The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

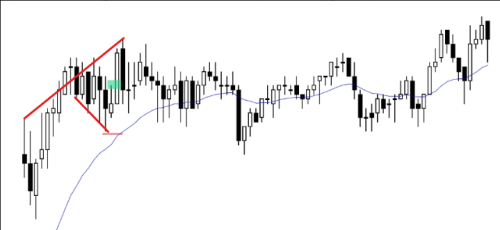

#1 actual risk(AR) for buying that close

#2 IR for buying above the H

#3 IR for buying close

I don't personally buy the close of that bull bar but anyway, by buying at the high, you got reversal at 1IR.(good wedge so good to put SL below the most recent major HL)

FF(tight PB like that one) and strong bull bar at the end of the trend. Common pattern so reasonable to get out at 1IR (which will keep your trader's equation positive) or hope for a swing and scalp out below wedge. (some would also sell with limit order at the high.) It depends on your style, but always think about RR and probability.

Keep in mind 1IR is just one way to keep your trader's equation positive, and of course you need good reasons for entry. 1IR is not always the best choice. (good here after the possible FF)

buying at the high, you got reversal at 1IR

Do traders exit at 1R exactly or 0.75R ? For a limit order (exit order) to be filled, price needs to go 1 tick beyond (1.25R) so looks like they were trapped if no early exit.

I'm afraid I only trade forex, so I haven't cared too much about spread or that last 1 tick in Emini.

When you are buying that PB, I think you are basically scalping after the possible FF, so maybe it's reasonable to exit on power just after one bar, that big bull bar. (although it's also ok to hope for a swing and keep holding but less probability)

It's beyond 1AR anyway, so I don't think it's too early.

As you say, I think some bulls indeed were trapped, and disappointed bulls got out at the same price as the close of that bull bar creating DT. (Although it's questionable if that bull bar is BTC)

My opinion is, if you take a trade hoping to get out at 1IR(scalping in this case), why not just get out on power after that FF and wedge?

I never thought of that way. I was thinking of having a limit order in the market for an exit.

Al's markup does not highlight that trade, so there are probably good reasons to not enter there in the first place (bull bar closing below midpoint, TRPA, etc)