The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

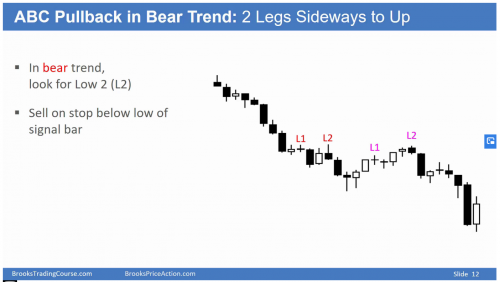

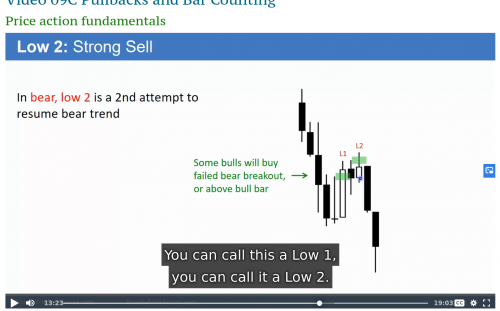

15 minutes into the video the lows in the pullbacks of the bear trend are not labeled correctly.

The bars labeled as lows are highs, the labels should be one bar to the right.

Greetings

Sascha

According to Al's definitions, the bars labeled L1 and L2 are correctly pointing to the Signal Bars, therefore one bar to the right would be pointing to the entry bars.

From the book:

low 1, 2, 3, or 4: A low 1 is a bar with a low below the prior bar in a bear flag.

As far as i understand it this has nothing to do with signal bar vs. entry bar, this is simply how these lows (1,2,3...) are defined and does not deal with the question of when to possibly enter with a trade.

This is the very first video of the course and the terms signal bar or entry bar have not even been introduced.

The previous slide in the same video is almost correct with the labeling of the highs, except for the last one which does not have a higher high then the previous bar.

If what i am saying is true then this should be

From the book:

low 1, 2, 3, or 4: A low 1 is a bar with a low below the prior bar in a bear flag.

When Al wrote the books, he counted the legs of a PB using the definition you are giving, using the entry bar. Now (in the video course and all other training materials), he rather uses the signal bars. There are dedicated videos on bar types and bar counting early in the course so refer to them.

As far as i understand it this has nothing to do with signal bar vs. entry bar, this is simply how these lows (1,2,3...) are defined and does not deal with the question of when to possibly enter with a trade.

The only reason something is in the course is to tell you when to enter a trade. Why would you count legs if this was not related to taking trades? This is non-sense, so keep going thru the course and you will learn that counting legs is actually a core concept.

This is the very first video of the course and the terms signal bar or entry bar have not even been introduced.

You are in video 1, Al will keep introducing concepts as far as in video 36...

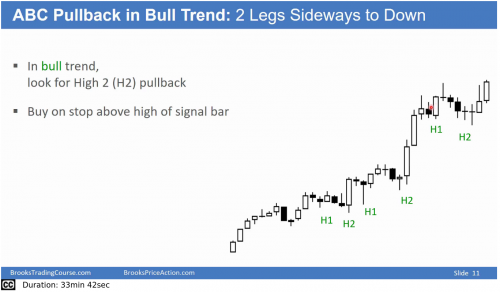

@richardhk As you see in the slide 11 of the 1st video attached by Sascha, the H1 and H2s are a little bit off introducing confusion so, please, tweak them so they are just below the signal bars.

I see, thanks for the clarification.

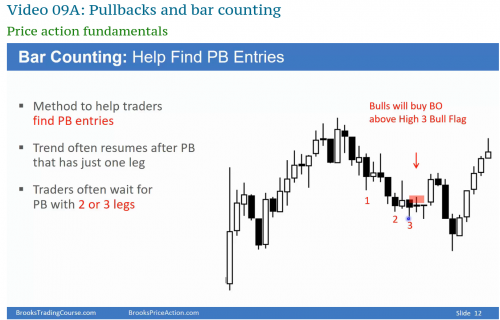

The first time Al explains these terms is in Video 09A.

He calls the actual highs and lows as such, the labels are however as you explained on the previous bars, the signal bars (even though they don't signal anything really, the price could just continue to go down. A real signal bar would indicate a change in direction which these don't. These "signal bars" are nothing more then previous bars imho and for that reason i don't see any reason to put the label on them instead of the actual highs and lows that Al does call highs and lows when pointing on them with his mouse-cursor. It seems to me that Al didn't change anything and instead that simply all the labeling has been done wrong).

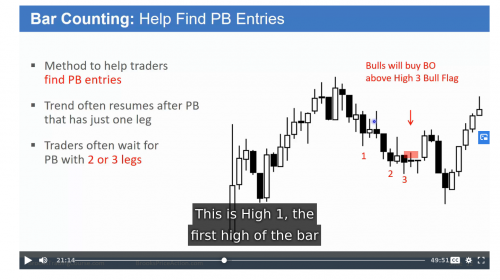

Excerpt from his narration: "This is High 1, the first High of the bar, that went above the high of the prior bar".

However there is another mistake in this slide, the H1 should be one bar to the right.

@saschaheidgmail-com Yes, you are right with the H1. @richardhk one more thing for you!

