The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

In the course, Al talks about Opening Reversals at S&R. Mainly yesterday's H/L/C, the 60 & 20 EMAs.

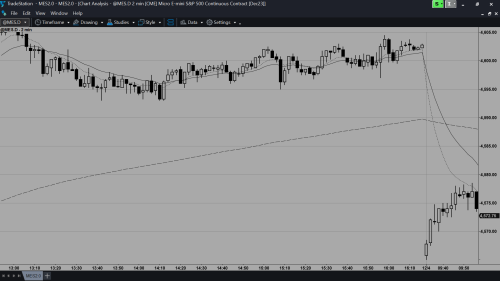

Today on the 2 min chart, we had CC Tops at the 10 EMA. Is this setup as reliable if it's reversing at the 10 EMA vs the other S&R ? Follow up question> if we remove the 10 EMA, is this a good short without having tested the 20 EMA ?

Thanks & Great Trades

Hi w,

I think it's ok to use the 10 EMA (I may even have seen Al using it for strong trends in some webinars). I suspect that it's not going to work any better or worse than the 20 EMA or any other EMA or else everyone would only use that one. I would expect it to have same probabilities as other EMAs for the opening reversal strategy. The key is probably in applying it consistently and following your rules for entry/exit as for any other EMA.

Have you tried backtesting to see how well it works vs the 20 EMA? Maybe over 2 months of data or so?

CH

__________________

BPA Telegram Group

Thanks Mr Carpet.

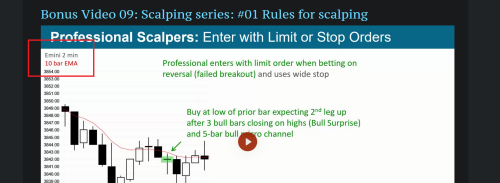

I saw him using it in Bonus Video 9

I would expect it to have same probabilities as other EMAs for the opening reversal strategy.

Good point. I'm guessing it's like any other S&R, if you see reactions there, then it means that it's important. Maybe if something happens at the 10 instead of the 20, then it indicates a little more urgency or strength.

I don't do computer backtesting, but when I check out older charts I will see how it reacts.

Good Trades