The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

(I apologize in advance for whoever reads the complaints I have towards my lack of skill.)I have been trading now for about almost two years and just cant seem to be profitable. I've watched Al's videos and read his book and have only traded the "best setups" and yet I haven't been able to accomplish my goals. I realize that there are only a very few that make trading work for them. I get it. I just am not sure where exactly it is that im going wrong. I really want to make this work. I have gone in debt and am about to lose almost everything. I don't know if I'm that stupid to believe in myself in a field where only about 1% of traders are actually profitable or that I have the guts. Can someone please help me. Al has allowed me to gain a better understanding of whats happening in the markets. I have no problem acting in what I see. I have no problem taking a loss and letting positions run. I just seem to choose the worst trades over the long run I suppose. If anyone here is profitable, what are some steps that you took when looking in the mirror and habits you "aligned" to be part of that 1%? I can't give up. This is all I have and I am not looking for a god or guru to save me but to just lend me a hand and be straightforward with me. Thank you for your time. I appreciate you.

Hi Carlos. The challenge in answering what you posted is that there is hardly anything to go on with. You have said a lot in a congested paragraph without actually divulging any reasonable information. If you wanna know what's wrong, kindly share at least a few trades with the charts explaining your logic, plan, trade management and the outcome.

Also, I can say something which you will probably not like. If you are in debt and need to make it work through trading, the first thing you need to do is to not rely on trading to survive. Please see if you can take a job so that you have at least another source of earning. The current way, too much is at stake while you're trading and that's not a healthy mindset to have. You don't really have a I don't care mentality right now.

Third, I see you have been member for 7 months now. While there are people who turn profitable in this time, I am yet to meet someone who has gone through the course at least 3 times over completely along with the encyclopedia. What's your status right now? If being very honest, without this, that is having gone through the course at least quite a few times over, you will not have enough grasp of price action to be consistently profitable over the long run.

Finally a suggestion, that will help you in your current situation - if you're in the US or not but can trade Emini(micro initially), join the trading room. Highly likely, you'll turn a profit and learn at the same time.

Try and be strong, it is a long journey and only the strongest survive here. Wish you the best!

Hey Abir, thank you for replying to my question I really appreciate you. Sorry, as I was typing it, I was coming straight off from a losing day so I know I didn't give much to go off of. If I am being 100% honest I have watched a majority of Al's videos but not all. I have also read "Reading Price Charts Bar by Bar." After each session I do go to the blog and see how the trades were "supposed" to be read with the marked up chart Al provides. I try to train my eyes as much as I can to see what Al is teaching. I've printed hundreds of charts and have marked them up looking for second entries and swing highs/lows, I look for M2B/M2S, High 2s, Wedges, to practice and find different variations. Sometimes I do think I see things differently, or am not acknowledging fully what the context before it is saying.I think one of my biggest concerns is that I've made money by trading the setups Al talks about in the past. Yet somewhere down the road I just lose it all. A lot of times trades turn up to be disappointments or I lose two to three trades in a row and freeze so I don't lose anymore, just to see the market later make a setup that I cant take because Ive taken too much of a loss and my confidence for the day isn't there. I only like to take swing trades because Al says thats the best for beginners. So my trade management is to take half off at a support/resistance level and swing the rest because like Al says "you never know how long trends will last."

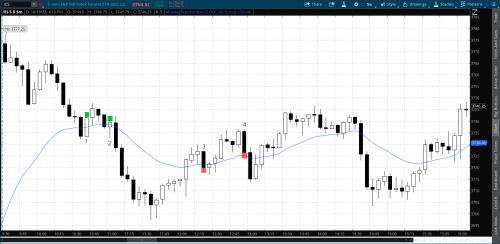

This is how I traded today.

For example Bar number 1 I went long because it is three pushes down to the moving average. Bar 2 shows a test of the wedge bottom and is also another opportunity to go long. I only took the first buy since I don't add to my losing positions and get stopped out shortly after. Bar 3 I see a wedge and low 4 so I short and get stopped out. Bar 4 shows me a Low 2 and another wedge. It has some follow through but then reverses back up and I get stopped out. Paper cuts are starting to make me bleed heavily so I don't trade for the rest of the day.

Hi Carlos. I think you're still lacking a lot in your homework that is studying the course. If I discuss the trades you took, 1, 2 and 4 have been marked by Al in the daily setups but I doubt if any of them will be marked by blue rectangle. I don't know if you realise that 3 was a mistake. That bear bar was following so many consecutive bull bars, the odds of a sell working below the first bear bar in many bars(despite as you call it low 4) is a low probability bet(and not a swing trade).

1 and 2 have been marked by Al but you need to understand what kind of FT to expect on these trades. I took 1 and exited promptly when the 2nd bar after the signal bar looked like that at breakeven. I took 2 and it got stopped out. I then sold below the BO below the wedge(on bar 1 you marked) making back more than I lost. I took partial profits and exited my position full after the 2nd bull bar at the bottom.

Maybe there is still some mistake in my management but it is working so far. What you need to realise is, the patterns you are trading must behave at least a certain way(FT) to think that they are working. Some patterns need immediate FT(like 1 and 2 you marked). If you're not getting that, you have to look to exit(despite the small profit or loss you might be running).

