The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

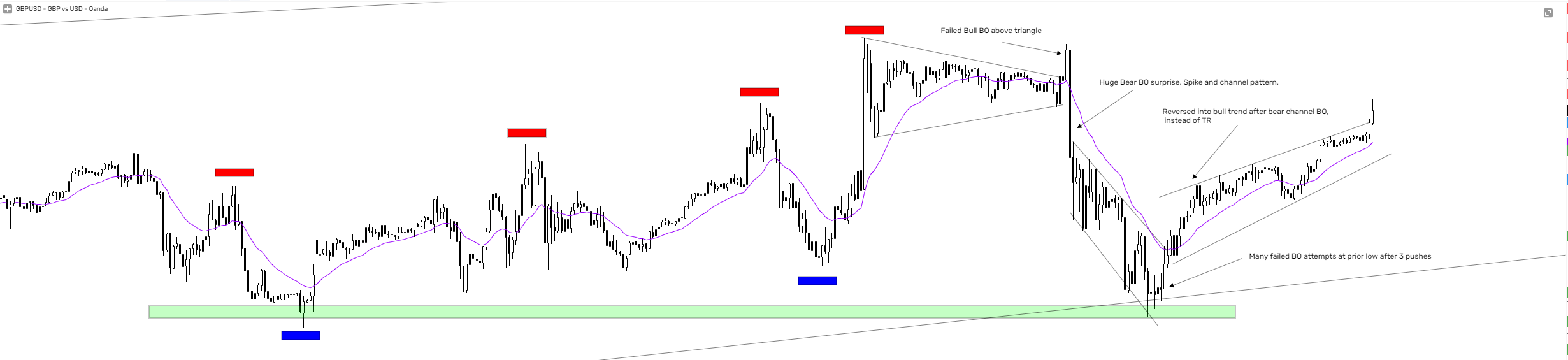

I had a trade yesterday on GBPUSD 15min chart. I had a limit order to buy 50% pullback but quickly got stopped as the sell-off was fast and strong. I didn't even have time to cancel my order. It was 2nd leg trap (after making the third new high) within a broad bull channel. I can see clearly that it is within a broad channel now.

Question 1: GU broke above TR and the channel and instead of a quick sell-off to the bottom of the channel like previously, it is consolidating right above the TR. Is it correct to still look for reversals down to the channel?

Since GBPJPY is a closely correlated pair, I was looking at GJ on 15min chart as well, but I've noticed some difference. When I draw a channel, is it a broad channel but it enters a series of smaller trading range, instead of falling far below like GU.

Question 2: Is it correct to call this trending trading range instead of broad bull channel? Or are the characteristics of trending TR same as the broad bull channel? It looks good for scalp and swing on long and scalp for short.

GJ

GU

Question 1: The chart is blurry but it seems bulls are trying to break above (huge BO bar breaking above prior H) and create a stronger trend up. They have so far failed and a triangle has been created instead, which is BO mode. Once the triangle is in place: around 50% for both sides so right now you should not be looking for a test of the bottom of the broad channel, raher you need to focus on the triangle BO and, once it happens, 50% it fails. You don't have the EMA drawn, but while bears are not able to break below it, and taking into account the strength of the BO above the prior H, I would be looking to buy.

Question 2: Categorizing the trends has only a purpose, trading them profitably. As you pointed out, both type of trends have similar characteristics (a lot of TR PA) but in real-time the trading is different, reason why they are differentiated. The Trending Trading Range Day, as it names implies with "Day", is more of an intraday pattern. While broad channels can be both in intraday and several-days charts, it is more common in the later (you need a number of bars to actually see the channel). Finally, as many times happens, these trends are mainly TR PA (very similar) so as long as you understand what is going on you can name them as you want!

Thanks as always! There was bull breakout from the triangle but it failed right at the prior high. GU plummeted fast but too quick for me to trade and it did get down to the range. It reversed back up this morning, which I was able to catch a trade on.

And thank you for the explanation on the intraday and higher time frame chart. I guess I can just think of trending trading range day as a smaller intraday pattern within a bigger pattern. But broad channel would be more common on HTF chart pattern as you said.

I'm definitely learning at a deeper level by asking questions here. I'll be back with more questions soon! 😀

Here's my quick recap and analysis of the GU 15min chart.

https://gyazo.com/8cf4608202388af356a52fcd6fa8a4a7