The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

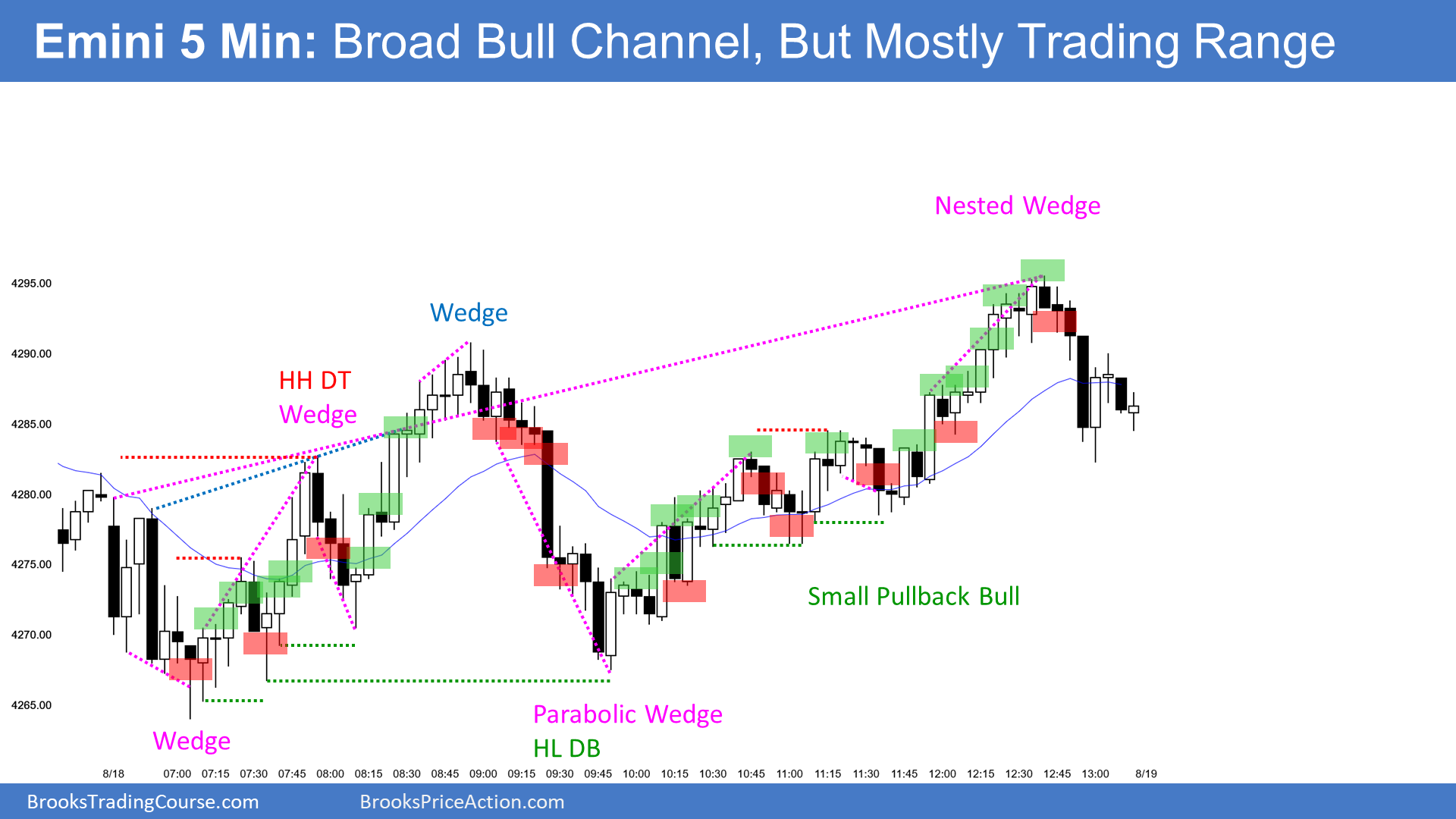

When reading left to right on the e-mini daily chart markups on BTC, there are many entry points, both sell & buy.

If a trader takes the first entry, is the next opposite entry the exit for the first trade?

Example> sell bar 7, exit that trade on bar 8-9 & start new trade there with a buy.

If a trader takes the first entry, is the next opposite entry the exit for the first trade?

Not the first opposite signal but definitely one of the followings. I explain below.

Example> sell bar 7, exit that trade on bar 8-9 & start new trade there with a buy.

Yes, in this example the exit for 7L is 8H because the swing buy is stronger (better context) than the short. But if a trader buys 8H he can hold thru the next two marked shorts. The first one is the typical bull trap that shows up often in decent bull setups, aimed to make bulls exit only to chase afterwards the MKT (re-entering at the next COH) and the second is a minor reversal after 4 growing bull bodies. The third bear signal is a big wedge and nested wedge so there you exit. If you then take any of those sells, you exit at the next bull signal because again it is a wedge and big DB. If you buy there, you don't exit on the next bear bar for the same reason you didn't on 8H. The second or third sells happen in a tight channel so you can hold...

One of the problem with swing trading is that, especially on the open, you get several signals while bulls and bears battle so you can enter and exit every signal, which is very difficult to do, or compare setups, bet on the stronger and allow PBs that can be deep and frightening, like the second sell after 8H, or the first sell after the DB. If you rather exit there and leave money on the table, at the time you will feel relieved but at the end of the month (or week!) you will regret because for swing trading to work, you need some big big winners or else mistakes plus commissions will let you underwater. Your account will be down, and this is the reason. I learned the hard way (of course!).

If you exited on the second sell after 8H instead of on the third, you left around half the money on the table, and if you exited your DB buy at the second sell instead of holding, you left again half of of money on the table, but this time it was a bigger amount, amount that you definitely need to make the strategy work. In swing trading, exiting early is a soft kill, your account will slowly but steadily be going down, so learning to hold and exit at the right time is an absolute requirement to make it work. Sounds easy, isn't it? We all know.

So you initially shot for twice actual or initial risk but then you keep reading and exit when the opposite side develops a credible swing sell. Sometimes it will below your initial targets, and that is fine, but some others the MKT will run much much longer that someone could have expected. You need to be still in when this happens because without those occasional big winners swing trading is a headache.

the second is a minor reversal after 4 growing bull bodies.

Is it reasonable to add to the position here at B21, wait for B23 to see the FF or to stay with the initial size?

Buying for a swing, either for adding or for taking the initial position, at any green rectangle makes sense but some trades are more risky and, therefore, more difficult to manage, than others. For instance, bar 23 you are buying at the high in a developing TR and within the third leg of a possible wedge while bar 20 or 21 you are also buying the 3rd leg of a wedge but you have room to the top and your risk is lower, so managing 21 is much easier, emotionally, than 23.

@ludopuig For beginners, when reading the Daily Setups, is it acceptable to exit a position when an opposite signal occurs that is bordered with a blue box? Because Al calls these blue box entries "Beginner Swing Trades", I'm assuming these signals are stronger than those buys/sells not bordered by a blue box, no?

is it acceptable to exit a position when an opposite signal occurs that is bordered with a blue box?

Yes, you should.

Because Al calls these blue box entries "Beginner Swing Trades", I'm assuming these signals are stronger than those buys/sells not bordered by a blue box, no?

Correct!