The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello, by studiyng Al's course I came across a doubt that I can´t solve myself. When entering on a bull trend, where the probability is about 60% or more for upside prices, if I enter in a high 2 for example or something that is not within the spike that lead to the bull trend, won't my target be always less than a 1:1 ?

My thought is, the spike will lead to a MM up and normally that is the largest MM, so if I enter after the bull spike is formed in some other setup that has a price that surpasses the high of the bull spike, my target will be less than 1:1 because the stop placement must be below a Major Low.

The only resulotions that I came across is to use a tight stop witch will drop imensely the probability (also the risk), or to have a 70-80% rate of sucess. I know that I can also be profitable by using the actual risk for a 2:1 RR, but that is the minimum target.

Am I thinkg right or is there anything that I didn't understand?

Hi Rodrigo,

Here are some hypothetical scenarios to explore this:

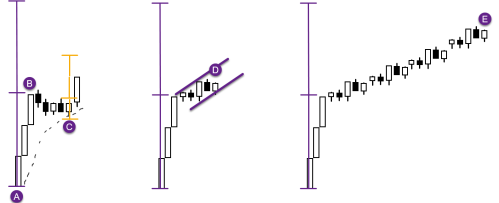

In the first one a spike A-B and 60% chance or better to reach MM. Traders who buy (B) stop at (A). Traders who wait for PB and buy H2 at (C) and want to swing stoploss also at (A). Although after a strong BO above prior high they can adjust stoploss to (C) and go for 1:2 AR.

In 2nd example, instead of a convenient PB the market grinds higher forming a tight limit order CH. Traders who buy (D) stoploss is still at (A).

What if it keeps going like in last example? Buy at (E) hoping to reach MM just a little higher, stoploss still below (A)? Is it still worth it?

I think the answer comes down to Trader's Equation. Assuming the probability of 60% and these various risk/rewards we can estimate whether the trade is still reasonable.

Side note, for channels like the last example there's also a concept of BLE4:

BLE4 : Bulls can Exit about half an average bar's range below any bar, or 1 tick below bear bar closing below its midpoint if disappointed. Can always buy again above next bull bar closing near its high.

This helps avoid sudden big drops all the way back to start of channels but it's for those who manage actively and are obligated to re-enter back long if bears fail to reverse.

But back to your original question, it's true that your reward is becoming less and less than 1:1 as the market is going higher. But as long as the trader's equation holds then buying high should still be reasonable.

Al also has a nice video about "Entering Late in Trends": https://www.youtube.com/watch?v=LYu-s76bgwI&t=16s

Hope that helped!

CH

___________________

BPA Telegram Group