The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

When you get a BO like the one that came after the first long, the day will likely be a bull day (here became the strongest one, small PB bull trend) or a TR. In both cases, you can hold thru a PB and expect the MKT to come back and test the high (while AIL), so if you are swing trading you need to give it time and don't rush to the doors at minor reversals (taking for granted that you could bear the risk, otherwise you should not be in the trade).

Yet, you can also exit (half off, for instance) below the PW if you fear the risk and you are able to reenter below. Because most traders can't, better to hold until you get a major trend reversal (MTR or wedge) expecting anything else will likely be a PB, like here.

In this particular case, exiting at the PW and not entering again wouldn't be a problem from the profit point of view, the trader would get a nice one. But from the strategy point of view, if you usually exit too early your swings you will find quite often that you exited with a small profit, and then the MKT keeps going three or four times your profit. When this happens, you will regret because that money that you leave on the table is needed for the strategy to work in the long run or, else, you will not be able to overcome your loses.

Hope it helps...

Hi ludopuig,

Thanks for explanation! That makes sense.

I'd like to ask for your opinion on the following point if you don't mind.

In both cases, you can hold thru a PB and expect the MKT to come back and test the high (while AIL)

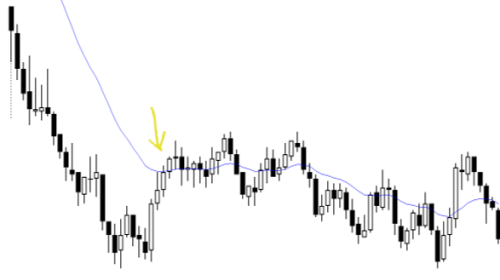

Here, would you consider the yellow arrow third (or fourth) consecutive bull bars as flipping the market to AIL?

If it did flip the market to AIL, given the swing strategy, should trader just exit at the market and look to enter short later (since the premise now is a trading range)? Or it it still better to hold on short for a test of the low?

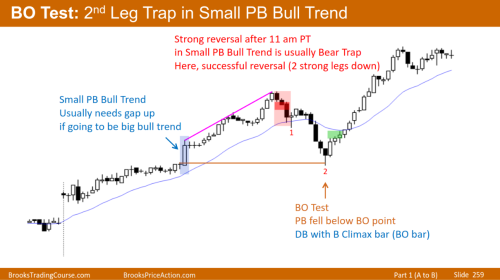

Similarly, here, would you consider the consecutive bear bars before 2 as flipping the market to AIS?

Should swing trader exit at the market or better to hold on to the long position, relying on stop loss bellow (given that the trader can bear the risk as you pointed out)?

Thanks in advance!

Cheers!

Here, would you consider the yellow arrow third (or fourth) consecutive bull bars as flipping the market to AIL?

No, to switch to long you needed consecutive strong bull bars with bodies above the EMA. Therefore, you can either exit at the DB (which would be like exiting at the wedge in the previous chart) and reenter at EMA, or hold and exit at the low test, near the end of the day.

Similarly, here, would you consider the consecutive bear bars before 2 as flipping the market to AIS?

Yes, consecutive bear bars closing on the low below the EMA so AIS, but the second leg down in the context of a Small PB bull trend so it can be a trap. Therefore, you either exit when AIS and then reenter at the bull bar, or you keep holding with the stop-loss at the low of the day.

In both charts, when you have a tight trend going, the first reversal is probably going to be minor but it can be deep (the deeper, the more likely the MKT transitions to a TR instead of following trending), so you need to be prepared for this to happen and trade small, because the stop-loss is far away!

Yes it does, thank you for your confirmation.

That makes a lot of sense. Thank you very much!

Hi @ludopuig

I stumbled upon another case related this weekend and would like to pick your brain on this (no zombie tho) if you don't mind.

Here, would you say that we're AIL now at the blue arrow 3 consecutive bull bar closing on its high?

What about wait for the 4th consecutive bull bar?

If trader decides to keep holding with a stop-loss at the high of the day for example, the low was never reached. Would you say that trader should exit above the DD at EMA at the red arrow?

Or definitely should get out when see the next outside up big bull bar closing on its high and above the high of many bars just before that?

Thanks in advance!

Here, would you say that we're AIL now at the blue arrow 3 consecutive bull bar closing on its high?

Yes, most traders would see AIL after 2 consecutive bull bars closing on the high and breaking above the EMA coming from a decent swing buy setup.

What about wait for the 4th consecutive bull bar?

Now second bar with body above EMA so increased probability for a swing up.

If trader decides to keep holding with a stop-loss at the high of the day for example, the low was never reached.

This would be a mistake. Bulls had a decent swing setup plus a wonderful entry bar (reason already to exit shorts) and then it was added two follow-thru bars breaking above EMA. The trend now is up and bears have to exit the sooner the better.

Would you say that trader should exit above the DD at EMA at the red arrow?

Nop, a doji is not a reason to exit.

Or definitely should get out when see the next outside up big bull bar closing on its high and above the high of many bars just before that?

Yes, a bull bar closing on the high is a buy so bears have to exit.

Thanks for the detailed answers @ludopuig! You answered all my questions even though the rest had been made irrelevant after the first one answered.

I still left me with one confusion if you don’t mind.

Yes, most traders would see AIL after 2 consecutive bull bars closing on the high and breaking above the EMA coming from a decent swing buy setup.

What made it a decent swing buy setup in this chart?

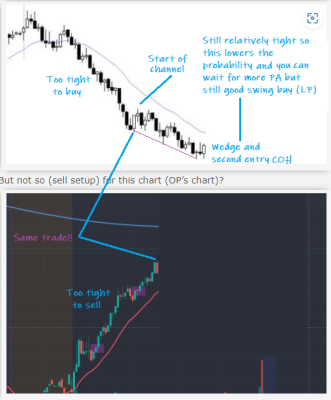

But not so (sell setup) for this chart (OP’s chart)?

They both look like strong trend in my novice eyes.

Thanks in advance!

Thanks for the detailed answers @ludopuig! You answered all my questions even though the rest had been made irrelevant after the first one answered.

Happy to help!

What made it a decent swing buy setup in this chart?

See the picture below:

That makes sense! Thanks a lot!