bet against the trend

Same than with any trend. The only difference in the open is that reversals are more abrupt and often come without DTs or DBs that might warn you about the reversal.

Sorry, still unclear.

"BO on open (Bull or Bear): 80% have minor reversal, 50% have major reversal"

I'm trying to get 100% for each statistic. So to separate them:

* BO on open (Bull or Bear): 80% have minor reversal and 20% have...?

* BO on open (Bull or Bear): 50% have major reversal and the other 50% have...?

* BO on open (Bull or Bear): 80% have minor reversal and 20% have...?

... not, so the move keeps trending without looking back.

* BO on open (Bull or Bear): 50% have major reversal and the other 50% have...?

... not, and they become opening reversals.

I'm sorry for reopening this thread but I'm still a bit confused. So GU on open 80% has reversal and 20% it keeps tranding (bull/bear trend from the open). When it has a reversal (which is 80% of the time) 50% is goind to be minor reversal and 50% is going to be major reversal. Is that correct?

In the video Al states that when there is a BO on the open, 80% of the time there will be at least a minor reversal (some of those minor reversals will lead to major reversals). He then states that 50% of days will have major reversals (not 50% of the reversals).

So if there are 10 trading days with a strong BO on the open you would expect:

2 Days (20% of days) with no reversal.

8 Days (80% of days) with at least a minor reversal, but 5 of these days (50% of days) will be major reversals. Therefore 3 days will have only a minor reversal.

Hope that helps with your understanding.