The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi

Can anyone explain what is the importance of looking at different time frame charts like- 5Min(trading chart), 15 min, 1 hour, Daily, weekly & monthly

Is it only to set up the targets of various time frame charts ?

Or there is any other rational for this

Kindly reply as I am bit confused on this

Also let me know, do I have to look smaller time frame charts if I usually trade daily chart ?

I really wish to understand the logic behind referring to these multiple time frame

Hi Tarun,

It's best to do actual trading on one chart only and maybe use higher timeframes for supportive analysis only. For example, if you're entering trades on a daily chart then you would measure where to place targets and stoplosses using price action from the daily chart only. Higher timeframes can assist in analysis to see where are the important levels are such as weekly/monthly gaps and swing highs/lows that act like magnets when price approaches them. Knowing that there is a strong magnet nearby from HTF can keep you from taking swing trades in the opposite direction.

HTF can also give a hint of whether there are more buyers or sellers above or below. For example, 5M traders often reference the 60M bars as those bars are closing. If the 60M bars are alternating like "bull|bear|bull|bear|bull|bear" etc. then one can reasonably expect the next hour to produce a bull bar. This can also be seen on the 5M chart if squeezed together enough, but seeing it on 60M gives you the knowledge that 60M traders are seeing the same pattern clearly themselves. Knowing this you would probably not be taking a swing sell within the next hour.

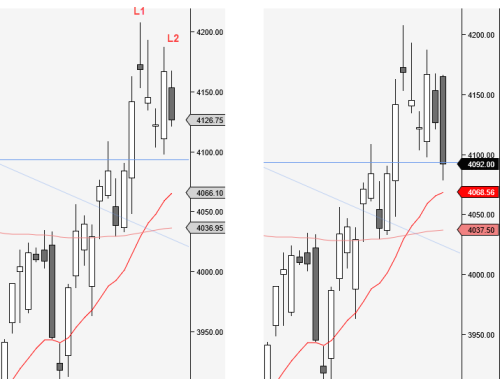

Another example is like today (2/9/23) daily chart that setup an L2 inside bear signal. Traders using 5M charts would probably not be looking to swing long knowing what may happen if the daily bar triggers and you can see what happened.

Lower timeframes can help to fine tune entries but one has to be careful not to place stoplosses on LTF but profit targets on HTF hoping for massive win with tiny risk - mixing timeframes like that is a trap. It's best to always wait for the signal to trigger on your own chart (let's say a buy on the daily) and then monitor intraday charts (5M, 15M, hourly etc) for a pullback and a bull bar that may give a slightly better price. Although one risks missing the whole trade if there's no PB and the market simply takes off.

Hope this helped. Let me know if you want to discuss more or can join us in the Telegram BPA Group for more chatting and questions.

Cheers,

CH

Thanks Mr. Carpet....

I understand & appreciate the detailed reply

I will surely join the Telegram channel...As I think It will surely help me with my practical trading skills

Are certain time frames more/less important/reliable?

example> do most institutions trade certain time frames, making them more reliable

example> are patterns on the 1 min chart less reliable than 60 min

Hi w,

If anyone knew the answer for which timeframes are most reliable then everyone would know it eventually and everyone will go trade them and the edge will be gone and the markets will either be forever in a flat range or shut down because no trader will be on the "bad" timeframes so everyone will be either long or short together on the "best" timeframe and no one will take the other side of the trades.

Price action concepts are the same on all timeframes. Traders will pick the one that

- matches their methodology/system

- matches their brain/personality

The reason to match methodology/system is because different timeframes and markets have different sets of patterns that dominate at different times of the market cycle. The reason to match brain/personality is because some discretionary traders can react OK on 1M timeframes but others need more time for their analysis so they use 5M or higher.

Also, while price action concepts are the same, some markets are more trendy and others are more rangy, for example, compare intraday CL and ES. If a trader is mostly trading wedges or TR FBOs they won't find too many trades for themselves in a market that mostly trends all day and then trends the other way next day. Also, a 5M timeframe from one market doesn't necessarily correspond to similar price action on a 5M from another market, e.g. ES 5M vs Forex 5M. For this reason many traders prefer higher timeframes than 5M when trading FX. Also, if a system is mostly mechanical then it may be easier to use it on 1M charts because the rules are faster to process since most of it is codified, but systems usually focus on only a few setups. On higher timeframes there is more time to apply more analysis and find more types of setups but it's slower. So for everything there is a tradeoff and any timeframe can be profitable if approached correctly.

Is CL mainly wedges in a trading range ? Is CL easier to trade , more profitable, more opportunities ?

thanks

Hi w,

If one market was easier and more profitable then everyone would know it eventually and will go trade it and the other market will shut down because no one will be there. But so far all these markets are busy so people must be making money. Best way is to open the charts yourself and to look at the price action of another market. You will find that some patterns either dominate or are more pronounced in one market over the other. However, is only becomes apparent after becoming very familiar with a market by spending months staring at the charts. For someone still learning to trade it might be best to stay with one market only and master it before branching out.

Hi,

Please watch Video 48K- it will clear out a lot of your confusion.

BTC How To Trade Manual

"Although many traders try to trade in the direction of a higher time frame, this is not necessary. All a trader needs to trade profitably is the chart in front of him, no matter what the market, chart type, or time frame. Every chart has plenty of trades if a trader knows how to spot and trade them."