The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello fellow traders,

in this post I would like to share my progress in trading towards profitability. Every week, I'm going to post my results from trading the DAX (GER30).

Just a few words about myself: Currently, I'm studying chemistry at a university in Germany and I've been trading for almost exactly three years. I started with stocks, continued with CFD's and then futures and options. I was never profitable and in fact I lost a lot of my equity over the three years. A week ago, I signed up for the Brook's trading course. Of course 399$ might seem like a lot of money (and it is), I arrived at the conclusion that I'd rather spend it on some proper training from the ground up than loosing an equal sum in trading.

Even though I'm not proud of my losses, I know that they have been / are part of the path (at least for me). I had to make the mistakes myself and try out a lot of things. Now I'm finally in a state of mind where I actually listen to people instead of trying to outsmart the market. If I would have singed up for this course three years ago, I believe that it wouldn't have helped my a lot, since I wouldn't have listened.

So anyways, I've been through the losses - so if you want just feel free to openly comment onto my weekly results - I can handle it.

Why do I even trade? Well, firstly, I'm young so I don't really care if it takes me another three to five years to reach profitabilty. That still leaves enought time to archieve my financials goals (and if I happen to die young than I'll never have to worry about money ever again). -> I can only win by learning to trade.

I also like the mental challenge in trading and would like to be able to eventually be an independenten reseacher(funding myself). Chemistry and Astronomy really fascinate me.

My plan:

- In the first phase, I'll try to cut away my biggest losses and the obviously stupid trades. I hope that that will bring me closer to breakeven on a weekly or monthly basis. My verifyable goal is to have the 20d SMA of my P/L at or very close to 0. I'm estimating around six months for this phase.

- In the second phase, I'll try to reach into the region of profitability. My verifyable goal is to have the 20d SMA of my P/L turn positive. I'm estimating around twelve months for this phase

- In the third phase, I'll try to keep my 20d SMA of P/L in the positive as consistently as possible.

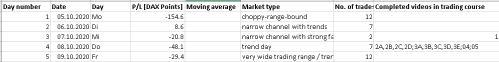

Week 1: Mo, October 5 - Fri, October 9

Gross P/L: -244.3 DAX points

Average daily P/L: -48.86 DAX points

Std.Dev.: 55.9 DAX points

Analysis:

- + did not let losses run

- + successfully convinced myself not to try to pick tops and bottoms

- + better understanding about what the market is doing at any point in time

- - impatience: took profits early before trade hit TP

- - Friday: relapsed to bottom picking (one trade)

- - too early entries

- - every day, I took some trades that I clearly should not have taken

PS: Should I attach the broker statements? I don't want to spam the forum...

Week 1: Mo: All trades with chart

Attached you'll see the chart from monday with all trades. In my opinion, my biggest problems on monday were:

- Overtrading (as can be seen from the large number of trades after the opening bell at 9 o'clock (Berlin time, GMT+2)

- Not taking notice of the trading range / bull channel soon enough.

Hi Kristof,

First of all, I don't agree that $399 is a lot of money. I actually find it very cheap, in relation to volume and quality that is delivered. You are going to be spending hundreds of hours on this course. Time will be your biggest investment.

I will be following your journal, although I signed up for the Forex Course.

Thanks for sharing.

@marvinbertonyahoo-co-uk

Hi Marvin,

thanks for the reply. I guess you're right (have only completed the first ten videos so far). But I already see that the amount of stupid mistakes is drastically dropping (shorting the spike up for example was my speciality...).

I have looked into your journal as well. Happy trading!

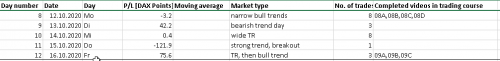

Week 2: Mo, October 12 - Fri, October 16

Gross P/L: -6.9 DAX points (+237.4 points week to week)

Average daily P/L: -1.38 DAX points (+47.5 points week to week)

Std.Dev.: 66.9 DAX points (+11 points week to week)

Total P/L since start: -251.2 DAX points

Analysis:

- + always had a rough idea, what the market is currently doing

- + convinced myself to let profits run at end of week

- + personally, I feel like I'm making big improvements

- - impatience: took profits early before trade hit TP (Mo-Thu)

- - Thu: let one bad trade wipe out twice the previous profits

- - fear of loss, closing trades with marginal profits

In summary, I feel like I have learned a lot. Also, the results are practically at break-even. So I consider this to be a step forward.

I have gone ahead and annotated a lot of things on the charts. So for details, please refer to the charts below. Also, please note that all the comments have been added at the time during trading, with the information I had at that time. The reason for this is that when I did last week`s analysis, I realized that often, I could not remember why I even took a trade or closed a position. So now, I have added a short comment to most of the trades so that I can recall what I was thinking at that time. I'm hoping that this will not only help me prevent making bad trades but also spotting false thinking-pattern.