Video duration 46min 04sec.

Scalping 2-minute Emini chart — Video transcript

Introduction

I’m Al Brooks. Thank you very much for watching this video. It’s the second part of a series on scalping. I’m using a 2-minute Emini chart as an example.

If you’re interested in finding some detailed rules about scalping, you can look at the Brooks Trading Course, or you can see the basic rules in the free Scalping Rules video (Part 1 of this series). This is part 2.

Emini Scalping on 2-Minute Chart

I’m using a 2-minute chart as an example, but you trade it the same as you would a 5-minute chart, a 60-minute chart, a daily chart, or a weekly chart. If you watch television shows with professional traders, like on CNBC or Bloomberg or Fox, they sometimes will show hourly charts, sometimes daily charts, sometimes weekly charts, and sometimes monthly charts, and you don’t hear them say, “Oh, this is a weekly chart and therefore I’m going to trade it differently from how I trade a daily chart.” Everybody trades all charts the same. They’re all based upon human nature, rational human behavior. It doesn’t matter what the timeframe is.

Here we have consecutive bear bars, and one of them is a very big bar and it’s closing near its low. For me, that’s the minimum that I want to see for a Sell The Close bear trend. Always In Short. A bear trend. I want to see 2 bear bars, one with a big body closing on or near its low. It can be the second bar like this, but it could also be the first bar. And sometimes both bars will be very big bear bars.

Some traders, as soon as they see this close near the low of the bar, a second consecutive bear bar, big bar closing near its low, they’ll simply hit “Sell the market” and they’ll get filled around the open of the next bar. Others will trade with a stop 1 tick below the low of this bar. Most traders will make more money if they trade with stops. Sometimes the bars are extremely big and the market’s moving very fast, and when that’s the case, it’s usually better to trade with limit orders because the appearance of the bar can change dramatically in the final seconds, and you don’t know where the low of the bar will be until exactly when it closes. And then the next bar often moves very quickly, and you don’t have time from the close of the bar to place a stop 1 tick below the low of the bar.

ii Breakout Mode

Here we have a big bear bar, and then this bar is inside. It’s an inside bar. Its low is above the low of that bar; its high is below the high of that bar. Then we have a second consecutive inside bar. Low above that low, high below that high. In general, if you have an ii (inside-inside), consecutive inside bar pattern, and the second bar is closing near its low, you would look to sell below it. It doesn’t matter if this is a bear flag in a bear trend. It doesn’t matter if it’s the top of a Buy Climax. It could be a reversal. In general, if you have a strong bear bar for the second bar, it’s better only to look to sell and not look to buy above. It’s a BreakOut Mode pattern. It’s a Triangle on a smaller timeframe chart, and some traders will simply trade it like a BreakOut Mode pattern. They’ll sell below, they’ll buy above.

If it goes above, triggers the buy and reverses down, they’ll get out of longs and possibly reverse to short below. If it goes below and triggers the short and then goes above the high of the ii, the first bar, they’ll get out of shorts and many will go long.

Bear Breakout

BreakOut Mode pattern, so it’s both a buy and a sell setup. Sell below, 1 tick below. Buy above, 1 tick above. And here we have a bear breakout. As I said, with the bear bar closing near its low, with the market below the 10-bar Exponential Moving Average, with a big bear bar here, we’re probably going to get a second leg sideways to down. This is a good-looking sell. Sell on a stop 1 tick below the low of that bar.

And these bars are about 4 points tall, 3 points, 4 points, 5 points tall. You have to decide how much you want to scalp for if you’re scalping. In general, you’ll probably be scalping for about half the size of an average range. So if these bars are about 4 points, you might try to scalp out for 2 points. You sell on a stop 1 tick below that bar and you’d get filled right here.

And you immediately place a bracket order, maybe a stop up here and a profit-taking limit order 2 points below. It fell 10 ticks below the low of that bar, which is exactly what it had to do for you to scalp out with 2 points. You sell 1 tick below that bar, and then if you’re trying to make 2 points, 8 ticks, it has to fall 8 ticks. And if you have a limit order to buy back your short, the limit order usually is not going to get filled unless it falls 1 more tick. So, the low of this bar has to be 10 or more ticks below the low of that bar for you to sell 1 tick below that bar and scalp out with 2 points (8 ticks).

