The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

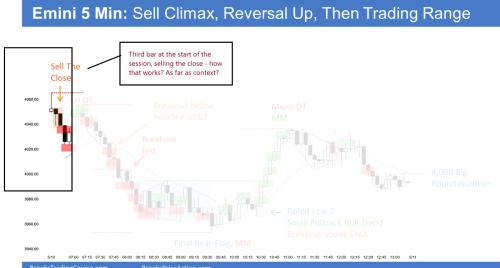

Came across this article https://www.brookstradingcourse.com/analysis/emini-testing-april-2021-gap/ and noticed the annotation corresponding to selling the close ... Just wonder what comes to that decision? Successful breakout and follow through?

Hi Mike

I think some arguments in favor of bear case is it's a gap up. Usually after a GU the market tries to find its way to the EMA in a form of some DB or wedge.

Also B3 didn't have an upper tail suggesting that traders already market sold B2 close (even though it had a tail).

Another way to see it as a micro TTR composed of B1 + B2. Al sometimes shows swing sell setups that are right up into the bottom of a range in anticipation of a BO. It looks like something similar may be happening here as well.

So since there's no BO yet, this is a low probability trade (maybe >=40%) so we need 1:2 which seems to just fit before reaching the EMA if the stop is right above signal bar (and most likely tightened to just above the entry bar later).

But also I think also it's important to remember that no matter how much analysis, is still not a guarantee that it will always work, only that it's reasonable (there are enough reasons) and Al says it's important to try to catch the swing of the day due to the magnitude of potential profit. But traders hunting for the swing of the day on the open can easily end up with a few small losses before the market finally takes off and that's ok too. As you can see, the climactic bear drop later more than made up for whatever small losses incurred trying to catch the opening swing.

Hope this helps,

CH

------------------------------

BPA Telegram Group

Thanks a lot Mr. Carpet - that's explains a lot!!!