The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi

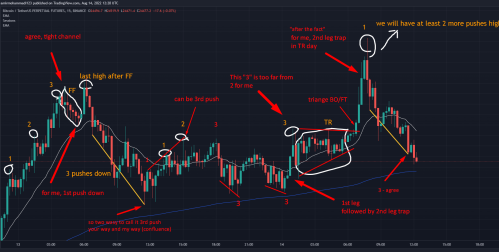

as per the attached photo below, I highly appreciate comments about the way I counted number of pushes high / low.

Should we consider any new high such as failed breakout, or close above last high but with bad follow-through also as a new push high? or just the ones with close above the previous one and good follow through are counted?

Hi Reza, IMO great that you are annotating and finding pushes. The annotations look great. For me, wedges are somewhat subjective, but that does not mean they don't work 🙂

Just a quick note, and that is what Al B says: Pushes often start when the opposing trend has not ended. For example in early morning, those 5 bear dojis constitute the first push down (as I have annotated). The nice green bar a tad before 12:00 is also the first push up and resulted in a near-perfect 3 push pattern.

Hi Steve

Thank you loads for taking your time and sharing your points, highly appreciated.

1 question, the bull climax after those 5 dojis made a new high above those 5 dojis. Can we still consider those dojis the first push down, and the next one after the bull climax as the second push?

also to be noted that the wedge the way I drew was sold by bears, not bought by bulls 🙂

I'd suggest avoiding niche crypto instruments and minor/exotic forex pairs, if you're trying to learn to trade particularly on lower (sub-daily) timeframes. You will feel perpetually confused, the moves are erratic and the price action structures do not look normal.

Niche crypto instruments are not traded by institutions or professional traders / algorithms. Minor Forex pairs are very arbitrage-driven, so they are in a a three-way tug of war between USD and the two constituent currencies of the pair.

Trading is hard enough, the odds are very much stacked against you if you are trying to learn on these instruments.

Hi Kevin

I have already learned this lesson very well as I entered financial markets with crypto last year and lost 15k in crypto.

Just training with its chart on the weekends.

already made my decision to focus max on 2 charts; S&P500 24H chart, and GBP/USD.

I trade 1H chart with daily chart as the HTF trend, and use 15M chart for entries.

I have had bad experience day trading ANYTHING with low volume. Best to stick with very high volume instruments, as price action works best.