Probable bear trend

We’re in an early bear trend. We reversed down from the Moving Average, reversed down again near the Moving Average, reversed down again. It’s a Sell The Close bear trend, so traders will sell the market. They’ll sell as soon as a bear bar closes near its low, and they’ll sell with a stop below the low of the bar. Again, as I said, this is early in the day. The bars are big, and if you’re scalping, it’s probably good to scalp for 2 points. If the bars were 20 points tall, you might scalp for 5 or 10 points, about half as many points as there are in the average bar. If the bars are only 2 or 3 points tall, you’d scalp for 1 point.

Here we have another big bear bar closing on its low. If you sold below the low of that bar and you had a limit order to take 2 points’ profit 8 ticks below your entry, you would have been filled on that bar. You’d scalp out with 2 points.

We have another bar closing on its low. Good size bodies. It’s still a Sell The Close bear trend, so you could still sell the market on the close of the bar. Sell the market as the bar is forming or sell on a stop below the low of that bar.

Possible Micro Wedge on Smaller Timeframe Chart

There’s a problem here. This could be forming a Micro Wedge on a smaller timeframe chart. We went down here, we went up here. We went down here, and we went up here. So this is actually a second leg down, and therefore this is a third leg down. Therefore, it’s a Micro Wedge, a small Wedge on a smaller timeframe chart, and that could attract some profit-takers, and therefore we may get a reversal soon. So if you sell below the low of this bar, you have to be able to make quick decisions. Also, the bodies are getting bigger – here, a little bit bigger here, and a little bit bigger here. So it’s accelerating down in a Parabolic Wedge, and that often attracts profit-takers. So if you’re selling down here, you only take the short below this bar if you can make quick decisions, because there’s a risk of a reversal.

Also, an ii in a bear trend often is the final bear flag, so it breaks out below and then it comes back to the ii. Remember, an ii is a Triangle on a smaller timeframe chart. A Triangle is an area of agreement. Traders thought this was a fair price, and now it’s cheaper than a fair price, so bulls might start to buy aggressively and bears will stop selling, and it could come back to that ii, the apex of that Triangle. So there’s an increased risk here of a reversal.

Scalps must be high probability

It was reasonable to sell below this bar because we could’ve just kept going down, down, down, and if you sold below and you have this bull bar closing on its high, it’s a credible buy. It’s a Parabolic Wedge and we have a magnet here, an ii. Traders thought this was a fair price and we might come back to that fair price, and we have a bull bar closing on its high. If you sold below that bar, you’d get out above that bar and you’d take an 11 tick loss. If you’re flat, you could go long above this bar, trying to get a scalp – either a 2 point scalp or maybe hold for a test of that Triangle.

Could you hold short after a 7-bar bear Micro Channel, 7 bars, every high at or below the high of the prior bar? Well, usually the first reversal up from a 7-bar Micro Channel and reversal up after 3 big bear bars is going to be minor. We’ll go up a certain number of bars – I don’t know, 2 bars, 10 bars – but we’ll probably test back down at some point. So some bears will sell as it goes higher.

Remember, some bears sold the close of this bar or below its low and they were disappointed by this bar. They never had an opportunity to get out breakeven. Most would get out here with a loss, but some will hold, expecting this close to get tested. So they’ll sell and then they’ll look to sell more higher, expecting the market to come back down around that close. That would allow them to get out breakeven on that sell, and with a profit on the higher sell. If you’re scalping, you don’t do that. You just quickly get in, you quickly get out. So if you sold below, you would get out above that bull bar or you’d even reverse to long.

Bear Bars Reversing down near Moving Average

Remember in the first video on scalping, I talked about this. I said that when it’s near the Moving Average and you’re getting bear bars reversing down, you sell below. But if you’re reasonably far from the 10-bar Exponential Moving Average and you get a pretty good bull bar, the market usually tries to get back to the Moving Average, so bulls will buy.

Parabolic Wedge, bull bar closing near its high. We’re far below the Moving Average, so it’s a climactic reversal up. And because it’s a Parabolic Wedge, we might get a couple legs sideways to up.

We have a second bull bar closing on its high. Traders will buy above the high of that bar. And this bar closing on its high with a good size body, they’ll buy on the close of that bar. Some of the bulls who bought here have a limit order to get out with 2 points, so they’ll get out somewhere up in here with 2 points. Others will look at this and say, “That’s a pretty good bar. We have a magnet above the Moving Average. We have that ii. Maybe I’ll hold long, and maybe I’ll even buy more above a bull bar closing on its high.” So they might buy here and they might buy more here, expecting it to go up there.

