The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello,

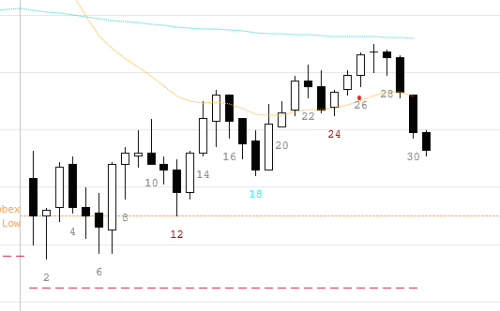

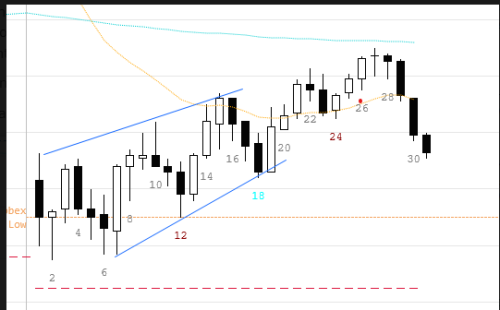

If a trader bought bar 8 arguing the market is always-in long and will probably test the moving average and double the opening range in this direction, does he stay long below bar 10? It is a failed breakout above a double top on a big gap down day so the market will probably have a more complex leg down at some point. However, right now bears will probably not get follow-through since it is always-in long and at least a small 2nd leg up is probably coming.

And more importantly, does he stay long below bar 16 or exit anywhere during bars 16, 17, 18? At the bar 18 close it is probably always-in short? However, the test of the moving average is probably strong enough for a 2nd leg up, but it is now a wedge bear flag to the moving average after a big gap down.

If he exits below bar 10, re-enter at bar 13, exit below 16, and re-enter above 19 it takes all the profit away. How does he choose which bars to exit below and which to hold?

I want to swing trade in the always-in direction and stay in the trade as long as the premise is still valid. As far as I understand, sometimes you have to get out early even though the always-in direction has not yet reversed, but probably will soon.. (perhaps at the 16 low, but it went much higher so probably a bad decision in hindsight)

Comments on managing these specific trades is appreciated.

And please correct me if I am wrong about anything.

Hi Andreas,

If buying B8 hoping for a breakout, I would probably exit for BE after seeing 9 or even before 10 even closed since the BO wasn't happening. This is just my personal approach to exit and not scale in but you can see that bulls who scaled in lower were able to get out BE on first and with profit on second. In fact this TR is a good example of how traders prefer to limit buy a 50% PB of a strong move in TR instead of with stops near the highs.

Exiting below 16 inside bar, wedge, at MA is reasonable.

The problem with exiting and re-entering with stops on this chart is there wasn't a strong BO of something. If I was a stop order bull I'd want an unquestionable move so strong it left no doubt about a new trend started. So even though could argue AIL, traders appear to prefer limit orders and scalps instead of swinging with stops on this day. You can see that every prior swing high was limit sold by bears for scalp profit and bulls are limit buying PBs and getting out near new HODs.

Hope that helped,

CH

______________________________________

Traders in BPA Telegram Chat trust no bar.

Hello Mr. Carpet.

Thank you for the reply.

Good point about bulls wanting to buy pullbacks instead. I now see that bar 7 and 8 is at the top of the opening range making bulls hesitate to buy there and instead wait for a pullback. When bar 12 failed to make a strong bear close, they instead used this pullback to buy eargerly. And if they buy something like bar 7 or 8, they need a strong breakout immediately because it is at the top of the opening range and it will probably pull back.