The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

The market was in a bear channel that broke to the downside, creating exhaustion gap. Biggest breakout late in bear and downside break of a bear channel meant that there was a 75% chance of the gaps getting closed which it did. The market did not break above the earlier bear trend line but it broke strongly above the sell climax bear trendline. The buying pressure was good enough to make bulls believe that they could start buying at new lows hoping that the actual low won't be far away. The strong buying also meant that the bears lost control of the market. Also, with the exhaustive sell climax, bears will pause their selling and look to sell only after they see that the bulls cannot take control of the markets. Therefore, good case for the bulls to get a MTR attempt(in this case LL MTR) and the bulls will look to get 2 legs up from here which they got. When bears sell that the bulls have taken control of the markets, they will sell only higher and after the bulls have taken their profits and not before.

Buy on close of large Bull reversal Bar (left arrow) for 75% probability scalp to trend line.

- Then buy on close of Bull doji (right arrow, H2?) for 40% chance of MTR swing. Exit TBTL and/or MM

I see that as a trading range, big up big down, failed breakout bellow tr. Answer is the same as in 18 that I just replied to. 50% to first major swing high, 40% for higher than that, and 60% for a scalp to the middle ( getting 1 times your risk).

Are those % based on TR probabilities?

Buy on close of large Bull reversal Bar (left arrow) for 75% probability scalp to trend line.

Correct.

Then buy on close of Bull doji (right arrow, H2?) for 40% chance of MTR swing. Exit TBTL and/or MM

Can't recall a situation where we use MM for MTR setups but you get the general idea. TBTL is more ideal but need to remind you, when a trend has gone on long enough, reversal setups are sometimes 20 bars 2 legs and not just TBTL.

HL DB + BO below = type of wedge.

(+micro DB)

Probability % of reversal= ?

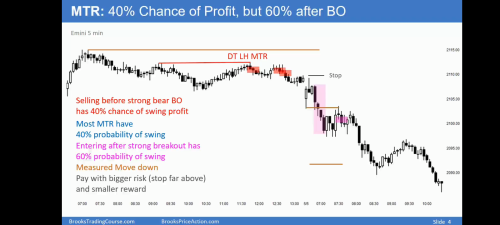

Good looking MTR reversal setups are always 40%(for a swing). If the context is good, the setups might be a little higher than that but better to always take it as 40%. Can't recall Al saying otherwise. So, I won't either.

Reversal Target= prior major lower high?

All trends end at resistance so it might end there, but it is usually taken on a case by case basis. Since, MTR setups sometimes evolve into large swing profits(and that's why you enter MTR setups), does not make sense to limit yourself to a profit target. If you're getting TR PA, better to get out near the top of it but ideally the least you're looking for is TBTL.