The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi,

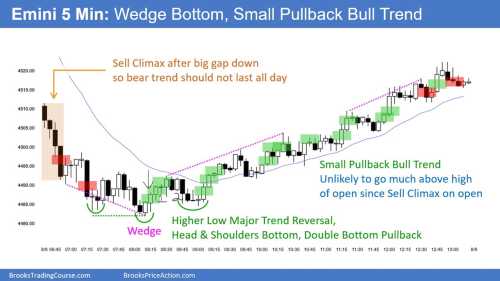

I took the wedge bottom trade after seeing the consecutive bull bars around 8:15 and the bear legs weakening. However, I noticed an opposite signal (2nd entry short) near the EMA and got out of the position.

1) Is that a reasonable thing to do?

2) What would be a better thing to do considering trade management?

Hi S,

I think it's fine to exit. I was actually expecting a broader bear CH to develop myself after spike down as per market cycle. And there wasn't yet a strong move above prior major LH to officially end the bear trend so any buys would be for a low probability swing.

The only trick with exiting early is if the bears fail the trend resumption, then a trader is obligated to re-enter long. Especially if a good MTR is setting up. You can see Al marked more reasonable swing buys there after bears failed.

Hope that helped,

CH

__________________

BPA Telegram Group: for intermediate to advanced traders.

Great question! In hindsight it is easy answered: if you exit, enter again above 30 or at close of 31 cause your premis is still valid. But how to manage this real time?

I prefer to exit at resistance, so close of 24 or 26. 24 because bulls got weaker (overlap) and EMA is resistance, so exit and watching pullback is reasonable especially as you got nearly 2 times your initial risk at this point and your stop is far away. Or if you hold 25 disapointment you can exit 26 close cause with EMA above a breakout after 25 is not likely, more likely a deeper pullback, which came.

I did not take the longtrade but I watched the L2 and decided that I clearly dont want to short this L2 cause bulls were too strong and L2 after strong bullbar 26 is lower probability then after a bear bar. This could be the argument for a swing trader to hold through this pullback.

Hope this helps, wish you good trades and great management!

Hardy

MES 8.9.2023

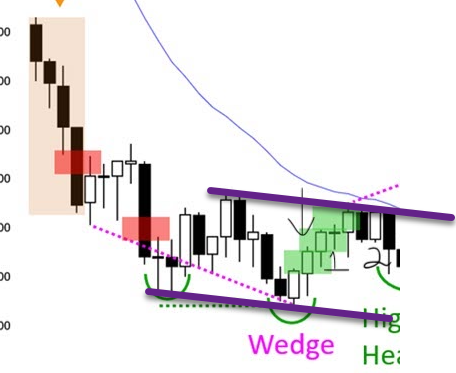

Short with Stop above 20. Target Low of Yesterday.

1. Is 25 Credible Opposition ? Possible 2nd Leg Trap in TR ?

2. Then, after no stop out:

- 24-26 = i O i

- Spike + H1

- BO Test + Gap 24,26

Is this Credible Opposition ?

In both cases, it is risking a lot to make a little.