The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi!

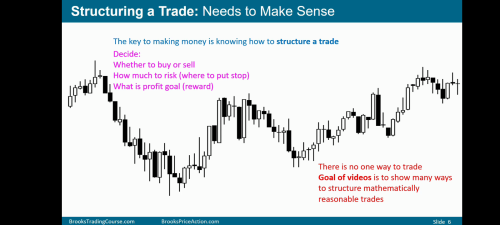

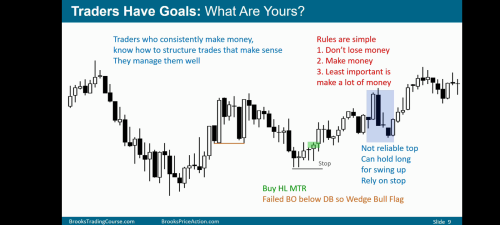

Start by solving the trade equation: Probability of Win x Reward > Probability of Loss x Risk. If it is positive, proceed. (this helps a lot to structure an operation, as it will be used to structure the trade).

To structure a trade you must decide whether the trade will be a swing trade or a scalp trade.

After deciding this you should set your stop loss position, to protect yourself from yourself - and from black swans (low probability events that may occur).

After deciding where your stop will be, you can calculate the size of your position, always remembering that the stop cannot exceed your normal risk size.

You should also decide in advance IF and WHEN you will scale the position, again always calculating so that the total stop does not exceed your normal risk size (beginners should avoid scaling their positions).

90% of the time the market is in a 40-60% zone for an equidistant move up or down, so beginners should primarily look for 2x1 trades for their initial risk. Exiting a trade 2x1 your current risk also results in a positive trader equation because even if a trader only wins 40% of the time, if the gains are 2x1 his risk he will still make a profit.

Still, the hardest part of the trader's equation is to give a value to the probability. There are times when the probability can be 60% or more for a move of X ticks up before X ticks down and in these cases the trader's equation goes positive going to a 1x1 target.

When you really don't know how to quantify a percentage for the probability, assume that you have 50% of an equidistant movement up as well as down, so it is necessary that the return is 2x1 your initial risk - or current (I emphasize that doing the minimum in whatever the task - school/work and also in trading - is rarely the best choice, so this would be a minimal target for the trader's equation to turn positive.

Use support and resistance, projected moves and also market context to take profits.

I hope I was clear, but if you have any questions, please ask.

Att,

Hi Felipe

I like your comment.

If i may add, Al often says dont bother with the below-40%-probability trades.

😀

Hi Felipe

I like your comment.

If i may add, Al often says dont bother with the below-40%-probability trades.

😀

There must be shockingly few sub 40% trades... That means you could trade the other side and have over a 60% probability. I guess maybe if you had a great scalp set-up and then hit the wrong button.

To structure a trade you must decide whether the trade will be a swing trade or a scalp trade.

It seems that a swing is entering a reasonable setup with low risk and seeing what develops. The start is known but the ending is not seen in advance.

Scalping seems more calculated. Trader has setup & a prior S&R point in mind for an exit, estimating a high probability of getting there.

Not really - the NB word in the comment above regarding probabilities is "equidistant". There are many great trade opportunities that have a 30% probability, or some even less. but with a potential reward of 10 times the risk.

Remember the turtle traders has a less than 30% win rate - so its very important to keep the reward in mind as well when we quantify probability

For swing trade setup, I am still unclear if we need a PA target or just Estimate a move of 2x risk.

Generic example:

Buy on bar X and target the prior LH high of previous Bear leg, which is >2x risk.

Vs

Setup looks good, estimate= 40% chance of 2x risk before stopped out 1x risk (60%), but with no prior S&R target goal. Estimate is based on buying pressure vs selling pressure. Bidirectional Equidistant estimate, no goal for reaching a point of S&R.

The short answer is whatever you are most comfortable with. But make sure your trader's equation is positive as previously mentioned. If 2 to 1 gets you to the S/R level you are looking at then maybe just do that. But if 3 to 1 gets you there you might want to squeeze the trade for a 3 to 1. Then again if it is a 60% probability trade then you can take a 1 to 1. I only look for trades that I think will go 2 to 1 even if they are 60% probability. So that might be I think it will break the S/R or that the S/R is at least twice as far away as the stop loss I am willing to take. I always have a set stop loss. I don't use support and resistance for my stops unless my stop is already really close I will put it just lower or higher.

But make sure your trader's equation is positive as previously mentioned.

For sure. That is #1 priority.

Maybe if there is an obvious recent S&R point, then that is the first target/magnet to aim for, but only with a good TEQ. If it's a BO into open ground, then maybe a MM is the target.

After reaching 2x (or 60%1x) then try for more points depending on PA.

I only look for trades that I think will go 2 to 1

How do you estimate it