The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi everyone, first time posting here.

I always wanted to be trader mostly using price action. Since 2006, I read lots of books, tried different strategies, even algorithmic trading, and spent tons of time looking at charts. But making money was always tough. Constantly loosing, I had no clue what to do. I was doing stupid things for sure !

During the COVID lockdown, I found Al Brooks' books and courses. I liked them, so I joined. After watching some videos, things started making sense. Al's courses were super clear, and my trading got better quite quickly. I felt like success was possible !

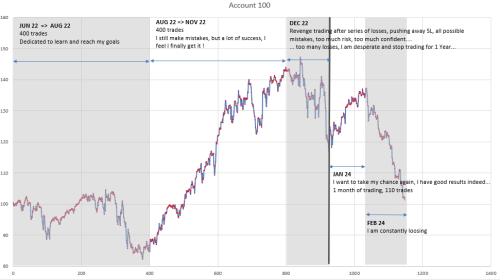

I've attached a little graph of my account (100 as a basis). After some learning phase, mostly loosing, I had a good time making profits for 4 months... it was quite significant to me !!!

But everything went wrong. It's almost like, from one day to another, nothing was working anymore, losses after losses,... of course, I made more mistakes as I was revenge trading. Worse and worse, I was risking too much. But... even when I was calm and trying to do my best, risking less, I was loosing.... So, after so many loosig trades, I stopped trading for a long time, thinking I was just lucky for some time before.

This year, in January 2024, I gave it another shot. Spent hours again into the videos, and I had a good month in fact !, and felt hopeful again. But after one month... I was constantly loosing, all my trades were wrong, and I am here there now... quite desperate in fact, confused, doubtfull.

I still think Al Brooks is the best teacher, and I believe I can do it. But part of me feels like being a trader is impossible. It's like flipping a coin. Sometimes you're lucky, sometimes not. And that's it. Market always evolves, so sometimes your strategy works, sometime not.

I know trading is hard and takes time. But how many of you here are profitable and can make a living with this activity ? i need some hope, I think I need some people to clearly tell me that 's possible !

Hi Patrick,

Welcome to forum. Can you tell us more about your style? Are you scalping, swinging, discretionary or very systematic. How many trades per day? Do you keep a journal? Can you show a screenshot of what it looks like? Can you show some screenshots of your losing trades (including stop/target and analysis of price action).

The best way to get help with BPA is to share one's approach as detailed as possible and then people here can suggest areas for improvement.

Hope to hear back,

CH

__________________

BPA Telegram Group

Hi,

thank you for your quick reply/reaction.

Well, I do not really keep a journal... maybe that's my first mistake ! I just keep track of the trade I make, P&L, but no notes.

Living in France, I trade the DAX and 'US500' (equal to Emini) through CFDs. 5min chart. In the history I showed from 2022, I overall made 8 trades per trading day.

I believe Al's course pushes to be very discretionnary. In term of rules, I tend to exclusively use stop orders, with a very basic ground rule to buy above a bar closing near it's high, selling below a bar closing near it's low, and within a good context.... which is of course the most difficult part. Mainly trying to catch Breakouts with follow through, H1, H2 with trends, wedges top and bottoms at previous S/R, etc..

Setting a binary decision, by first deciding wether we are in a trading range or a trend is something I find very difficult. I try time to time to use limit orders when a trading range is clearly there, but i am not confortable with this, as Al says we should not as beginner.

As Al's advice is to swing most of the trades, this is what I am trying to do... when the context is good. But honnestly, I find this quite frustrating, I find those opportunities are quite rare within a day. Reaching twice the initial risk, is rarely achievable unless you pick THE right candle of the day, or with a good trending day. Most of the time, I realise a lot of good trades in the day are possible only when scalping, but Al says we should not !!

I believe I put my stop at some common reasonnable location, above or below recent major lows and highs. Eventhough, time to time, yes, I know I make the mistake to put the stop too close. But this is not the major source of my losses.

I think the difficult part for me is to get out before my stop is touched. Most of the time, I have my stop, my target, and despite the obvious clues that show the grade is not going well, i tend to give it a chance till the end. It's difficult for me to get out when I reach 1 time my initial risk, even if I took a high probability trade. So I let it go, ... it reverses... i let it... give my trade a last chance to work... and I loose.

What's your advice in term of journaling ? I am thinking maybe just simply create a graph a the end of the day, and mark on it all the trades ?

