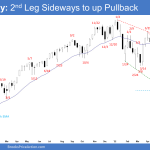

The S&P 500 Emini futures traded higher from a higher low major trend reversal. Bulls need to create a consecutive bull bar (follow-through buying) next week, something they have failed to do since March. The bear trend line and 20-week exponential moving average remain resistances above. If next week closes as a bear bar instead, it will mean the bulls failed to get follow-through buying yet again. Odds of a re-test of June low increases.

EURUSD sideways at wedge bottom pullback

The EURUSD Forex broke below the 2017 low with follow-through selling recently. The bulls want a reversal higher from a wedge bottom (Mar 4, May 13 and July 14) and a trend channel line overshoot. However, the move down is in a tight bear channel. That means strong bears. Odds slightly favor lower prices for the EURUSD after a larger pullback.

Bitcoin pullback after stalled at major support

Market Overview: Bitcoin Futures Bitcoin pullback finally became a reality after the price stalled at major support. Traders expect the price to reach $28800 during the upcoming months. Bitcoin futures The Weekly chart of Bitcoin futures Traders still think that the Bear Trend on the Weekly chart is contained within a Trading Range; therefore, the […]

FTSE 100 double top pullback testing prior breakout

Market Overview: FTSE 100 Futures The FTSE futures market was a double top pullback testing the prior breakout. We have been going sideways for many weeks now so it’s a tight trading range ready to break out either way. The longer we go sideways the less steam the bears might have to push down further. The […]

DAX 40 High 1 bear channel pullback

Market Overview: DAX 40 Futures DAX futures was a High 1 Bear Channel Pullback. It’s a major trend reversal on the daily timeframe but still always in short on the weekly. Confusion, sideways but probably more upside as we are struggling to get below the March lows. Both DAX and FTSE are looking stronger but […]

EURUSD pullback after breakout below March 4 low

The EURUSD Forex is trading sideways after breaking below March 4 low. It may continue to trade sideways for another week or two. If there is a breakout, odds slightly favor a downside breakout more. Bulls need to create consecutive big bull bars trading far above April 21 high to convince traders that a reversal higher may be underway.

Nifty 50 futures pullback (50%) & limit orders filled

Market Overview: Nifty 50 Futures The Nifty 50 futures pullback (50%) gave a indecisive close (i.e., Doji) for this week, and filled the buy limit orders present at the positive gap. Overall week was sideways with no major move. Nifty 50 gapped down on the open (i.e. Monday ~start of the week) and the close […]

Emini reversal up from Low 1 pullback

Trading Update: Thursday March 24, 2022 Emini pre-open market analysis Emini daily chart Emini reversal up from low 1 pullback with market finally getting a bear close yesterday after five consecutive bull closes. With yesterday triggering a low 1 (L1) short, odds are this L1 will lead to a 1-3 day pullback. The pullback might […]

Emini likely 1-3 day pullback following last week’s bull breakout

Trading Update: Tuesday March 22, 2022 Emini pre-open market analysis Emini daily chart Yesterday was a doji with a bull close. It was also the 5th consecutive bull bar, which significantly increased today’s odds of having a bear close. The odds are the market will have a 1-3 day pullback, and yesterday may be the […]

EURUSD in pullback from parabolic wedge on weekly and daily charts

EURUSD Forex: Weekend Market Analysis The EURUSD Forex is in a pullback from parabolic wedge sell-off testing the 700-pip measured move which started in October 2020. Traders are monitoring whether the bulls can create consecutive bull bars closing near their highs or the pullback is more sideways with weak bull bars. The leg down from February is […]