Most Traders Do Not Like to Reverse

I said that if a trader sold below this bar and exited above this bar, he probably would not reverse. Most traders do not like to reverse because if you’re thinking short, it’s hard emotionally to be completely objective. Therefore, the probability of you making the correct assessment is lower. You don’t have much of an edge as a trader, and if at any time you feel less than at your best, it’s usually better not to take the trade. Most traders end up not reversing. They get out and then they wait a bar or two, and then they start trading in the new direction.

Consecutive Strong Bull Bars

Consecutive bull bars, decent size bodies, closing on the high. We’re probably Always In Long. We’re probably going up higher, maybe to the ii. It could be a bull trend. As I said, if you bought above this, you could try to scalp out with 2 points. Or you could look at this bar and say, “Well, we’re Always In Long. We’re probably going higher. I’m going to hold and get out maybe up here, or hold until it stalls and then get out, or possibly even buy more.”

Another bull bar. A smaller body and a conspicuous tail on top, so a little bit of loss of momentum. It’s still Buy The Close. It’s still closing in the upper half, the upper third, but it’s less reliable. If you bought 1 tick above the high of that bar and you’re scalping for 2 points, you’d get out right there.

Scalper Can Exit with Scalp – Sometimes Hold for Swing

It’s a Buy The Close bull trend. As I said, you do not have to get out. You could hold or you could buy more or you could buy more above this bar as well.

Okay, so this is an example where you buy. You see a very strong bull bar. Consecutive strong bull bars. Now Always In Long. Probably we’ll get a couple legs up. You could buy more.

This is a 2 minute chart. Everything happens very quickly. Also, the appearance of the bar very often changes dramatically in the final second or two. So when you’re looking at a picture like this, it’s easy to see where to enter. You sell below, sell below, buy above, buy above. But in real time, very often, probably most of the time, the bar does not look like this until the end of the bar. So you have to make quick decisions and place orders quickly.

Bad Sell Setup

Now we have 3 consecutive bull bars, all closing on or near their highs, but we’re around a 50% pullback and we’re getting close to the ii, a magnet. Might get some profit-takers. And we’re at the average price. Might get some profit-takers. So it might stall here. Now, for the bears, they’re hoping it gets back to this close. They were disappointed by this bull bar. They never had a chance to get out breakeven. So some bears are holding short. If it comes down near that close, they’ll buy back their shorts. Some of them are looking to sell up here somewhere if they can get a bear bar closing near its low, taking a chance that we’ll come back down here.

3 consecutive bull bars after a Sell Climax. We should get a second leg up, and therefore, do you think there’ll be more buyers or sellers at the low of this bar? Probably buyers, so I would not place a stop order 1 tick below. Instead, if I’m scalping, I would put a limit order exactly at the low of the bar. It usually will have to go 1 tick below the low of that bar for my limit order to get filled.

Bear bar closing on or near its low. We have Sell The Close bears here disappointed by this. They might sell more below here, hoping that it comes down here. They could get out breakeven on their first sell and with a profit on that sell. But now we’re Always In Long, and chances are we’re going to get a couple legs up, and therefore there are probably buyers not too far below the low of this bar.

Scalpers Often Scale In

Can you buy with a limit order at the low of this bar? It’s a 5-bar bull Micro Channel. 5 bars, the lows are at or above the low of the prior bar. You’re at the Moving Average. We have a bear bar closing near its low. We have a magnet here. I think it’s probably not worth buying at the low of that bar. However, you might buy a point or two below and use a stop down below this. And for the bears, I don’t think it’s a very good short. We have 3 good bull bars, we’re Always In Long. A second leg sideways to up is likely. I usually like to trade in the direction of the trend, and I think the trend is now long.

We have a bear trend, a pullback, so this is a Low 1 sell signal bar. But it’s also now Always In Long, so it could be a Small Pullback Bull Trend where the market just goes a little bit below this and keeps going up. In other words, we have an early bull trend, a reversal attempt, and it’s just a pullback in this. So it drops for a few ticks and then goes higher. Drops for a few ticks and then goes higher. So it could be the start of a Small Pullback Bull Trend.

Scalpers Sometimes Exit with Profit During Entry Bar

We went below the low of the bar and we reversed up. I said many bulls would not buy that low, but they might place a limit order to buy 1 point lower, 2 points lower, 3 points lower. And had they bought that low with a limit order, and it fell 4 ticks below that and now it’s back up there, they could’ve made 1 point. Other bulls would not buy at the low of a bear bar at the Moving Average, but they might start buying a point or two lower, and they made money when it got back up to the low of that bar.