Patrick

Journaling is absolutely critical. Especially the notes section for why you took the trade and what could've been the reason for a loss. After a while you will discover the most common mistakes (whether psychological or technical) and know which ones to eliminate first. Just remember that some losses are ok, simply due to probability. But if you keep writing notes about having fomo, fear, greed, revenge and so on, then study those trades especially closely. Also just because a trade is a winner may not be good either if taken for unreasonable reasons. This should be recorded in the notes as well.

You can copy my journaling template here as a start: https://docs.google.com/spreadsheets/d/12Ut-YCWwHSoTOMDQyNhx1PNbF1RQTwYWOgqb71iAHPc/edit?usp=sharing

Keep us updated 🙂

Thank you for providing this template. I've come to realize that journaling was definitely missing from my routine. I will now commit to journaling diligently.

I see you have some setup names clearly defined that I find very smart, and typicals in the sheets are shown, with some criteria/description. I wish you could show an exhaustive list of names and description of all the setups that you use ! 🙂

you do not track the initial target that you have when you start the trade ?

edit : Where does the TB.PB.L3 setup comes from ? this is typically the kind of setup that... was not a setup for me

I personally don't track initial targets. After the trade is done the iR (initial risk) and aR (actual risk) will be calculated and that will tell me what I need to know regarding performance of the scalp or swing.

Regarding trade setups, my trade setups change overtime and the names also. I just provided that as a sample if others are interested to model on. Everyone has to build their own.

Same advice here to Patrick. What helps me is making an analysis of the day afterwards, similar to Al does every day (see the Encyclopedia). There's a lot of subtlety that you often miss during the day, so make it a daily routine to train your eye to identify patterns and reasonable setups afterwards, cost you maybe half an hour a day and it's actually fun to do also. In time you will be more proficient spotting decent setups as they are unfolding real-time. Example attached (I highlight green and red possible entries for long and short. Blue is my actual long trade, yellow is short (not in this example), and white is exit).

I use CFD's also btw. What I can suggest you to do is get an account on Tradestation or Ninjatrader or similar, and only use that data to decide when and where to enter and exit. Data on "real" futures platforms give much more clear and reliable price action (CFD's have a lot of slippage and false entry signals, etc). If you're still experimenting with different strategies, don't shy from using a paper account also, I do it all the time refining scalp setups next to my real account swing strategies.

Have fun trading!

All best from the Low Countries 😉

Hi Patrick, thanks for sharing your story and the graph. It looks like you took 2 years off? It could be that you're rusty so to speak? I'm new at BTC - but check out the annotations - doesn't mean anything - but i find it interesting?

[EDIT] - Sorry it's 1 year break from the look of it

[EDIT] - That area where you are right now, you could try to make it a reversal area - by holding this move down and creating HL MTR 🫡 (which could take few weeks?)

Been there. Journal is critical. Retrospection is important. Maybe you should switch to trade SOXL, SOXS, TQQQ, SQQQ and mostly swing. I used to trade ES and lost 50% of my account. Even if my entry goes against me I feel more comfortable holding an ETF (I know it doesn't make sense but I made peace with my mind :D) and wait until it returns back to break even of buy more at the next best hourly reversal.

The biggest change in my trading has been to stick to 1 or 2 favorite and well studied setups. I only trade wedge reversals and breakout measured moves with bars bigger than last 10 bars. I ignore the rest.

Don't need to trade all day. I only trade the first 1.5 hours and then focus on my day job. I went from inconsistent to consistently making profits. Don't focus on P&L just the process. Hope this helps and gives you motivation to continue.

Just take a few days off, relax and start again with small positions. All the best!!

Thank you for sharing your thoughts. The equity curve analysed as Price action 😆 , but this is something I thought as well, some psychological effect here for sure !

Hi everyone, this is my trading day on the DAX. Happy to had such a good day, despite mistakes on trade N° 3.

A fantastic spike and channel day, so similar to yesterday... I love Al Brooks' concepts... so accurate.

I'll keep posting my trading days here. Simply having the goal to show my trades at the end of the day is apparently a good motivation to stop doing stupid things all day long !

Any comments are of course welcome !

[EDIT] : I realise this kind of post would preferably be in the "trading journal" category.

As Al's advice is to swing most of the trades, this is what I am trying to do... when the context is good. But honnestly, I find this quite frustrating, I find those opportunities are quite rare within a day. Reaching twice the initial risk, is rarely achievable unless you pick THE right candle of the day, or with a good trending day. Most of the time, I realise a lot of good trades in the day are possible only when scalping, but Al says we should not !!

