The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Dear all

I have a confusion regarding whether wedges occurring in trading ranges have to be traded the same way as we do in trends or any differently.

Request you to help me with your knowledge and experience regarding it

Hi Ashish,

Here's something interesting about wedges in TRs.

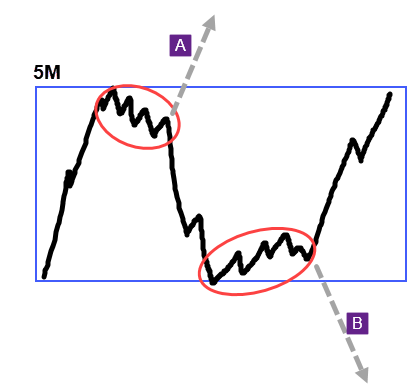

In a strong trend we expect a wedge to be a pullback/flag and for trend to resume (like A). However, if it's a trading range, these bull flags tend to fail to the downside and become strong bear legs (that often end up becoming 2LT). So if seeing a bull flag near top of trading range it's best to not buy it but actually to look for bulls to fail and try to catch a sell.

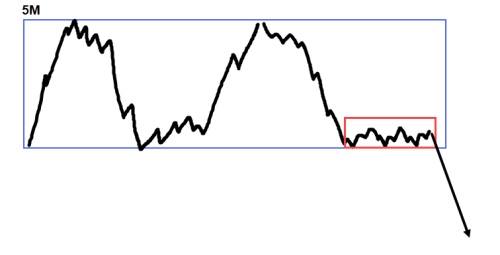

On the other hand, eventually TRs will BO, and wedge pullbacks that are mostly flat and near one side of a TR are often a sign that a BO may be coming (like below). Probably because bulls are showing extreme weakness in not being able to reverse the bear leg for multiple attempts. This is different from a sloping wedge at bottom of TR above where bulls are succeeding at pushing higher and eventually bears give up.

Hope this helped!

CH

_________________

BPA Telegram Chat

Great, you have remarkable clarity on how wedges to be considered in the trading ranges.

It helped me a lot,

Thank you a lot for giving time to reply to my query

Hi

Need your help in one more confusion that I have about wedges.

Wedges generally have 3 touches on one side and at least 2 touches on other side, does it mean we can have 3 touches on up side or down side irrespective of trend being in bull or bear.

Hi, I don't think so because a wedge is the market's attempt to bring the price down (in a bull trend) the market tries 3 times and if it cannot find enough sellers in that particular price range, market goes up to find more sellers which makes a wedge bull flag.

hope it helps.