The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

In Video 15B slide 27, Al advises to hold till the premise is invalid. That makes sense, but on slide 27, bar 11 is a BO of the small pause but bar 12 is a bear bar which is a bad follow through. Shouldn't bulls exit below bar 12 as the premise of bull trend continuing higher is less valid? Bulls see parabolic wedges, climactic buying so should exit below bar 14 if not below bar 12? Thanks!

Shouldn't bulls exit below bar 12 as the premise of bull trend continuing higher is less valid?

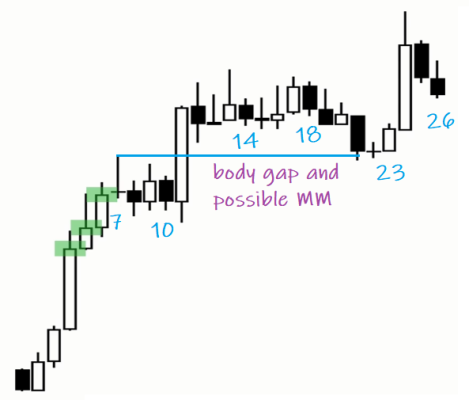

Not really, with the strength shown with 2-7 BO, the bulls would want some kind of MM (2L-7H) unless the bears put a lot of pressure to overcome the bull BO or the MKT became climactic. Bears tried to top at 10 (micro DT) but as expected they failed and they did so with 11 becoming the best bar on the chart that far (closing on the high and well above 7H), so a second leg up would probably come, strengthening the MM up premise.

The tail in 13 could be that second leg up from 11 BO but, check the selling pressure so far, few bear bars, not consecutive, small and not closing on the low... most likley this was not the end of the second leg up but another PB within a trend. Yes, the FT 11 was not great but also bad SB for the bears to sell which, and this is the key (more than 11 being bad FT for the bulls) had not shown yet from bar 1, so you can't sell either to exit nor to enter. 18L another DT and again maybe the second leg up from 11 but, like 10, no prior selling pressure so early to sell. If you sold 18L you have to buy again 23 COH.

Bulls see parabolic wedges, climactic buying so should exit below bar 14 if not below bar 12?

Not sure why you say it was climactic... You have consecutive BOs 2-6 and 11 at the beginning of a trend, so they were more likely part of the spike phase of the spike and channel bull trend that the end of the trend that it was just starting off strongly (without any selling pressure)

25 and 26 are different, you are now more than 20 bars into the trend and you get the best looking bull bar, 24, followed by good consecutive bear bars closing on the low (COL) and they are part of an expanding triangle 11 14 21 24 or a Wedge 7 14 25. Still little selling pressure so this reversal is likely going to be minor and become another bull flag, maybe at EMA or DB 21, but there you can exit longs and see what happens or hold with stop-loss at 21L and target the MM up. If the bears can't switch the MKT to AIS after a few bars, bulls will again, like at 23H.

I missed seeing this through Bear lens. This is very useful. Thank you so much ludopuig!

How did you draw the wedge using 7 14 and 25? I thought 14 was just another side trading bar.

Yes, sorry, I meant 13...