The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello everyone, I'm new here and I've been exploring the world of trading for about nine months now. While I spent six months reading Al Brooks' books, I only started live trading with a small account three months ago, and I've already realized that I need some clarification on a many areas.

That's why I'm planning on starting a thread where I would share my daily trades with the community here. I'm hoping that some of the more experienced traders can provide me with feedback, critiques, and suggestions so that I can learn and grow faster.

I'd be really grateful for any insights or advice that you can offer, and thanks so much in advance for your help!

Hi Gan,

What works very good for me is to make an analysis after every trading session (this takes about half an hour). See for an example below. I also mark where I went long (blue) and where I closed my trade (white). Make your own chart, and then compare with Al's daily setups. It's one of the best ways to spot patterns and learn from your own setups.

Good luck!

Sybren

Hi Sybren, thank you for your reply. I will try to do the same for my journal and make it as tidy and readable as yours. However, I am from Malaysia and I do not have the capital to trade on the Emini's yet so I am mostly trading futures on Binance (Crypto) now as I can trade with as low as $100 as capital. Mainly using this as a practice ground until I am better with my chart readings

Thanks again for your reply brother

Hi everyone, I hope you're doing well. I wanted to share my journal with you today, and I realized that I broke my rule of taking more than three trades. As a result, the chart became too cluttered to share my positions with you all.

However, I still want to learn from today's experience, and I've decided to focus on understanding the "always in" direction better. I've marked two points on the chart where I think the market's always in direction changed. The yellow point was where I believe the market was in a long direction, and I should have only bought. After the blue point, I think the market flipped back to an always in short direction, and I should have only looked for pullbacks to sell from that point onwards.

I'm new to this, and I'm not sure if I've interpreted the market movements correctly. If any of you have feedback or thoughts on my analysis, I would be grateful to hear them. Thanks for your help and support!

I wanted to share a bit more about my trading experience today. Looking back, I can see that I made two losing trades earlier in the day. However, I've learned from those mistakes and realized that my entries were terrible. I'm determined to improve my skills and make better trading decisions moving forward. Any advice or suggestions from fellow traders would be greatly appreciated. Thank you for your support

Hi Gan,

Regarding Always In

I think your first mark (AIL) is correct. However, what you need is to consider more context. Specifically, ask yourself "is this a bear trend, bull trend, or trading range?". It's because in bear trend, we look to sell low or on a pull back; bull trend, we look to buy high or on a pull back; trading range we buy low sell high.

Say you decide this has been a bear trend at before your AIL mark. Now you see consecutive bull bars with some closing on its high and closing above MA. And this isn't the first time it's doing so in the ongoing bear trend. So start asking again "is this a bear trend, bull trend, or trading range?". They're all possible but what's more unlikely is that the market flip directly from a bear trend into a bull trend. It's more likely to transition into a trading range first which is what happened in this case.

Just a side note, if you find someway to put numbers on the bars on your chart, it would be very easy to discuss the price action. Something like this:

Hello Water Buffalo, thank you for your reply.

I will try to start looking at the chart and looking at it to decide if it's a bear trend, bull trend or trading range. You made a very good point actually, been spending the last few days trying to figure if the market is in either a bull trend or bear trend but I have somehow forgotten the possibility of a trading range. I think the books did mention something about the four stages which are trend -> channel -> trading range -> trend again. Please correct me if I got the stages wrong, said it more for affirmation 🤣

Let me see if I can find a script that I can use on my exchange to start labeling the bars

Again, thank you for your reply.

Hi guys, these is my journal for today. I started today with only looking to sell after the breakout of the possible final flag of a protracted bull trend, and a three bar bear spike which I felt turned the market to always in short. However, shortly after I started, there was a large bear trend bar which made me thought that that was the end of the second leg in the correction and started looking to buy and took my first long trade.

When an actual sell signal appeared, it was the top of a channel and a failed second attempt to break out of the channel, I did not take the trade because this time, I wanted to only sell at the top of the tight trading range which resulted in my missing out on the move.

Finally, feeling defeated as I have had a losing trade that not only cost me money, but also made me missed an opportunity, I took a high risk trade after the sell off in what looks to me like a wedge pull back and also bottom of the channel but quickly closed my position when I saw the weak follow through. I lost only a small amount of money here due to fees, but still not a good feeling.