This low is 9 ticks below that low. It’s a 9-tick bear trap. Now, why do I call it a 9-tick bear trap? Remember what I said a few minutes ago? I said that if you sell on a stop below the low of a bar, the next bar has to fall 10 ticks below that low to scalp out for 2 points. There are a lot of bears that sold 1 tick below that bar. They placed a limit order to buy back their shorts 8 ticks below, and therefore there are a lot of bears with limit orders buying 9 ticks below that low. And if it hits their limit order, most of them will not get filled, and if it starts going up, the bears will panic and they’ll buy back their shorts. They’re trapped into a bad trade, and that’s why I call it a 9-tick trap.

Now, we have a doji bar here, a doji bar here. Those are Trading Range bars. The market went down, it went up, it went down, it went up. So we’re getting a lot of reversals. These dojis could be a sign that we’re starting to enter a Tight Trading Range. If the market’s in a Tight Trading Range, traders will buy below, buy more lower. They’ll sell above, sell more higher. So what should you do here? Should you buy? Yes. Should you sell? Yes. If we’re in a Tight Trading Range, we’re probably not going to go all that far up or all that far down over the next few bars, so some traders will sell, sell more higher, buy, buy more lower, and then both will scalp.

If a bull bought that low and bought more 2 points lower, it had to fall 9 ticks. If he buys that low, 2 points lower is 8 ticks below the low of that bar. It has to fall 9 ticks for him to get filled. He would be filled here. He could get out breakeven on his first buy and with a profit on his lower buy. But the stop order bears are trapped. It had to fall 10 ticks for them to make money. They sell 1 tick below. Limit order bulls buy at the low, not 1 tick below. So limit order bulls only needed it to fall 9 ticks for them to scale in 2 points below. Stop order bears need it to fall 10 ticks to make 2 points.

Sometimes Trade Goes First Wrong Way

Here we got a decent size bear bar. Closed in its lower half, but closed at the low of this bar, not below. So it’s not all that bearish. We’re probably still Always In Long. This looks more bullish than this looks bearish. Remember I said there were Sell The Close bears here who are upset by this, and they’re trying to get out breakeven. After all of this, instead of placing a limit order to get out breakeven at the close of that bar, they might be willing to take a small loss. They might place a limit order 2 or 3 or 4 ticks above the close of that bar, and if they did, they would’ve been filled here, and they bought back their shorts from here with a small loss. The stop order bears who sold below here now did make 2 points.

4 bars without a bull body. We’re still likely to get a second leg sideways to up after a Parabolic Wedge and a strong reversal up, but that’s not a good-looking stop entry buy. And for the bears, I think we’re still Always In Long. They have not had consecutive big bear bars closing on their lows – plus we’re still above that low. I would not be selling down here.

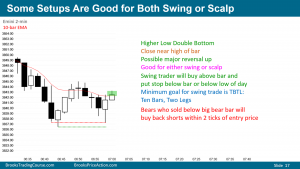

Some Setups Are Good for Both Swing or Scalp

Bulls, we got a big reversal up, and look where it reversed up from – from below that close. So the bears who held and sold more below here and they started to get out around breakeven, they were able to get out breakeven on the close that they sold here and a profit there. In part, this big tail, this reversal up, is from bears buying back shorts.

Well, guess what? The bulls are not stupid. They know that the bears who sold this close were trapped, and those bears will be eager to buy at that close. So if you’re a bull, what are you going to do? You might place a limit order to buy at that close, or a tick or two above that close, thinking that a whole bunch of bears are going to buy back their shorts. The bears are saying, “Oh, thank you, I’m able to get out without a loss,” and they’re not eager to sell again. So this tail is caused both by these Sell The Close bears getting out, being thankful to be able to get out without a loss, and from bulls betting that the bears would panic out, buy back their shorts, and that we would get a second leg up after this.

A good-looking buy signal bar. It could be better. A bar could close on its high. It could close at the Moving Average. But it’s still a pretty good buy signal bar. On a smaller timeframe chart, it’s probably a Wedge Double Bottom. We went down, we went up, we went down, we went up, and we went down, we’re going up. So it’s three legs down and it’s a Higher Low Double Bottom. That’s a pretty reliable and pretty common buy pattern and a very good buy signal bar. So it’s a credible buy here. And this could be a Major Trend Reversal. A Major Trend Reversal means a couple legs up, maybe 10 bars or more up. On a 2-minute chart, 10 bars is 20 minutes. On a 2-minute chart, it could be a major reversal, but on a 5-minute chart or a 15-minute chart, it would be a minor reversal, just a bar or two.

