The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

If you BTC of a bar, and before exit the price never drops below your entry, is the actual risk zero?

No, you need price to go 1 tick through your price to guarantee a fill.

So risk is at least a tick.

Assuming exit is bar 2 close, is the actual risk zero?

Yes, but zero or a few ticks doesn't matter, you just can't use it and stick instead with initial risk.

Agree, but this question is regarding the trader's equation.

When the actual risk is negligible you use in the traders equation the initial risk.

Actual risk can be used in the Trader's Equation.

Ignoring the context & Assuming this example was probability= 60% MM. So 1:1 risk/reward is acceptable.

If BTC bar1, stop below bar 1, initial risk=12.75.

If exit was @8 points profit, well over 2x actual risk (even 1 tick actual risk), then trader's equation is good.

If exit was @8 points profit, well over 2x actual risk (even 1 tick actual risk), then trader's equation is good.

No, you should not use actual risk when it is very small. If you do, any profit would be 2x and therefore any exit would be valid. If anything is valid you can't use it to discriminate between trades, which is the only purpose of the trader's equation.

Minimum risk is the spread.

No, you should not use actual risk when it is very small.

Agree, actual risk is usually bad for profits. However, it is always acceptable trader's equation with actual risk, as long as minimum scalp size.

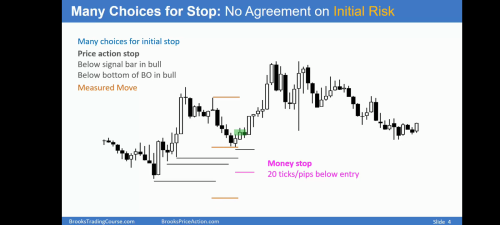

There is no agreement on initial risk, so with a wide stop the trader's equation can be negative, even though profits were mathmatically acceptable based on actual risk.

34a slide 4

34a slide 13