The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

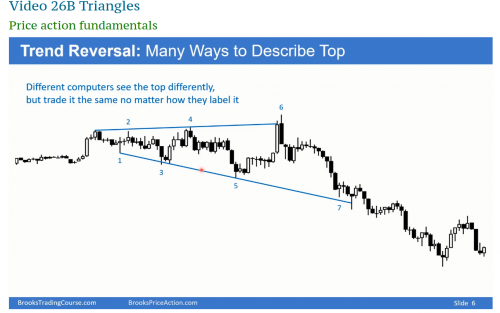

I am still in a slight shock about the Expanding Triangle Videos where Al says repeatedly, that they always (!) lead to a Major Trend Reversal.

He repeats it calmly, but explicitly with the only condition of them having a certain size.

Here is another example from the video:

It seems that the ET usually forms another leg up/down, but slowly, then climaxes and reverses.

Here is the current situation on the Euro/Dollar 5min chart:

Now, if we ignore the uncertainties of this happening at the end of a friday, is this a good sell setup?

How would you factor in the bigger picture from the hourly timeframe?

Very strong rally up, 3 pushes, wedge.

I often get overexcited, but isn't this a really good sell-setup?

Of course it is always critical the judge the proportions correctly.

A big MTR on a 5min chart might be done after 40 pips and be completely invisible on the hourly chart.

I am still in a slight shock about the Expanding Triangle Videos where Al says repeatedly, that they always (!) lead to a Major Trend Reversal.

Not sure what he says exactly but a expanding triangle is a type of LH MTR (bar 5 in your first attached chart) or HH MTR (bar 6 in your second chart) so as any other MTR it has a 40% prob for a swing reversal, no more!

Now, if we ignore the uncertainties of this happening at the end of a friday, is this a good sell setup?

Your trade is at the end of an endless PB so at any time there can be a BO but... around 50% per each side. The effect of the Expanding triangle is long vanished after a 4 hours TTR so if there is a bear BO bulls will try to create a DB with any of the prior lows and 60 min bulls will be waiting for you at EMA.

How would you factor in the bigger picture from the hourly timeframe?

Very strong rally up, 3 pushes, wedge.

Wedge but strong trend up so early to sell but maybe a test of the EMA will come for a second leg down after the bear surprise bar (7th bar from the end), enough to take a swing sell in the 5min chart, if it comes.

All-in-all, I would take the trade but if the BO is dissapointing I will be also the first to exit (BO of endless PB need to be strong because the 4 hours TTR is a very strong magnet). Look for examples in the encyclopedia.