The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello all, novice here. I would like an explanation of a pullback. Because in a bull trend let's say on a five minute chart Al list a pullback as a long upper wick within the trend as an implied pullback. But then just a few minutes later he also references a pullback as a candle with a long lower wick in a bull trend? So, is it both because they have long wicks or is it the upper or lower wick? Thanks in advance!

Hi,

as far as I understood Al means that even one bar can be seen as a pullback. Also consecutive bars can be a pullback as well. I looked on those one bar pullbacks on a smaller time frame to understand better how they are forming. Try this for yourself to get an understanding what is happening on M1 while a bar is forming on M5 would be my suggestion here. So from my point of view it depends a lot of the context what can be defined as a pullback.

A pullback is counter trend move that is then resume back up into the original trend. So a pullback can be very small like a one bar pullback, or many bars.

he also references a pullback as a candle with a long lower wick in a bull trend

That is an even smaller pullback. The long wick was the result of a counter trend move when the bar was forming that was then reversal up by the bar closed.

A pullback is any pause in the up to then prevailing trend.

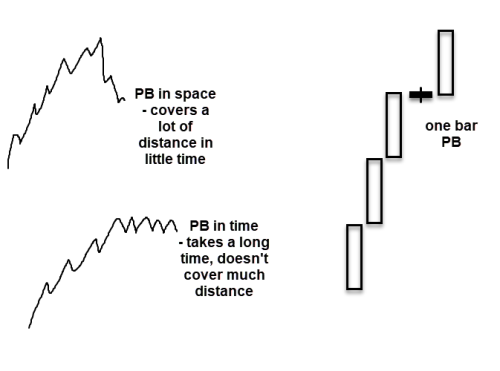

Pullbacks can be:

- in space (deep and fast) usually attributed to profit takers

- in time (take a while but not cover much distance/flat) usually attributed to either lack of interest (low volume) or big limit traders entering in the opposite direction but not yet actively initiating at market a.k.a final flags

- just a single small bar

There is no "definitive" pullback. Pullbacks are a natural part of market cycle. As a trend loses momentum, pullbacks increase in magnitude as more with trend traders begin to take profits and more counter-trend traders initiate fresh positions. And depending on the strength of the prevailing trend, pullbacks can start small or big, it depends on the context.

Ok. Thank you. But I am talking about in the context of what Al was speaking on. In a bull trend he referenced a pullback as both a long tail on top and also on the bottom of the bar. I am just wondering was that a mistake or is a pull back in a bear trend also when you see a long tail on top and/or the bottom of the bar?

Thank you! This was what my question was about. But I appreciated all the feedback much obliged. GOD you guys sound so smart in here, I hada reread the answer like three times in order to even remotely understand. But I'm on my way. Much obliged.

Is there a percentage of how often the pullback fails and becomes a reversal?

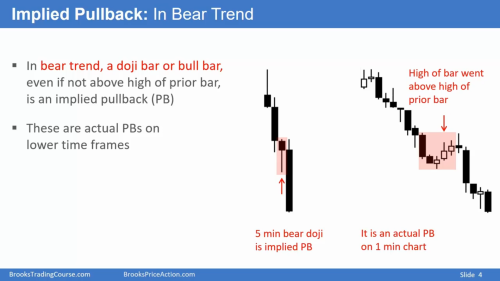

Can a dojo bar in a breakout also be considered as a pause (PB) even if it doesn’t go below the low of the prior bar ( more of an implied PB )

Hi Satya,

The annotations were my take at describing the pullbacks - the ones that are inside bars, and the breakout bars with the small tails - both imply the inferred pullback 🤔

I could've gotten it all wrong ...

yeah..it seems to be alright, although Al sometimes uses an alternative terminology where pause bars ( dojis which do not fall below the low of prior bars ) are also called as pullbacks. you can go through market cycle videos to learn about this.