The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

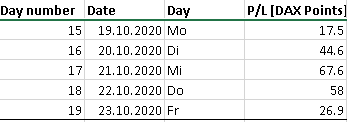

Week 3: Mo, October 19 - Fri, October 23

Gross P/L: +214.6 DAX points (+221.5 points week to week)

Average daily P/L: +42.9 DAX points (+44.3 points week to week)

Std.Dev.: 18.7 DAX points (-48.2 points week to week)

Total P/L since start: -36.6 DAX points

Analysis:

- + very consistent in return, low std. deviation

- + avoided a lot of stupid trades by thinking twice

- + personally, I feel like I'm making big improvements

- - impatience: took profits early before trade hit TP

- - fear of loss, closing trades with marginal profits

In summary, I'm incredibly happy. This is my first week ever to have made money each and every day. My results correspond to a return of 41% (based on margin). Also, I'm now very close to breakeven(globally speaking). Al, if you're reading this: I'm very happy to have signed up for your trading course. If have only completed 23% of the first part of the course, but I'm already seeing, how the puzzle pieces fall into place. I have avoided an incredibly amount of stupid trades by applying concepts from the course.

- don't try to catch the falling knive

- wait for confirmation

- trade with the trend

(I used to be a die-hard countertrend scalper, so trading with the trend is very different for me.)

I won't have too much time to trade next week, so I'll take this as an opportunity to do more swingtrading instead of trying to scalp. Also, I just completed the videos 14 (Trends). So this is probably a good time to practice staying in trades longer. If you have followed my journal, you know that that is something I struggle with a lot. Exiting trades with 10 points of profit that could have easily made 100 points is not a good thing to do long-term.

Happy trading everyone!

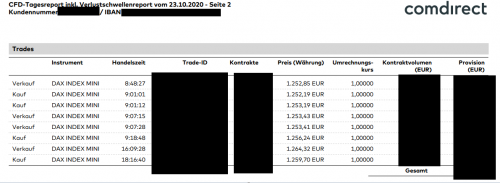

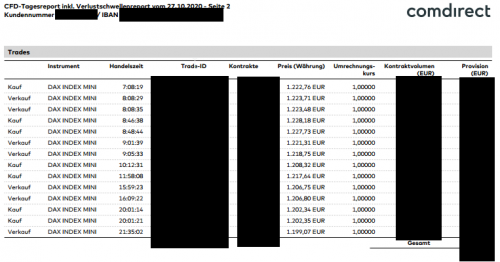

Week 4: Mo: All trades with chart

Daily P/L: -1.3 DAX points

Detailed analysis: What a day! Up and down and up and down and at the end I managed to come to a screeching halt at the breakeven line. I have to say, that I'm very dissapointed with my trading today. Not because of the result, but because I fell back into old habits: Taking profits early, not riding winners and taking stupid trades. I can consider myself lucky that this has not been a day with -100 or -200 points. With my trading, that certainly could have happened. Days like these should probably make 200+ points. I mean, it went straight down and that's it.

- Trade: Went short after I laboriously convinced myself that it is indeed a downtrend and that it's fine to simply sell the market. P/L: +44.2 DAX points.

- Trade: Well, that's what you get for catching the falling knive. P/L: -83.3 DAX points.

- Trade: Went short after breakout below LOD. P/L: +61.6 DAX points.

- Trade: Short for possible retest of V-shaped bounce: P/L: -37.7 DAX points.

- Trade: Long after breakout above bull-flag: P/L: +13.9 DAX points.

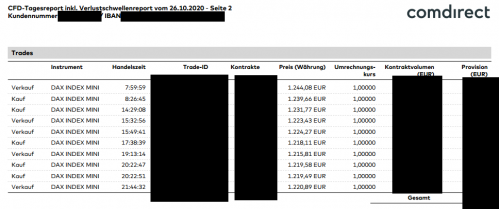

Week 4: Tue: All trades with chart

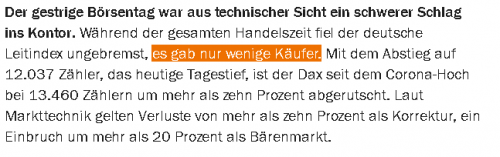

Daily P/L: -94.5 DAX points

Detailed analysis: What an utterly stupid trading behaviour again. Yesterday was a warning, today was a shot across the bows. Things have to change. How is it, that I'm still lured into taking longs in this kind of market? Also, today shows that although I know what I should do, I just rarely do it. For example, in the morning, I was down 100 points. Suddenly, I'm able to trail a trade all the way down and close it with 105 points profit to reach breakeven. Why am I not able to do this normally? Whenever I'm green on the day, I'm sooo afraid of taking a loss as it could "ruin" my good trading day.

