The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

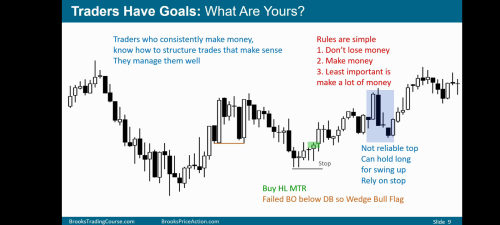

Buy HL MTR.

Why is the blue box not a credible exit point?

Either exit on Bull close for 2x initial risk (3 pushes up +top of TR), or exit on Big Bear close for ≈2x actual risk and early exit to protect from a loss. Entry point is tested 2x.

If either exit, can re enter@Bull reversal Bar DB HHL @end of blue box.

Channel up to the bull close you're talking about is tight. The big bear close you're talking about is the first break of the tight channel trendline. First break despite being a wedge will not reverse the tight channel and at a minimum will test back up to the highest close.

You can argue top of TR but most MTR patterns are. That is not why we take MTR setups. We take the MTR setups expecting a swing up(40%). Also, there is not much selling pressure before the big bear close. Odds are, there are eager bulls waiting to buy any PB since tight channel and many bulls are probably trapped out of the trade. They will use the big bear bar to enter the trade. Also note, the place where you're looking to exit is very close to the major trendline(using the previous two major higher lows)

Al does explain the trade in detail, not sure if you went through the whole section explaining the trade. Like he says, a credible top is not in place yet and most swing traders will stay in the trade.

If either exit, can re enter@Bull reversal Bar DB HHL @end of blue box.

That would be a reasonable thing to do but difficult. If you exit, would you be prepared mentally to enter the trade again? The market is still AIL so re-entering is reasonable if you can do it. However, given how several traders would be entering where you are exiting - does not make a lot of sense to do something like that. If you're trading multiple contracts, you can probably take half or a quarter off and look to re-enter. Smart thing would be to stay in and ride the swing.

Channel up to the bull close you're talking about is tight.

Begins with 7 bar MC, prominent tails, bad follow thru, no consecutive big Bull bars, lots of overlap. Looks like a Bull leg in a TR.

Next 5 bar MC, decent middle 3 bars. Then Big Bear bar closes a gap.

Next is 2 great Bull bars with doji middle, leading to top of TR (Complex leg 1 + complex leg 2 =2nd leg trap?)

You can argue top of TR but most MTR patterns are. That is not why we take MTR setups. We take the MTR setups expecting a swing up(40%).

Swing (2x risk) was achieved @Bull close@ top of TR (+2nd leg trap?).

Also, there is not much selling pressure before the big bear close.

Agree, but big Bear bar before blue box closed a Gap.

Also note, the place where you're looking to exit is very close to the major trendline(using the previous two major higher lows)

Like he says, a credible top is not in place yet and most swing traders will stay in the trade.

I will have to rewatch this, I'm sure you guys are correct.

There's a good argument for 2x initial risk achieved, possible 2nd leg trap@top of TR. MC legs but Bear closed a Gap and broke a (minor?) Trend line. If not exit@Big Bull bar then huge Bear reversal, maybe cut losses@2x actual risk.

This relates to another post I did about never exiting early. There can be lots of missed profits. I guess it's always a difficult decision.

Hypothetical, but I'm 90% sure if I saw this live I would exit on the close of the big bull bar that closes at the high of the immediate TR. It's two legs up, hits the 2:1 RR criteria and even seems a bit exhaustive compared to nearby bars (vacuum test of a previous high?). Whether or not I would get back in or miss the next trade is a different story.

Al says hold? Well, he saw additional bars to the left that we don't see. This looks like a big TR to me, but given more context, a bottom might be move obvious.

Hi,

This is what I think: if we go deeper into the move, we can see what it was not a good idea to sell that big bear bar closing on its low and was a good idea to sell (exit to take profit) at the close of the big bull bar before that.

At 1, we have a W top, resulted in a 2LSD that broke the bull trend line of the move. The 2LSD was ioi, and so a possible FF.

Next we got the biggest bull bar of the entire bull leg broke above the ioi PS FF. And look to the left, we are at top resistance A, so it was possible Vacuum Test of that.

So what do you think one should sell or buy here?

60% chance it was an Exhaustion Gap (EG). EG so odd favor selling. So it was good idea to sell out of long here. It was a sell zone.

Now, the EG is closed. What’s 1st target of EG? The FF right? So is this a buy zone or a sell zone?

BR who shorted would take profit here. If we sell out of long here, we would be doing the opposite of what those (profitable) BR were doing.