So we have a Higher Low Double Bottom, a Parabolic Wedge selloff, and a reversal up with a pretty good bull bar. As I said, we could get a couple legs up over the next 10 bars, so you could buy that for a swing up or you could buy it for a scalp.

You buy on a stop above the high of that bar. You’re disappointed that this bar is not all that big. If you took the buy, I would put the stop below the low of this bar.

I talked about this. The bears who sold that close or below the low of that bar were able to get out around breakeven.

Every Trading Range Has Both Buy and Sell Signal

Now, what do you do if you bought above the high of this bar? Is this very disappointing? Are you thinking, “Oh my gosh, I’ve got to get out”? Or are you thinking, “Eh, that’s not all that bearish, we should get a couple legs up; I’m going to keep a stop below this bar and take my chances”?

Possible Small Pullback Bull Trend. Right now we have a Trading Range. We have a Double Bottom and a Double Top. It’s BreakOut Mode. But we’re Always In Long from this, and now we have a Higher Low Major Trend Reversal. So it’s slightly more bullish than bearish. You can call it a Triangle. We have three lows – one, two, and three – and two highs and a Trading Range. We have Lower High, Higher Low, Higher Low. BreakOut Mode. But slightly more bullish.

That’s not a good-looking sell, and if it’s not a good-looking sell, there probably will be buyers below. So limit order bulls would place a limit order to buy at the low of that bar and put a stop down here. They might buy more a point or two lower.

The bulls are hoping this is the start of a bull trend. They see this as a pullback. We now have an ioi. We have an outside bar and then an inside bar. The bar before an outside bar is always an inside bar, so it’s an ioi. It’s another BreakOut Mode pattern like an ii over here. It’s a bull bar closing near its high. When you have these small BreakOut Mode patterns and the third bar is a bull bar closing near its high, it’s better not to look to sell. It’s better only to look to buy. And here, a bar closing on its low below the Moving Average, it’s better only to look to sell below and not buy above. And now we’re above the Moving Average and we have an ioi and a bull bar closing near its high, so it’s a stop order buy above that high. We’re still in a Triangle, and we could stay more sideways, but it’s more bullish than bearish. If you take that buy above that bar, your stop is still probably below this low.

The limit order bulls who bought at the low of that bar, they got filled over here. They could scalp out right here. They could also hold long.

Again, as I said, this was an ioi, an outside bar followed by an inside bar. So the bar before the outside bar has to be inside. If this is outside, the bar before it has to be inside. We’re still on the Double Bottom here. We have the buy above the Double Bottom, and this is a pullback. It’s a bull flag. The bulls are hoping it’s a Small Pullback Bull Trend, so a bull trend where you get a small pullback, a bar or two, not too low, and you go up, and then another small pullback and you go up.

Can you buy above the top of that ioi? I think it’s okay. It’s closing above the Moving Average. We’re Always In Long. The problem you have is you’re buying at the top of a Trading Range, top of a Triangle, and that’s somewhat lower probability.

Breakout Mode – Often Can Scalp in Either Direction

Now what do you do? We have another ii. Pair of inside bars, and it’s also an ioii. So we still have the ioi here, and now it’s ioii. It doesn’t matter that it’s now an inside bar; it’s still a BreakOut Mode pattern. It’s a bear bar closing near its low, so you will start to get some bears selling below the low of that bar. But we still have a bull bar closing near its high. You’ll get bulls buying above the high of that bar. Even though this bar is a bear bar, this bar is a pretty good bull bar. It’s BreakOut Mode. Traders will buy above that bull bar, which is also the high of that bear bar, and they’ll sell below that bar. Two legs up – one, pullback, two. Two legs up – one, pullback, two.

Remember, down here I said the minimum goal for the bulls was a couple legs sideways to up, and that’s what we have. One, pullback, two. Right now it’s still on the buy above this and the buy above that. It’s slightly more bullish than bearish.

It could not be going sideways if it was 60% or 70% certain that we were going up. It’s better than 50%, but not 60%.

