The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hello,

I have a question regarding reversals.

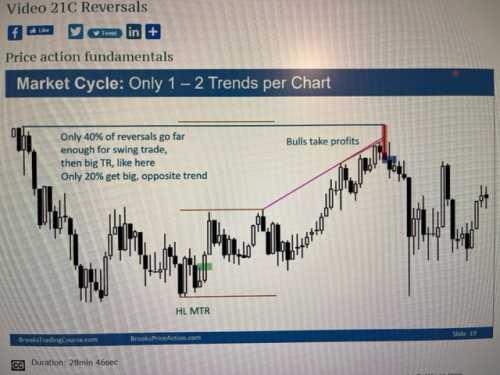

Only 40 percent of reversals go far enough for a swing trade, then big TR like here

Only 20 percent get big, opposite trendSource: Video 21C, slide 19

When Al says that 40 percent of reversal trades go far enough for a swing trade, and 20 percent of reversal trades go far enough for a big, opposite trend, is this to be understood like this:

If there are 10 major trend reversal setups, 4 of those go far enough for a swing, and out of those 4, 2 will go far enough for a big, opposite trend. This would mean that half of already successful major trend reversal setups will go even further for a big, opposite trend, and only half of already successful major trend reversal setups will stay in a trading range.

I don't think this is correctly understood since Al says that those 4 trades stay in the trading range.

Thank you,

Andreas

Hi Andreas,

I don't remember Al ever nesting probabilities like that (but not completely sure). Other than the Trader's Equation Al mostly keeps the math in BPA very simple. Actually this reminds me of the probabilities on the open where Al says "80% of strong moves on the open have a small pullback and 50% reverse completely". I don't think he means 50% of the 80% so best to not overthink the math.

In this case it's probably similar in that we shouldn't nest these probabilities and just keep it simple. Any reversal is usually a low probability event and swings are by default a 40% chance so we need to set a 1:2 RR. And since 80% of TR BO's fail, then for a big trend to develop there needs to happen a 20% event.

Hopefully someone else can chime in on this.

CH

______________________________________

BPA Telegram Group