The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Was the breakout(the couple of bear bars) before the sell is marked strong enough that the stop should move above the top of the first bear bar(marked with red line)? Is the probability 50% because it would have been 60-40 in favor of the bears if the market was at 50% PB of the couple bar bear breakout but since the market is almost at the high of the bear breakout, the probability has dropped to 50%?

Does the probability improve after breakout of the neckline of the double top(marked in orange line - creating a measure move)?

Finally, we know that we're to target 2x risk(IR/AR) if the probability is 40% and 1x risk(IR/AR) if the probability is 60%. Do we target 1.5x risk(AR/IR) when the probability is 50%? I haven't heard Al talk about 1.5x RR ratio in the course or at least I fail to remember.

Does the probability improve after breakout of the neckline of the double top(marked in orange line - creating a measure move)?

Okay, this was a stupid question. I already know the answer that after a breakout, there is a 60% chance of a MM down. Kindly, ignore this part.

Was the breakout(the couple of bear bars) before the sell is marked strong enough that the stop should move above the top of the first bear bar(marked with red line)?

Yes, but it was also a climax so the MKT could test the sell climax high if it revesed so better to exit above the bull closing on the high(COH), which was a decent swing setup (sell climax and bull bar COH) for the bulls.

Is the probability 50% because it would have been 60-40 in favor of the bears if the market was at 50% PB of the couple bar bear breakout but since the market is almost at the high of the bear breakout, the probability has dropped to 50%?

The bulls had a swing buy so at that moment the MKT was likely in a TR (minor reversal leading to a TR or a PB in a bear trend), and the entry was slightly below the high of that developing TR (It was a LH DT).

Finally, we know that we're to target 2x risk(IR/AR) if the probability is 40% and 1x risk(IR/AR) if the probability is 60%. Do we target 1.5x risk(AR/IR) when the probability is 50%? I haven't heard Al talk about 1.5x RR ratio in the course or at least I fail to remember.

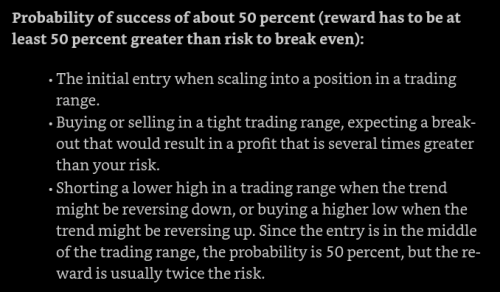

Yes, not sure if or where he explains that in the course, but this is from the books:

Okay, I took a lot of time in digesting the information you provided. Thanks for the help ludopuig.

If I could clarify one thing - does the sell marked above in the chart fall in category 3 of the screenshot you provided? I realize it is not the lower high of the TR but only the first high but the sell is almost in the middle 1/3rd zone(at least that's how it appears on the chart) and hence the probability of the setup working is only 50%?

Thanks again! It seems like I'd have to delve deeper into his books once I am done with the course. Should be easier this time around considering I would be familiar with the material.

If I could clarify one thing - does the sell marked above in the chart fall in category 3 of the screenshot you provided?

Yes!

I realize it is not the lower high of the TR but only the first high but the sell is almost in the middle 1/3rd zone(at least that's how it appears on the chart) and hence the probability of the setup working is only 50%?

No, it is actually a LH in a TR with the high of the range being the top of the climax, so it perfectly meets the criteria in category 3.

Thanks again! It seems like I'd have to delve deeper into his books once I am done with the course.

I love the books, I fully studied them before I got to know there were a course but, as everything, interesting reading is slow reading so it takes a lot of time. Yet, there are gems in almost every page (and there are many pages!) so it is really worthwile if you have time.

Should be easier this time around considering I would be familiar with the material.

Absolutely, I got crazy going back and forth to the glossary but having watched, at least, the PA fundamentals part, the reading becomes much easier.

ludopuig,

Just curious to get your take on the following

- I have all 4 books, but somewhere I read on the blog to start with the series (Trends, Reversals, Trading Ranges) as first book 'Reading Price Charts Bar by Bar' is a difficult read. But I see that the first book is a gem and every page is loaded with insights (have not read the series yet).

- In the first book, Al advises placing stops just below or above the signal bar (based on bull or bear case) and move the stop to breakeven once taking partial profits at your target (1R, 2R etc), but the course advises structural stops based on major higher lows/Lower highs. What's your read on this?

Thanks!

Yet, there are gems in almost every page (and there are many pages!) so it is really worthwile if you have time.

I think I won't be able to trade properly if I can't figure out the two variables in a trade - probability and risk. If I know only risk and not probability, there is no way I can structure trades consistently and profitably. So, I don't see any other option than to read the books. I think it is imperative that I do and not something I should do if I have the leisure.

Absolutely, I got crazy going back and forth to the glossary but having watched, at least, the PA fundamentals part, the reading becomes much easier.

My experience exactly, except I couldn't keep the patience to finish it then and broke down to purchase the video course first.

So, I don't see any other option than to read the books.

The video course gives all you need to trade, including probability (if not, it would be useless!). Yet, again, the books are a great complement, or another way to present the information that might be better suited for some people (myself, included).

- I have all 4 books, but somewhere I read on the blog to start with the series (Trends, Reversals, Trading Ranges) as first book 'Reading Price Charts Bar by Bar' is a difficult read.

This was a common criticism the book got. I didn't go thru it and started directiy with the trilogy so I can't tell.

But I see that the first book is a gem and every page is loaded with insights (have not read the series yet).

Sure, can be at the same time difficult to read and interesting! Anyway, he wrote the trilogy to address those readability issues and at the same time he included much more info so better to go for the improved and extended version than the initial one, I guess.

- In the first book, Al advises placing stops just below or above the signal bar (based on bull or bear case) and move the stop to breakeven once taking partial profits at your target (1R, 2R etc), but the course advises structural stops based on major higher lows/Lower highs. What's your read on this?

Thanks ludopuig! My question was more around placing stop just under signal bar (for bull case) vs. using the structural stop. Al talked about this in context of trading stocks intraday, may be he was using this for scalps and not swings, assuming risk and trade management should be similar irrespective of stocks or futures.

Ok, I guess you mean that when you have a PB buy you can either use a tight stop below the SB or a wide stop below the last swing low. In general, you have to go with the wide stop if you don't want the probability to be greatly reduced but if you have buying pressure within the PB and the setup forms with a good SB (good size, closing on the high) then you can go with the tighter stop with not much probability reduction, because the MKT should not go below your SB if your premise was still valid. You will somewhat reduce your probability but not as much as you would do in a worse context.

As an example of what I am saying, taking yesterday's EMINI, I would place my stop-loss just above 22 (Wedge PB in tight channel down with good bear bars within the PB and good SB). However, if you sold 43L you can't use such a tight stop-loss so better to start with the stop-loss at 22 and trial above 43 at 45 or 46.

Thanks ludopuig for the clear explanation!