Stop Entry

Now, can you take that sell? You can. The bars are pretty small. You might try to scalp for 2 points and may switch to 1 point since we’ve been in a Tight Trading Range for 8 bars here, from here to here. Not much profit potential. If you did sell below that bar, you’re probably disappointed by this. If you sold below it, it fell 6 ticks. If you’re scalping for 1 point, it has to fall 6 ticks to make 1 point. You sell 1 tick below the bear bar, it has to go 4 more ticks to reach your limit order, and it has to go 1 more tick to fill your limit order. It did exactly that. This low is exactly 6 ticks below that. So the bears who sold that were able to scalp out for 1 point.

Now, what about the bulls? Will they buy above this bar? Well, we have consecutive bear bars. You could redraw the Triangle. Instead of one, two, three, it might now be one, two, and three. But 2 bear bars, not a very good stop entry buy. Because it’s a Tight Trading Range, you will get limit order traders buying. They might not buy the low of this bar, but they might buy a point or so below – 1 point below, 2 points below – betting that we’re going to continue to reverse.

The bears who sold below the ii, the bars are getting smaller. If they scalped for 1 point, they would’ve made their 1 point. They would’ve gotten out here, 1 tick below the low of the bar. That tail on the bottom of the bar tells you that the bears who sold below that bear bar scalped. They scalped for 1 point. It fell 6 ticks and reversed up. That tells you there were a lot of buyers down there. Most of those buyers are bears scalping out. Some of those buyers are bulls buying a point or so below the low of that bear bar, betting that the bears would scalp out – and also, because it’s a Tight Trading Range, traders will buy below things and scale in lower.

Triangle – Often Need to Redraw Lines

You can redraw the Triangle. Still a Tight Trading Range, since over here, but a bull bar. Not a good sell below. A bear bar. Not a good buy above. Probably more limit order traders, buying a point or two below a prior bar, selling a point or two above a prior bar, and trying to scalp out for 1 point. Stop order bulls, if they bought, they would’ve made 1 point. I’m not sure that it’s worth buying with a stop after 2 bear bars in the top of a Tight Trading Range.

Big tail on top, so another reversal down. You can redraw the Triangle. Still BreakOut Mode, but I think we’re still Always In Long. A good reversal here and a good reversal here. This is not quite as good as that. This is not quite as good as that. So I think it’s still slightly more bullish. As I said, it’s barely better than 50/50. We could not be going sideways in a tight range if one side or the other side had a 60% or 70% chance of a breakout. If it was so obviously bullish or so obviously bearish, it would be breaking out right now. We would not be going sideways like this.

Strong Breakout

Very good bar. Why? Well, look at the high of the bar. First of all, it’s a big bull bar closing on its high. Consecutive bull bars, and it closed above this high and it closed above that high, and it closed above these bars. So it closed above the high of the past 15 bars or so. Pretty good breakout bar. Some bulls will buy the close, some will buy on a stop above the high, hoping that we’re finally going up. We have a Double Bottom, a slightly Higher Low Major Trend Reversal, and a Trading Range. Couple legs down – one, pullback, two. Not a good buy signal bar, but now we’re breaking to the upside.

When you’re looking to buy, you either want good-looking buy signal bars with good context – it has to make sense when you look to the left – or you wait for a strong breakout. This is an example of a bad buy signal bar, but a good breakout.

Closed above all of these bars, all the way out here. That increases the chances that we’re going higher, so you will get bulls buying above the high of that bar. Some bulls will wait to see the follow-through bar, and if the follow-through bar is a big bull bar closing near its high, or even a small bull bar, they’ll buy the close of the bar, or they’ll buy above the high of the bar. Bars getting bigger again, so if you’re scalping, you go back to 2 points.

Bull Surprise

Consecutive big bull bars closing on their highs. Two closes above the Trading Range. We’re probably going up. This is clearly a resumption of the bull trend, and it’s the strongest move up or down all day. So it’s Buy The Close, buy the market. You buy above bars. You can swing or scalp. It’s a bull surprise. This is a surprise, but now we have 2 big bull bars closing near their highs. That’s even more of a surprise. A surprise typically is going to have at least a couple legs sideways to up. Traders will buy the first attempt to reverse down, confident that we’ll get a second leg up.

If you bought above the high of this bar, you could scalp out for 2 points, or you could hold for a swing. Once this bar closes, it’s another buy above the high of the bar or at the market as soon as the bar closes. If you bought above this bar and did not scalp out, you could buy more here. You could take several buys on the way up if your account size is big enough, and if you’re trading a small enough position.