It’s tough, y’know? Many beginners start out attracted to scalping, often getting a false sense of security from early results before experiencing their first disasters. In a scalp trade, you get out of a trade because you must get out, and at first glance, it seems easier to learn and stick to hard and fast rules. And in a swing trade, you get out because you should get out, knowing only a handful of entries on a usual day will make 2R (unless the market is rather volatile), and that even stellar top/bottom-callers generally cannot average more than 3R on the wins (or, ~60% of each leg, with ~20% off the top and bottom, which isn’t much when you think about it).

To do better than the set-and-forget style requires a lot of nuance the beginner does not have. The problem is, this nuance is what the successful discretionary scalper has already learned. Being attentive to the price action (which does not require attempting scalping) is how to learn it.

In terms of a heuristic for scalping out of a swing… I try to cut through the fog by thinking about the reason I don’t know the result. In a majority of cases, indeterminate events favor inertia of the market cycle, and one’s exit should be adapted to what one believes the market cycle phase is (so, one would not enter a 2R target trade without believing there’s a market cycle reason for it to get there). Many profit-taking exits are performed where a trade in either direction shouldn’t be entered (such as a climax above a channel or the first pullback after a big micro channel), simply because someone’s method believes the edge is lost (perhaps exactly even, perhaps as weak as a respectable swing setup); it’s the same logic we use to stop out at a loss without also entering a reversal trade.

I can tell by reading your post, you have too much focus on the money, way to much, it won't work out for you. Its all about the process, thats what your focus should be on. You cannot define yourself by the money, how well or bad you are doing, NEVER.

You must learn from your mistakes and what you are doing well too. Learn how to go on to the next trade and not bringing the earlier trade in to the next trade, they have nothing to do with each other.

The process is the management of the trade, your trading rutines before, during and after the trading session. Trading is a lot of work, RIGHT kind of work. You can work a lot, and still dont make a dollar, its because you must make the right kind of work.

You will need to learn:

-Patterns, yes, here you can take brooks trading course, but the real thing about this, is that YOU must learn yourself to see the patterns evolve in real time, thats the hard part of it.

-Learn about yourself. Yes, there no Hokus Pokus here, if you really wanna get good at this, and are thinking about doing it for a living, you must get to know yourself really well.

-Managing yourself while trading. There will be a lot of thougts that doesnt help you while trading, this ones will kill you if you cannot define why they are there.

-Process. Focus on the process, dont even care about the PnL, I dont, and I know other really big trades who dont too. Money is just a distraction. Focus on whats important of the trading, and thats the management while the opportunities are on the screen. You really just are in the moment and not thinking about anything else (talking about daytrading here).

-Now, trade REALLY SMALL, and I mean the smallest you can. You need to get to the point where you at some point are following some sort of process and can do it flawlessly.

You must understand, trading is a lot psychology. Its not just about seeing a lot of charts, back testing and then you got it, if thats how you see it, then you have a problem.

You will always end up doing the same thing again and again.

You really must look inside yourself. Ask yourself, do I REALLY think I deserve to make money?

Trading is just not that simple, you WILL have to get to know yourself, more than any other job in the world.

And you do this by journaling. Journaling is number one, how you do it, is up to you, do what suits you best. Is it a print out on paper?, with comments, and entrys and exits of trades. Is it by just writing down what you where feeling and thinking while doing the trade (this is the key, just so you know) and how did I acted when I was thinking those specific things. You will see when journaling, thoughts and feelings will be reccuring, its a crucial part of journaling.

Make everything to suit you, how you learn the stuffs, your weaknesses and strenghts. You will have to find your Sweet Spot. Thats means, how you function best and can go on like a machine, first in last out.

You will have the answers yourself, and only you can make this changes. It doesnt really matter what we all say and tell you what to do. If you cannot feel or recognize the issues, then it wont happen.

We can only guide you, really important, GUIDE you, but really, its up to you to really think about your issues, stop trading if you have to, markets wont go away, and find out what your problem(s) is. Dont make it harder than it is. Have some thoughts about what you have done earlier, and try come up with what may be the problem. If you cannot, trade really small and be careful and try find out what issues you have in trading.

You cannot solve a problem if theres some sort of stress or you are afraid, you will have to scale down to make this work, doing this will make it easier for you to spot the issues you have.

//Alexander

Retail traders trade CFDs usually because they are underfunded. Are you underfunded?

If that is the case, you should stop trading real money until you have saved enough to trade futures contracts directly. Rags to riches doesn't happen in trading.

Once you have saved enough to trade (for example) 5 ES contracts, trade 1 micro and see how you get on.

Aside from the funding issue, CFDs are a secondary market created by bucket shops, and unlike a regulated exchange, they WILL run your stops and they WILL give you horrible fills, no matter what their advertisement says. They themselves make the market and they can see everyone's positions, stops and limits. What do you think they'll do?