The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

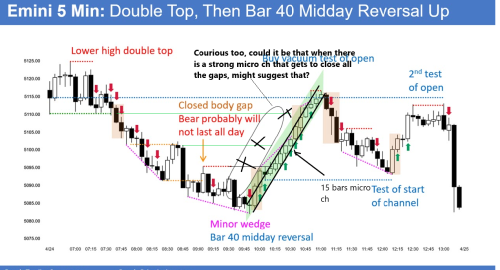

Hi all: Here is Al's EOD chart from Wednesday 4/24 of this past week. I caught none of that bull buy vacuum test of the open in the middle of the day. I was waiting for some semblance of a right shoulder for an inverse head and shoulders to buy and anchor a trade to and I didn't see one form. These type of reversals that are more "V" bottom looking or upside down "V" top always seem to give me problems. Is there a way to know that a buy vacuum or sell vacuum test is occuring before its over? It kind of seems obvious after the fact but while its occurring its not so obvious to me?

Thanks!

Dave

Hi David,

Unfortunately a vacuum test is something that's only confirmed after the fact (strong rejection off a level) and can be guessed at while it's happening only towards the very end (e.g. large climactic bars but bad FT).

V reversals themselves are low probability events so I don't think we can really base a solid strategy solely from expecting such.

However, on this particular day a few things aligned that strongly hinted on a possible reversal at LOD.

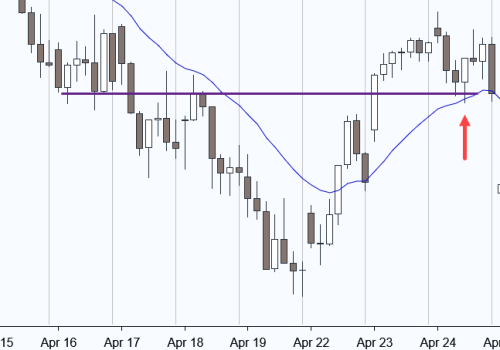

1) The hourly chart had a strong support level matching with 60M EMA:

2) On 5M the reversal started exactly after bar 40 midpoint of the day during which it's common to get reversal attempts. There was a rounding pattern from bar 23 down suggesting dying momentum (breakouts getting smaller and PBs getting deeper).

3) Bars 41,42 right off the 60M EMA are extremely strong.

For all these reasons I think it was reasonable to enter long. No one would be able to predict the strength of the move up to 54 or that it would even reach there. Getting in early and trying to ride at least a portion of the position after scaling out is the best we can do and I think there were hints here helping to enter early.

Hope this helps,

CH

_________________

BPA Telegram Group

O.K. thanks CH. If I had noticed that 60 minute chart bouncing off the EMA like that with a flat top bull bar maybe I would have recognize at least the possibility of a vacuum test. I was just so focused looking for a right shoulder and it kept going and going and going without forming, even a reasonable implied one.

I don't know Mike. I don't pay attention to body gaps in my trading. Double wedge down should get 2T up. 3 gets you 2 pattern normally unless a failed wedge so I was looking for that PB for the right shoulder and the buy which is what normally happens. I guess this was just a low probability event where it didn't really form this time. At least I didn't lose money, just didn't take any in that whole run.