The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

What is the difference between straight line drawn to see the breakout point at the beginning of the chart vs the bottom of the chart? At the beginning of the chart we are forming gaps, yes but if we consider the second lower high that did not go above the breakout point but how about the most recent lower high following that breakout point because it did go above that.

Now I am little confused about considering gaps regarding a bar going above breakout point. Which pullback should traders consider to see if its going above the breakout point? the first pullback followed by the breakout point or the second pullback. Should traders be waiting for the second pullback to see if it goes above the first breakout point to assume its in a strong bear trend.

Given below is the same chart for the responder to draw lines if necessary to illustrate the point regarding above question.

Hi Sudeep,

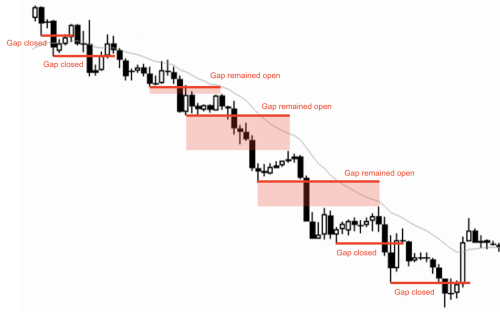

There are different types of gaps that you can look at to assess buying and selling pressure (see BTC video 10A) but the most important are gaps between swing highs and lows around a significant breakout. If the context is good they usually lead to measured moves.

On your chart, initially the trend is weaker with gaps closing, it then accelerates in the middle with gaps staying open before weakening again. The first open gap on the chart is a sign that the trend is strong and likely has further to go.

Hi Sudeep,

I concur about rewatching all the course videos with titles that mention "gap". This will make it clear what type of gaps are strongest. For example, gaps where tails overlap or body and tail overlap (bodygaps) are weaker than the micro gaps where nothing overlaps. Gaps using swing points are very strong too since they are gaps on HTF.

So if you see a progression of gaps that are closing a little and then suddenly gaps that are staying open, then bears (in this case) are becoming stronger. It has to do with limit bulls who were profiting buying prior lows but now got trapped and can't exit BE anymore, they will dump and this causes market to accelerate down.

So if you're asking if there's a specific sequence of what to watch for, I would say watch for gaps that leave no overlap as those are strongest. I would also suggest to develop a habit of thinking in terms of "who's making money and how?" Is it limit traders only? Limiters and stop order traders? Which side is getting minimums scalp of day, which side keeps getting trapped. Lots of insights will emerge from such practice down the line.

Hope this helps,

CH

____________________

BPA Telegram Group