The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

https://www.tradingview.com/script/zdvgCS1f-Major-Swings/

Let me know if its useful, if there are any suggestions and questions!

Could you please I am not following the description?

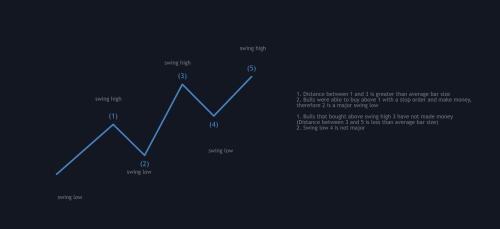

This is an indicator that shows minor and major swing highs and lows.

With the help of Average True Range it is calculating if stop order bulls are able to make money buying above swing highs and if bears are able to make money selling below swing lows.

Assumption is that if they are able to make money ( at least a scalp that is a size of an average bar based on atr ) the trend is strong and the opposite swing point is therefore major.

are you trying to figure out if stop order bulls or bears can able to scalp?

Could you please I am not following the description?

Hope this helps. Let me know if you have more questions.

Thanks for your time and explanation.

Hey, I have a doubt on this topic. like, you are saying that a major low is when the price moves up a minimum scalp from the recent high of the market to consider the recent low to be major.

Al says that the minimum scalp in forex is 10 pips, E-mini is 1 point and for stock is 10% or 5% of average day's range. Then is it really necessary to use ATR to find minimum scalp?

I'm asking this because I don't understand how to calculate minimum scalp using ATR like you say.

Hey, I have a doubt on this topic. like, you are saying that a major low is when the price moves up a minimum scalp from the recent high of the market to consider the recent low to be major.

Al says that the minimum scalp in forex is 10 pips, E-mini is 1 point and for stock is 10% or 5% of average day's range. Then is it really necessary to use ATR to find minimum scalp?

I'm asking this because I don't understand how to calculate minimum scalp using ATR like you say.

Hi, it is definitely not necessary and not the only way. The idea is from Al's book Trends and I've used atr to determine bar range since half an average bars range is also considered a minimum scalp ( this is mentioned in the course ).

If you don't mind me asking where is it mentioned in the course?

If you don't mind me asking where is it mentioned in the course?

In bonus videos, scalping series.

Ok thank you very much.