You will understand that, when you go through the COURSE AND THE ENCYCLOPEDIA enough times to know what to expect from the market and cut your losses if not getting what you expected. I know ludopuig suggested you to keep the stop and run the trades in a previous post but that is for the blue rectangle trades and not the ones you marked.

Coming back to my suggestion of joining the trading room, I don't know what Rose said about the early morning selloff but she sure was long as she shared that in the Discord channel during the bounce up.

Kindly consider and revisit the suggestion of joining the trading room. It is relatively cheap as compared to what you'll lose on a trading day. I can't tell you of other speakers but the days Al(he can't do many days now) or Rose is in the room - I think it'll be hard for you to lose money.

All the while, keep on going through the course over and over. I know you got success at some point and now it is suddenly not there and it can be overwhelming and confusing. There are way too many pieces to this puzzle and you won't understand what you're missing unless you're familiar with all the pieces like you know the back of your hand.

I also think, keeping a daily cutoff is a good way to go. Don't overtrade after you've lost more than your daily self-imposed limit.

Hope this helps a little.

This definitely helps, way more than just a little. I appreciate it. I need to do a lot more homework. It definitely feels like I am missing a lot of pieces to this puzzle but I won't stop. Thank you for being straightforward and helpful with me.

Carlos,

Can you post more of your charts? From the chart you posted, it looks like you are only trading reversals instead of working the trend. I can understand taking the 1st trade (marked 1 on your chart). Bar 2 on your chart was weak, but with better support lower and the market moving down, why didn't you consider shorting on either the bar before Bar2 or the bar after?

Trying to only trade reversals will lead you to ruin, this I can assure you.

Hey Gregory, before I post my charts I'll come forward and say that I really only trade setups from Al brooks chapter 15 in "Reading Price Charts Bar by Bar". So thats MTR, Minor Reversals (Wedges and second entries at new highs and lows), Pullbacks in a strong trend (High 2/Low 2 and M2B/M2S). I didn't consider shorting after bar 2 because well its not in the setups that I have in my trading plan. However I slowly am realizing that I need to not only trade reversals and small pullbacks and need to study more on how to incorporate working the trend. Any tips you can give? Thank you for your comment as well.

Hi Carlos,

I think the set of the videos on "Always In" topic would help you.

Al wrote in his book Reversal, chapter Always In: "This might be the single most important concept in trading".

Trading in the Always In direction is easier. I think it's ok to swing trade reversal but when we do, we're expecting the Always In direction is going to reverse. I guess that was what Abir meant by "you need to understand what kind of FT to expect on these trades", the trade after 1 didn't show follow through(s) that indicated that the Always In direction is flipping.

Thank you! I just rewatched the Always In series and Al said the same thing. "It's easier to make money in the direction of the trend" and although it sounds so simple, I am scared of placing the correct stop loss because usually your risk is higher but the probability is also higher. Im going to take a lot of time really reviewing the end of day setups that Brad Wolff posts and figure out why these are good Always In entries. Along with the sampler of the encyclopedia, though that one has A LOT to try to memorize at one go.

Carlos,

If you are only trading the setups from chapter 15 and you've consistently lost money, then stop trading or do the opposite of what you've been doing. I'm pretty sure you are trading against the trend. Al talks about this somewhere, but really its a basic tenet of successful trading.....the trend is your friend. Here's a few tips that have served me well.

When marking up charts after the fact, look at each strong bull or bear bar, one that closes on the high or low or very close to the high or low. Evaluate what happened after and before the strong bar (where did it occur, what kind of support or resistance...etc.)

If a market is making higher highs and higher lows, trade only in that direction.

If you must take wedges, make sure they end at some sort of support or resistance or make sure the wedges are bull or bear flags (a weak counter trend that's likely to at least get back to the most recent high or low). And be willing to scale in, if you can't scale in, then don't bother with them.

Try to avoid the middle of the day unless its a strong trend.

Be certain to develop an understanding of what type of day the market is likely to have (this takes time and experience) based on the open. Always know where the open, high, low, and close of the prior and current week. On any given day, the market is likely moving toward yesterday's high or low or away from it and back to the middle.

Watch the live training videos: https://www.brookstradingcourse.com/blog/live-trades/

Those are extremely helpful.

Evaluate your performance based on the bottom line, not whether you are taking the correct setups. If you're losing, stop! Your plan isn't working. Until you can prove that you can be closer to 60% and make a profit, use a simulated account. You should not be using debt or teetering on losing everything. The markets will be here in a few years, take some time off and do something else until you are in a better financial position to trade. You can still watch the charts throughout the day and after the close.

Thank you Gregory, I'll start to implement those training tips right now. I agree I should not have been using debt or be close to losing everything. I was a fool to think I could become profitable after just going through Al's course and reading his book thinking it was the end line. It takes much more than trying to mirror the trades i guess. I don't mean to disrespect you in any way when I say this but although the markets could still be here in a few years, I don't know if I will be. So I'm going to do everything in my power to succeed in this rough arena. All eggs in this basket. Thank you for your time, you have been very helpful friend!