The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

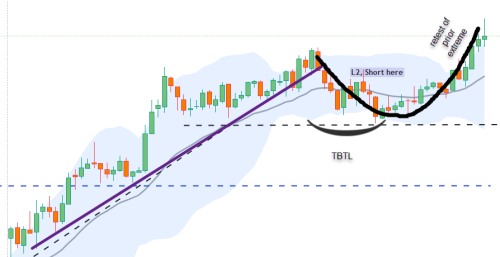

This may look quite simple to trade. Day started with a bull channel but if you look to the left it was a bear trend.

As per AL's book channel has at least 3 or 4 touches, after that it at some point it will break the trendline and it could touch the bottom of the channel whereas here it didn't. Here once it reached the top of the channel and it had 2 bear legs, L2 is where I would short but then I t didn't go far down and instead went up. At this point I wasn't sure if its' trading range or it is going to go up. It's confusing how I would trade this even though it's looking pretty clear.

https://www.tradingview.com/x/nXqMUgyq/

If I would short L2 i would end up in a loss and if I would have gone long I don't know if it's a trading range. If I wait and watch and for how many bars before I would have thought I could enter a long trade now and the by the time I would enter the trend would have gone weak already.

Regards,

Nandkishore

Hi Nandkishore,

This may have been a bull channel but it's pretty tight so looks like a strong trend from this screenshot, so I'll treat it like a trend. So after a break of such, to consider a reversal we need to see an MTR setup. For MTR we want to see a retest of prior high with at least one or two strong legs up.

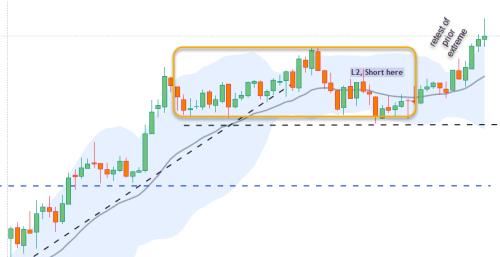

Here, after a TBTL pullback it did go higher to retest the prior extreme. So it looks too early to short during the PB correction.

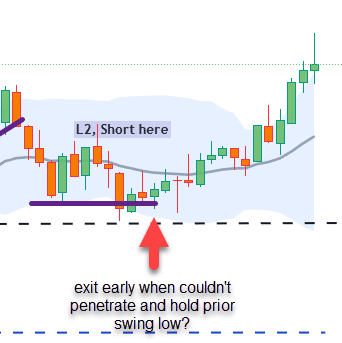

Most likely you were considering a swing. Al advises to learn to exit early when a swing isn't working out. This way most of the low probability MTR attempts (40%) will end up as small wins or losses and cancel each other out, leaving few that will succeed for massive profits. So where you marked an L2, I would consider exiting early after an H2 appeared. Especially since in a bear trend BOs usually go below prior swing lows and are able to hold those BOPs (breakout points during retests, here didn't).

Also, if we consider the market cycle, then after a trend break we'd expect a TR to form first, not immediately a bear trend. So I would actually consider this TR first. In this case the sell was low into bottom of TR and the hope is that it goes strongly immediately, otherwise look to escape the trade as soon as possible.

Hope that helped!

CH

(we also have a Nifty community available in our trading group on Telegram)

____________________

BPA Telegram Group

Thanks Carpet it does help. And Many thanks I didn't see the Nifty community before in telegram. Yes I was expecting a swing trade but didn't turn out as expected. Can you please explain this bit you mentioned which BO you talking about here 'Especially since in a bear trend BOs usually go below prior swing lows and are able to hold those BOPs (breakout points during retests, here didn't).' You mean the retest of prior extreme?

Just continuing this discussion how market opened today after yesterdays' test of extreme

https://www.tradingview.com/x/bUMpZ3kJ/

First was a TR bull bar. I went short on bar 3 but that didn't go much further so I exited on the next bull bar.

After that was a bear bar which I saw it as test of the low of TR bar followed by a big trend bar.

Since the TR low was re-tested and a good looking bull bar, I went for long trade on the entry bar

Also I scaled in on the bear bar I highlighted( 2. Long trade Scaled in). I was considering a second leg up to test the high of TR bar atleast but that didn't happen so just before the big bear bar iexited my long trades with a loss.

I saw a, b, c as a wedge but I didn't enter the long trade on the nxt bull bar after (c) as I wanted it to cross the trendline first and atleast one leg up. I went in for a long trade at (2. Leg2), I was expecting another leg up which it did highlighted (3. or Call this as Leg 2) but didn't go far up, i had to take a loss there as I didn't exit for next few bars. I was not sure if I should exit since the whole setup was looking like a trend reversal.

At this point it also looked like a trading range. Considering it as a wedge , test of extreme and looking like a TR I took the highlighted (3. Long trade) had to take a look again the bull leg was weak but because I was thinking also of TR and such indecisive bars are common in TR so I waited for next few bars and as soon as it closed below the dotted line I exited my Long position, I was sure that this point if it's still in TR.

I wasn't sure but I took a short trade after (4.after the bear bar with a big wick) and scaled in next bull bars. I exited after those 4 consecutive bear bars so I was able to cover all my losses but I wasn't sure I should exit since after such 4 strong bear bars I was expecting another leg which is very common as per AL's books.

Luckily I didn't scale in my short trades when it started going up after those 4 bear bars, I was waiting for L1 which never came.

What are your thoughts on this and my trades? After doing all this I only ended up in breakeven.

My problem is I don't know when I should exit a trade because lot of times I have seen exiting a trade much earlier and I missed the whole trend.

Also as you see there were so many indications of a trend reversal wedge, TR, trendline break, second leg closing above the EMA but it didn't reverse and instead went down. If you take a a short trade even that those big bear trend bars tells me that it's going to go down further atleast one more leg down but it reversed all the way through where I couldn't even expect it would have gone. How could you trade this to be profitable? And how one could have taken that long trade at the end with so many bull bars.

Regards,

Nandkishore

Hi Mr. Carpet,

I am posting here the Daily chart of the same index. Any suggestions here would be great?

As you see I have identified a wedge top with three pushes up, Also it has three touches to the trendline. It has created a high 1 and I am expecting a high 2 to be created. The question here it what should one be doing after the high 2 was created?

1. Wait for L2 and short it since it has a wedge top and already touched the trendline thrice so expecting it to go down to the bottom of the channel?

2. Wait after you get L2 to go up once and re-test the extreme that will be close to wedge(3rd push up)?

3. Long as soon as you get high 2 even if the high 2 goes lower that high 1 low?

4. Long once it goes to the bottom of the channel?

Regards,

Nandkishore

Hi Nandkishore,

as far as I can see in your chart marked with entries, I would recommend you watching the daily review videos of Brad Wolff - some of them are available on youtube for free, or you buy the trading room live acess. He talks so much about where to expect sellers above or buyers below, about channels and tight trading ranges. The first months after watching the course traders try to take wedges and H1 and H2 and so on, and wonder why they are not able to make money consistantly. But you also have to be aware of the context, microchannels, tradingranges, overlap...

Hope this helps, but I don`t have the time to read through all of your question.

Wish you good trades and enjoy the journey!

Hardy

I saved some charts from long time ago showing good examples of bear trends that break below prior lows and hold BOPs during PBs:

In a weak trend the PBs go above the breakout points. It's possible it's a stairstepping trend, but it's still weaker than a trend where BOs test BOPs without going above. Especially during the initial BO that starts the spike phase.

Thanks Mr. Carpet for those charts, I understand now what you meant by breaking prior swing lows. Any suggestions on rest of my queries please?