Excerpt from his narration: "This is High 1, the first High of the bar, that went above the high of the prior bar".

This is what he says in the video. This means that all labeling is wrong and that it should be labeled like he wrote in his book.

What is the reason to label the previous bars?

These are not signal bars that tell you to enter. They do not signal a reversal and the price could simply continue in his direction.

The Highs and the Lows are the signals, not the previous bars.

@saschaheidgmail-com Then he should change the whole course. Please, let us know the time of the video where he says that so Richard can check.

@richardhk more work for you!

He is beginning to explain it at 21:10.

Ok, thanks... now @richardhk has everything he needs to check this.

This is what he says in the video. This means that all labeling is wrong and that it should be labeled like he wrote in his book.

Or this statement can be wrong and all the labeling is correct. What do you think is more likely?

What is the reason to label the previous bars?

These are not signal bars that tell you to enter. They do not signal a reversal and the price could simply continue in his direction.

The Highs and the Lows are the signals, not the previous bars.

There are 59 hours of videos in the first part, you have gone thru less than 0,5%... but you can state with confidence all the above? Don't rush, be patient, and if you don't want to take my word, at least go thru the course before saying things like those!

This is what he says in the video. This means that all labeling is wrong and that it should be labeled like he wrote in his book.

Or this statement can be wrong and all the labeling is correct. What do you think is more likely?

If something is extremely likely it will probably not happen.

What is the reason to label the previous bars?

These are not signal bars that tell you to enter. They do not signal a reversal and the price could simply continue in his direction.

The Highs and the Lows are the signals, not the previous bars.

There are 59 hours of videos in the first part, you have gone thru less than 0,5%... but you can state with confidence all the above? Don't rush, be patient, and if you don't want to take my word, at least go thru the course before saying things like those!

If will check every video and if i am right you'll reward me with 1 month free access to his trading room. Deal?

I have to admit however that i already went through the course several times.

If you went thru the videos you can't say that unless you have been teasing me from the beginning...

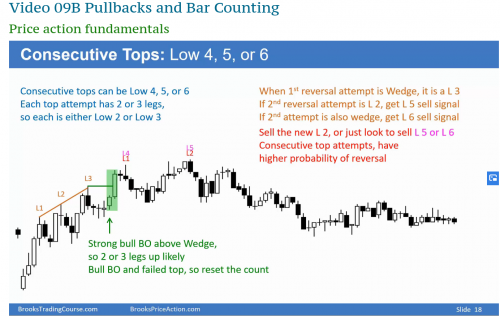

Video 09B:

Same thing here:

Al is pointing to the H1 and H2 according to his definition in the book, calling them a high 1 buy and high 2 buy, but the labels are on the previous bars.

Here it says: "Sell the new L2..." and the new L2 is actually the only low where the label is on the low and not on the signal bar. It is the first bar with a lower low.

At all previous lows the label is on the bar previous to the low (L1 is actually 2 bars previous to the low).

In the next slide - for the first time - Al clearly references the low as it's labeled as a signal bar.

I think i can stop this now.

You are right.

I am very happy with the course, i think that Al is the only person out there who is not a despicable scammer that deserves to be fed to the pigs and i'm glad i found him.

But this particular thing is slightly confusing, he never mentions that the labels are supposed to be signal bars for the entries as far as i can remember and the mouse cursor is often moving very quickly.

Maybe some time in the future when i joined his trading room i will mention to him that trump would not have made this mistake ;-p

Greetings

Sascha

>>Ok, thanks... now @richardhk has everything he needs to check this.<<

Sorry for the late entry here Sascha and Ludopuig. Have kept away as this topic has driven me crazy for far too long now!! 🙂

The good news: Yes, I can see how the H1/H2/L1/L2 labels will often be seemingly in the wrong place.

The bad news: There really is no need to change anything! If I was to shift labels, Al would likely disagree as happened in the past. Each trader learns to see pullback price action running across a continuum of very clear (as per glossary definition) through to 'implied' pullbacks, taking account of other price action patterns and time frames for example.

We need to be creative with bar counting and recognize that all a label really needs is to highlight an "area" of interest for a setup. Big picture context can be important in this. Some of the labels that Al will put on his charts have no correlation with highs/lows of previous bars, as he will often use the close as reference. I have discussed this many times with Al and suggested a webinar and Bonus Video on bar counting to delve into subject more, but that will be some time in the future.

In conclusion. Keep moving Sascha and your own understanding will develop beyond the glossary definition (that causes so much trouble IMHO). When Al adds pullback labels, analyze how "he" is seeing market. I will sometimes not see the same, especially when Al notes a H1/H2 in an overall bear trend, or a L1/L2 in a bull trend, for example. I also do not put so much importance on single tick moves, especially dojis, so would not usually consider such in bar counting. Your mileage may vary of course. We all develop our own style based on Al's methodology. Do not be afraid to diverge where needed to suit your own personality and style.

Hello, im having some problem understanding ABC Pullback trend, also not really sure what 2 legs sideways is. I've rewatched this particular video 3 different time but its just not sinking in. Is it better explained further down in the course or should I look for a better explanation on google?

Thank you in advance,

Sam