The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Interpreting some of Dr. Brooks' slides that discuss gaps.

My question: how big must a gap be to qualify as 'big'? I assume it should be expressed as a percentage, since daily range has expended over time. So what % gap should be thought of as big?

Interpreting some of Dr. Brooks' slides that discuss gaps.

My question: how big must a gap be to qualify as 'big'? I assume it should be expressed as a percentage, since daily range has expended over time. So what % gap should be thought of as big?

Hi Wesley,

I don't remember Al ever quantifying big gap size. Using ~1/2 daily ATR may be reasonable. Such gaps often lead to trends. However, if a gap is too big (> daily ATR) the day is more likely to end up as TRD.

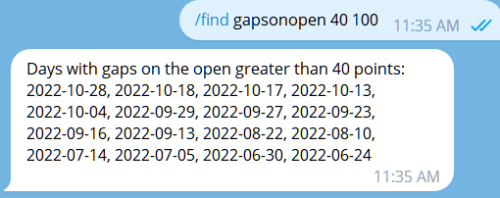

Exploring gaps is definitely something a trader can do for themselves. Over at Telegram chat our bot supports finding gaps of specific size in the ES just for this purpose. So if you want to do a study on this it may help you.

Hope that helped.

Cheers,

CH

________________________________________________

Thanks - ATR is a good idea. He references big gaps in his encyclopedia slides - e.g. slide 2.2 in section 5.