My issues today are :

- I am wondering at this point if the entire channel in blue is actually a bull flag and I should wait for a good buy signal or if the market has flipped to AIS as after the three bar bear spike that happened earlier today, the bulls were hardly able to close above the EMA, and I should only look to short?

- Been wanting to clarify, at the part where I I was not sure if it was a low 1 was because after the pullback, the first bear bar did not close or went below the prior bar, hence the I treated the following bear bar as a low 1, however it did not triggered, could I look at it as "no bears were trapped"?

- Also, in regards to the low 1 question, was the bar I marked a low 1 since it was the first bar that went below and closed below the prior bar or was the bar before it a low 1 setup since although it did not went below the prior bar, it had a bear body that closed on its low? Had the similar situation with the low 2 that I marked.

- Could I consider this a tight bear channel or is this considered a broad channel

I spent the rest of the day just watching the chart and writing this up as I felt I am not emotionally ready to trade anymore today after my back to back blunders.

For more context

- The yellow dashed line to the left of the screen is a wedge top but I could not put include the whole move in my screenshot or my notes would look jumbled up.

- The height of the spike I marked in the white dashed line was what I thought the market could reach but somewhere during the tight trading range, I felt that the correction is over and the market held above a lower high, hence the probability of the market breaking above the tight trading range was more likely

- The second chart is blank in case any of you guys feel like labeling the chart, I felt that a blank one would be easier for you to do so

I hope this chart would help you guys understand my thought process and be able to advice me on what are my mistakes, weaknesses and what I should work on to get better. Thank you in advance 🙂

P/s : Would also appreciate your feedback on how I could label my chart better to make it easier for you guys to read and comment

- I am wondering at this point if the entire channel in blue is actually a bull flag and I should wait for a good buy signal or if the market has flipped to AIS as after the three bar bear spike that happened earlier today, the bulls were hardly able to close above the EMA, and I should only look to short?

- Been wanting to clarify, at the part where I I was not sure if it was a low 1 was because after the pullback, the first bear bar did not close or went below the prior bar, hence the I treated the following bear bar as a low 1, however it did not triggered, could I look at it as "no bears were trapped"?

- Also, in regards to the low 1 question, was the bar I marked a low 1 since it was the first bar that went below and closed below the prior bar or was the bar before it a low 1 setup since although it did not went below the prior bar, it had a bear body that closed on its low? Had the similar situation with the low 2 that I marked.

- Could I consider this a tight bear channel or is this considered a broad channel

1.yes, AIS. No need to look at the chart from too far. I mean, care more about the trend you are currently having, which started from the 6 consecutive big bear bars.

2,3. bear low went below the low of the previous bull bar, so it's L1! Please refer to the attached chart.

4.Tight bear channel.no bulls are making money on this chart right? When you noticed that, you'd rather only look to sell. If buy, scalp or wait for trend line break for swing(MTR).

Hi YY, thank you so much for both your replies! I am looking forward to get back to my desktop tonight where I'll be able to have a proper look at both the charts you included. Am really thankful and appreciate you taking the time to help me by labelling your chart

Hi everyone,

I wanted to share my journal entry for today and get your thoughts on my trades. I'm happy to report that I stuck to my plan and only traded in the direction that I had identified as always in short after the five bars bear spike. Unfortunately, I did experience a loss on my first trade. I think it may have been due to placing my stop loss too close or accidentally selling at the bottom of the trading range. However, I took that trade because I thought it was a L2 below the EMA and a breakout pullback sell setup. Please correct me if I am wrong or if you think I should have been more patient and wait for a better sell signal.

Despite being stopped out, I still believed that the direction was always in short and took another short trade on the bar right after my stop loss was hit. At this point, I was conflicted because I wanted to stick to my rule of not adjusting my stop loss while in a trade, but I was still confident in the direction of the market. Should I have adjusted my stop loss here? I'm hesitant to do so because I've incurred high losses in the past when I first started trading and have made it my rule to never adjust my stop loss while in a trade.

Later in the day, after two consecutive sell climax, a wedge pullback, a potential final flag and a nested wedge formed, I held back from taking any more trades because I was expecting a major trend reversal to occur. I didn't want to take any more shorts, but I was also hesitant to take any longs because there wasn't any clear sign of a change in the trend. As a beginner, should I have taken the low probability trade and went long ? Or should I have done what I did and wait for a clearer direction before taking the trade?