- Trade: Long on breakout. P/L: +9.5 DAX points.

- Trade: Short on double top. I'm still angry that my stop was triggered just before the 200 point fall. P/L: -47.0 DAX points.

- Trade: Long on breakout: P/L: -64.2 DAX points

- Trade: Short after huge drop: P/L: +104.3 DAX points. Btw, this is my biggest winning trade on the DAX ever. I have to do these kinds of trades not only when I try to save myself from a drawdown. Also, after this trade, I was slightly in the green so I could have simply stopped. Instead, I decided to mess up again. This time, I was not able to save myself:

- Trade: Stupid: P/L: -108.9 DAX points.

- Trade: Guess I realized after two days, that there's a downtrend so so YOU COULD ACTUALLY JUST SELL! P/L: +44.6 DAX points.

- Trade: Yeah, let's try to pick the bottom again: P/L: -32.8 DAX points.

I'm so mad right now. My SL was triggered by one tick, so that I missed a 300 point decline in the DAX.

Week 4: Wed: All trades with chart

Daily P/L: +125.9 DAX points

Detailed analysis: What a day! I have learned sooo much from this trading day. Yes, I was angry in the morning but I still managed to make reasonable trades. Also, this is my biggest daily profit ever and today was my most profitable trade ever. Also, my most profitable trade is now bigger than my biggest loosing trade. I consider this a success, since I'm struggeling so much with letting trades run. Of course, I want to avoid a negatively skewed return curve under all circumstances.

- Trade: Short early in the morning, got stopped out unfortunately. P/L: -38.5 DAX points

- Trade: Shorted again at the daily low (at the time). Held until the afternoon. P/L: +131.6 DAX points

- Trade: Short after bounce up (2nd entry short): P/L: +22.1 DAX points

- Trade: Short after breakout from triangle. P/L: +10.7 DAX points.

Do you notice the pattern? The trend was down and I simply sold, even at the worst possible point (Trade 2) and managed to have a good trading day without even doing much apart from occasionally checking in on the chart. Thank you Al, especially for teaching me the right level for the SL. I finally start trusting the probability and accepting the "far away" SL. I hope experiences like these will for once and for all cure me from my bottom and top picking mania.

Also, I'm just about scratching breakeven regarding the total P/L from the start. So I'm very exited since I managed to trade myself out of a 320 point deep drawdown. Actually, there are only 6.5 points missing to total breakeven. Very exciting!

Had a terrible trading-day yesterday and today is not looking good either. Will post the usual details in the evening (Berlin-Time).

Week 4: Thu: All trades with chart

Daily P/L: -252.1 DAX points

Will do a detailed failure analyis for both Thursday and Friday.

- Trade: Short for second leg down. P/L: +1.8 DAX points

- Trade: Short at topping formation: P/L: +72.8 DAX points

- Trade: Short at false breakout downwards: P/L: -215.2 DAX points

- Trade: Reversed position as 3.Trade got stopped out. P/L: -82.0 DAX points

- Trade: Short. P/L: -29.5 DAX points.

Week 4: Fri: All trades with chart

Daily P/L: (-237.0 DAX points)

Will do a detailed failure analyis for both Thursday and Friday.

- Trade: Short at strong bear-leg. Thought that my SL has triggered, but didn't double check so I'm stuck with a short position over the weekend. Now it's pure gambling how it's going to turn out. Accounting-wise, I'm simply going to book the current P/L as is for the analysis. On monday, I will then post the actual P/L once the position is closed.

Befor I'll post my own failure analysis, I would invite you to take an unbiased look at the trades from Thursday and Friday and post, what I have done wrong in your opinion. Feel free to write openly. Of course I know what I think I have been doing wrong, but I'd appreciate another point of view.

Don't worry, I have prepared for this exact situation, so I have been trading really small. The P/L in points and % is dramatic, but the actual loss in cash is nowhere near to beeing dangerous.