Losing Momentum

A bull bar, but a smaller bull bar. However, it’s still closing on or near its high and we’re breaking out to a new high of the day. It’s still Buy The Close, Buy The Market as soon as the bar closes or buy above the high of the bar. But possible Double Top here, so we might get some profit-taking soon. Bulls could buy above the high of that bar. They could buy above the high of this bar.

Disappointment. So if you bought above the high of this bar and you did not scalp out, or if you bought above the high of this bar and you see a small bear doji reversing down, possible Double Top, a lot of the bulls will get out and then wait for the next buy signal. You don’t have to. We have 4 bull bars, a bull surprise. We should get a second leg up. You could use a wider stop. My general rule on the 2-minute chart is get out a tick below a strong bear bar; get out 4 ticks or so below a bull bar or a weak bear bar. So you might get out 4 ticks below that.

What about shorting? A big Low 2. One leg up, pullback, second leg up. A Double Top. This is too strong. Remember, it’s a bull surprise. We should get a second leg up, and therefore I would not be selling below that bar.

Some bulls bought above the high of the bar. They’re disappointed by the bar when it closed, and they might try to get out breakeven. They could exit breakeven. Once this bar closes, they could place a limit order to get out breakeven or with a tick or two loss. Or they could exit a point or two below the low of that bar. Chances are there’ll be buyers below that bar. It’s not a good-looking sell, and we have 4 bull bars, 3 closing on or near their highs. We should go higher, so there probably are more buyers than sellers below that bar. So some bulls will actually buy at that low or buy a point lower, 2 points lower.

Higher High, so it’s a Higher High Double Top with a bear bar, but a 6-bar bull Micro Channel and very good reversal up. We should get a second leg up, so I would not be shorting yet.

Bulls Buy Reversal Down

Now we have a 7-bar bull Micro Channel. The bull bar is closing in its upper half, but these 2 bars are small. The bodies are shrinking. Here, smaller, bear bar, small bar. So we’re getting some profit-taking here, and this is less reliable Buy The Close or buy above the high of the bar. We might be entering a Tight Trading Range. You could still buy, but you probably need a wide stop. A wide stop means different things to different people. In general, when you’re scalping for 2 points, it’s probably better to get out a point or two below a bull bar and a tick below a bear bar closing below its midpoint and having more than a 1 tick bear body.

We have a decent bear bar. It’s reasonable to get out below the low of the bar. It did not go below the low of the bar. Why not? The bulls knew if it went below the low of that bar, a lot of the bulls would start to exit. So what did the bulls do? As soon as that bear bar closed, they bought. They did not want the next bar to go below its low. They don’t want to get out. They think we’re going to get a second leg up. The bulls who bought here, the bulls who bought above that bar got filled here. They could scalp out here.

Now, this might be a third leg up – one, two, three. So we might get some profit-taking. There’s no reason to sell yet, but we’re getting bear bars here. We might start to get limit order bears – this is a High 1 bull flag. We have a bear bar here, a second bear bar. So you might start to get some bears selling, either at the high of this bar or a point or two above the high of the bar, betting that these bars are a sign that the market’s getting exhausted and we might enter a Trading Range.

High 1, but 2 bear bars and a decent size bear bar and a third leg up – one, two, three. Remember, the bulls are looking for a second leg up after this. They have it. They might get a third and fourth and fifth leg up, but at a minimum they’re looking for a second leg up. Also, we spent a lot of time going sideways here. This might not end up as a very strong bull trend. It could soon enter a Trading Range.

Scale into Shorts above Bear Bar

Now, some bears will sell that high and start to scale in higher, a point or two higher, betting that we’ll come back to these lows, that this is an area of agreement – 3 sideways bars and we have a Wedge. In general, when the market’s in a reasonably strong bull trend, you should not be selling with limit orders. Sometimes I’ll do it, but you have to be really careful. You have to be confident that this is not going to keep going up. There has to be some reason for you to think it’s not going to keep going up.

Well, we had a lot of bear bars here, a Trading Range here, and now we’re starting to get bear bars here and it’s a third leg up. So some bears will sell that and sell more higher, or instead of selling here, they might start to sell 2 points higher.

Traders don’t like to reverse, so the traders selling here are not bulls taking profits and reversing. These are simply bears betting that we’ll come down far enough for a scalp.

