The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

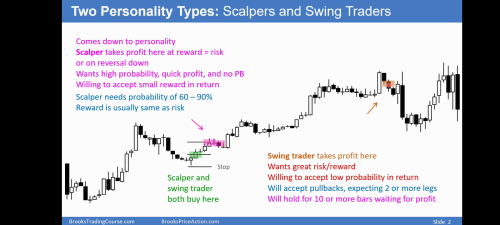

How can the same entry be high% for scalp & low% for swing?

Because the target for the scalp is small while the target for the swing is big so you have a high probability of getting a small reward and a low probability of getting a big one.

Seems like they would be closer.

And why is that?

Because they are not too far apart.

Also it looks like a great setup: Strong bull trend+ 50% PB+ not too strong selling pressure+ wedge Bull flag(?)

Considering everything, whatever% of reaching target 1, maybe not much more for target 2(?)

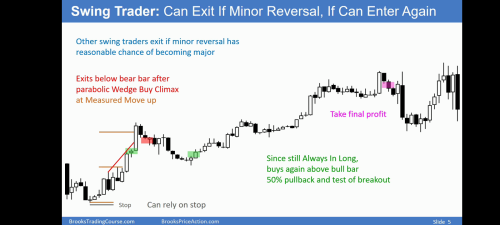

Side Note: is the protective stop in the correct position? Should it go beneath the start of the Bull leg which created the HH? (Correctly shown in slide5)

If so, this would make 1x risk well above PA target 2. The scalp would be low probability, swing much worse.

Because they are not too far apart.

If they are this close, it means you have low risk, and low risk = low probability. It feels like it had a higher probability because the market moved quickly towards the target and had a good bull BO. But by the time you buy, you don't know it.T

The probability increased for a bigger profit as the market went higher, but at the exactly time you bought, there is no way you know the direction and strength of the next bars to say you have more then 50% of a swing before your stop gets hit.

If you buy and think your 2x reward is close and easy for the market to reach it, it probably means that your stop is easier to be reached.