My questions today are:

- Based on the locations where I took my profit targets, am I taking my profits too quickly? I ask this because although I had a large win, my R/R was only 1.92:1, which is still below 2.

- Should I have taken a two bar reversal at the double top and top of the channel, low 4 sell setup right after I drew the channel? I was unsure if the market would react appropriately to the trend line I drew, but I also wonder if I should have just taken the short there because the market is always in short and I should pretty much sell for any reason. Another reason I held back from that trade was because of the three bar bull spike that made me wonder if the market had switched to always in long, but I think I should have recognized that there wasn't any gap bar, hence I should consider it a minor trend reversal. Am I right to interpret it this way?

- This is unrelated to my journal today, but I'm wondering if I'm spending too much time watching the charts. I typically spend about 6 hours and 45 minutes watching the charts a day because that's what Al says a typical full session is. Additionally, I spend another 1-2 hours going through the forums, my trades/mistakes for that day, etc., in hopes that I can learn faster. My concern is that I'm spending too much time watching the charts and that I tend to be a little more careless later in the day. Do you have any recommendations, or could you share how you typically spend your day as a day trader?

Additional context :

- I tend to include two reasons to enter a trade as that is what is recommended by Al Brooks in his third book if I remember correctly. Could you guys also share your thoughts on what I interpret as potential entries (Although I did not take them all, these are for my future reference)

- I've marked what I think are potential entries in "Italic" in hopes that it would make it easier for you guys to spot it on the chart I have uploaded

- In addition to the point above, could you guys also share your thoughts on my entries? (Also marked in Italic)

Thank you in advance for your feedback and suggestions. I really appreciate it.

Hi everyone, I realised my journal may have been a bit lengthy and decided to make it more condensed.

Was just wondering for today if you guys would have shorted at the point I marked right at the II pattern after the buy climax? Or would you guys have taken the low 2 short that I marked? I did not take the low 2 short because I expected a test of the extreme and that I could have short at a better price, at this point, the rest of the day have not played out so I still am not sure if it was the right decision, but was hoping to get some thoughts from you guys who are more experienced.

My profit target if I had taken the trade would have been at the bottom of the trading range, or would that have been too ambitious/greedy?

Hi guys,

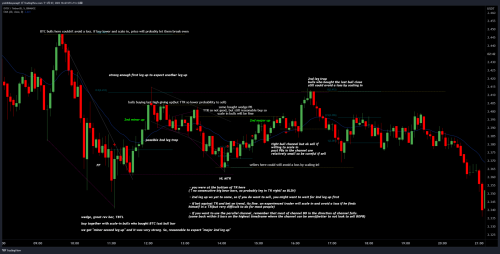

Looking back this was a pretty straight forward bear trend but while I was in the market today, every time it had a sell off, I thought at that time it was a sell climax and held back from selling but yet a strong buy signal never did come so I ended up not selling because I thought the trend was finishing and not buy because a good signal bar never really occurred.

It was incredibly frustrating when I looked back today and see all the good sell opportunities that I did not take. I have marked several points in the chart today in areas I thought of selling but did not because of numerous reasons which I have shared in the chart.

Would you have jumped in on the trend after 3-4 sell climaxes or would you guys have just stayed out because this sort of trends rarely happens? (I assume it rarely happens because this is the first time I've actually seen 3-4 consecutive sell offs.

The second chart included is for you guys to mark it if you feel like it ya, hope to hear from you guys and many thanks in advance

Hey guys, this are my trades for today and wondering what do you guys think of the decisions I made and how I could improve.

I usually wait for a good signal bar but I want to widen my options by "entering at the close". My personal thoughts on my trades today are below and I hope you guys could correct me if you think I have the wrong understanding

First trade

Reasonable to close early but should have entered again at the sell signal that tested the entry and had a large tail on top

Second trade

Bad choice to enter forgetting 80% rule and also the bar that close lower than the past 50 bars was not a strong close, it had tails on the the bottom. Bad decision to take the trade

Third trade

Bad decision to buy since it was the first buy signal after a tight bear channel, more likely that the reversal would have been minor

Fourth trade

L2 below MA and breakout pullback sell setup was a reasonable trade and reasonable decision to close early since it could form a double bottom test after the wedge pullback but should have re-entered on the third bear trend bar, especially since it closed on its low

Thank you in advance 🙂