Trading Range Likely Soon

Bear bar closing on its low. It’s actually an ioi. This is an outside bar, and now we have an inside bar. So theoretically it’s a sell below there. It’s a Low 2 top – Low 1, Low 2, plus we have a Wedge – one, two, and three. I’m not ready to sell with a stop. It’s still a Small Pullback Bull Trend, a Tight Bull Channel. For the bulls, this is a High 1, but we’re starting to get bear bars – here, here, here. The count may change. So it might be this is Leg 1, pullback, Leg 2, pullback, Leg 3. So instead of a Wedge being here – one, two, three – this might have started the count over again, so this is one, pullback, two, pullback, three.

In general, if it’s a clear third leg up and you’re starting to get bear bars, you only take the buy if you can make very quick decisions, because very often it’ll only go up a bar or two and then reverse and get a couple legs down.

Some bears sold this high, sold more higher, or they simply sold higher, and it had to drop 1 tick below the high of that bar for them to get out with a profit on their higher sell and breakeven on their first sell – and it did. This went just 1 tick below that, so the bears could get out with a profit on that sell and breakeven on that sell.

Bears are starting to make money. If bears are starting to make money in a bull trend, the bull trend is becoming weaker, and it increases the chances that we’ll get a Trading Range soon.

A High 1, but a third leg up – one, pullback, two, pullback, three. It’s a credible buy, but if you’re a bull who bought above that bar and you have this for your entry bar and then you have this, a lot of the bulls will try to get out around breakeven, thinking that we might start to pull back soon.

Tight Trading Range – Not Much Profit Potential

4 small bars in a Tight Trading Range and then 3 bars in a Tight Trading Range here. This is not good stop order trading. It’s more of a limit order market, a Tight Trading Range. And that’s what we did. We went sideways there. Tight Trading Range. It’s a limit order market. Traders buy below, buy more lower, scalp out. They sell above, sell more higher, and scalp out. Most traders should not trade in a Tight Trading Range, especially when the bars are small like this. They’ll lose money.

2-Minute Chart – 50 Setups a Day

This is about 2 hours of trading, and in this 2 hours, if you added up all the wins and losses, you would’ve ended up with 18 points in 2 hours. That’s about $900 in the Emini, and then you subtract out commissions. But if you traded it perfectly, you could’ve made $900 in a couple hours per contract.

On the 2-minute chart, there are at least 50 or more reasonable scalps each day. A really aggressive scalper might take half of them or a third of them. Most traders who trade very intensely and aggressively do it for an hour or two at a time because it just becomes too stressful. They get tired. They have a hard time focusing. They lose their edge. They can’t make decisions fast enough. If they traded well, they already have a lot of profit, so there’s less incentive.

Remember, when you’re trading, you have two goals. One is to make money and the other is to be happy. You’re planning to do this for a career, a long, long time, and you cannot be stressed out all the time. If you try to take every trade, you’ll be miserable. You won’t be able to do it. You can go on YouTube and watch that episode from “I Love Lucy” back in the 1950s, “I Love Lucy and the Chocolate Factory” episode, and it gives you an idea of what happens when you try to do too much. It’s only a 2-minute clip, so you might get a kick out of it.

There are a lot of choices available for scalpers, right? There are different ways to do it. But this is one reasonable version of what scalpers would do. Again, most scalpers are not going to take all these trades, but a good scalper will take a lot of them and have a very high winning percentage.

This is theoretical. It’s good practice to think about setups. It’s good to get quick at recognizing patterns. Most traders will make more money swing trading and entering with stops. However, there are some traders who are extremely good scalpers. They win 80%, 90% of the time and they might take 10, 20, 30 trades a day, and they can make a very good living. Most traders will be stressed out and not enjoy doing it. Most traders can’t do it, but those who can, a lot who can, will get stressed out. It’s okay to do it in spurts for a half hour or an hour or so, but to try to do it for a living, you’re not going to be able to do it. It’s much better to look for swing trades, enter with stops. Much less stress, much more profit.

I scalp a lot. A lot of times I’ll take a trade that is a possible swing trade, but it disappoints me as soon as I enter, and I’ll end up scalping out. I have never scalped perfectly for an entire day, and I’ve been doing this now for close to 35 years. I’ve never met anyone who has scalped perfectly for an entire day. But if you’re a good scalper, you can make a lot of money if you take a lot of trades and manage them well.

Close

Again, I’m Al Brooks. Thank you so much for your attention. I hope that you find this video helpful.