In conclusion, in regard to PA exiting point here, I think either exit at the close of the big bull bar, or hold long rely on stop would be the reasonable thing to do. Exiting at the big bear bar was a skunk exit.

Please let me know what you think.

Begins with 7 bar MC, prominent tails, bad follow thru, no consecutive big Bull bars, lots of overlap. Looks like a Bull leg in a TR.

Next 5 bar MC, decent middle 3 bars. Then Big Bear bar closes a gap.

Sure, but have you considered who is making money in this channel(which I claim to be tight)? Do you think bears are able to make money here? They have to scale in higher to get breakeven on their first entry and a scalp profit on their second entry. It is very difficult to do, and does not leave a lot of room for errors. When that's the case, the market is not going to evolve into a TR and bulls will be willing to hold on for a swing.

Next is 2 great Bull bars with doji middle, leading to top of TR (Complex leg 1 + complex leg 2 =2nd leg trap?)

Markets pause at S/R but it depends on its inherent strength as to whether that will be just a PB or a reversal. Everyone sees that bulls get 1:2 at that high and many might be expecting a TR so they take profits, especially when the bar touching the resistance is climactic. The bigger picture however remains - the market is getting a tight bull channel which is part of a broad bull channel and we're near the low of the broad bull channel(not the trendlines you drew). I was talking about the two important lows - LOD and the big HL.

Agree, but big Bear bar before blue box closed a Gap.

The PBs are just 1 bar so far, and the market might be entering a phase of small pullback bull trend(SPBL).

I will have to rewatch this

I did re-watch this video and the explanation is not there. Maybe somewhere else. It becomes very difficult to recall one specific example from where he explained. However, if you go through the entire course - I have seen him explain my previous doubts in the later videos. The coverage is extensive.

There's a good argument for 2x initial risk achieved, possible 2nd leg trap@top of TR. MC legs but Bear closed a Gap and broke a (minor?) Trend line. If not exit@Big Bull bar then huge Bear reversal, maybe cut losses@2x actual risk.

The case is strong for exit on the big bull bar, if you do, you have to be prepared to re-enter the trade. In any case though, exiting on the bear bar does not make sense. With the bear bar, you can at least expect a test of the highest close. When the channel is tight, 2nd leg traps happen with bigger breakouts and isn't usually 1 bar. You can argue, trend channel line overshoot and 75% chance of test back down and that is what actually happened. Bears saw the bulls will take profit and took this opportunity to scalp and were not expecting a swing down - confirmed by the FT bar - barely breaking below the big bear bar and is a doji.

This relates to another post I did about never exiting early. There can be lots of missed profits. I guess it's always a difficult decision.

It sometimes becomes difficult to stay in, I'll concede that. No doubt about it. However, good MTR setups having almost immediate and decent FT usually turn out okay and you get more than 1:2. I have exited my fair share of MTR setups early and regretted it. You only get better with experience and screen time.

In conclusion, in regard to PA exiting point here, I think either exit at the close of the big bull bar, or hold long rely on stop would be the reasonable thing to do. Exiting at the big bear bar was a skunk exit.

Exiting@close of Big Bull bar≈2x initial risk. Exiting@close of Big Bear bar≈2x actual risk. No skunks, but maybe not the best exits.

It sometimes becomes difficult to stay in, I'll concede that. No doubt about it. However, good MTR setups having almost immediate and decent FT usually turn out okay and you get more than 1:2. I have exited my fair share of MTR setups early and regretted it. You only get better with experience and screen time.

Maybe the safe strategy is to exit half@2x initial risk, then rely on the stop. Example> buy 2 contracts@ $10. Exit half@$30= $20 profit. Stopped out on half= -$10. Total trade was +$10.

Maybe the safe strategy is to exit half@2x initial risk, then rely on the stop. Example> buy 2 contracts@ $10. Exit half@$30= $20 profit. Stopped out on half= -$10. Total trade was +$10.

That is actually a strategy Al discusses somewhere in the course(been a while since I came across that so can't point out where he mentioned this). That's the reason I mentioned taking half or a quarter of your position off in my first post. That is a reasonable strategy.

Also, you can move your stop to breakeven. Al discusses this, where traders allow test of entry price once but not twice(after the market moved considerably in your favor). In this example, the market tested your entry price once after moving considerably in your favor. So, it would be a good idea to move your stop to breakeven. I have seen enough cases of this play out in real-time and it works pretty well.

Exiting@close of Big Bear bar≈2x actual risk. No skunks, but maybe not the best exits.

It’s good that in this case you’d still make 2x actual risk. However, my opinion is that just because the trade was profitable doesn’t make it a good trade. Good trade can end in a loss too.

My point is that it was not a reasonable exit point because that’s where bears were buying (back their shorts) and possibly aggressive bulls are buying to establish their position.