The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

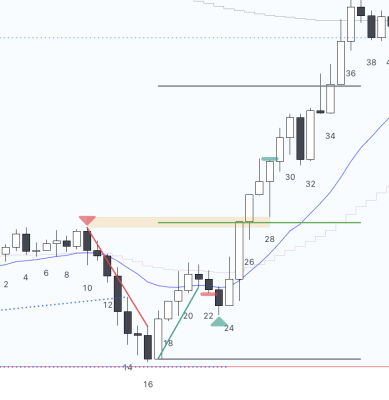

Hi I have question about this trade.

my entry bar was 28, SL below 23.

but when I saw 31 big BRBCL I got panic and breakeven.maybe it was too close to my first target.

I know the market probability is going to become AIL.

bar 28 and 10 had a gap. bar 33-34 hit the first target.

but where's my next target? later turns out price hit 1 risk reward. quite confuse what should I do or manage.

Hi,

when your entry was the green marked BTC B28 and your SL was under B23, ask yourself why you did not stick to your SL? When you

know the market probability is going to become AIL.

Al would say, stick to your SL, I assume.

where's my next target?

it depends if you was looking for a scalp or a swing, from there you should be able to define your possible targets with min. 1:1 or 2:1 depending on you risk.

From my point of view it's depending on a trained mind and practice to stick to the plan, which we have before taking the position. After we are in, the mind tries to confuse us with emotions.

I would have moved the stop 1 tick below the bear bar because often times bulls dont let bears trigger the stop order sell (as in this case)

Thanks Hubert

Can't agree more of what you said.

I found my dilemma was looking for high RR trade and couldn't find a proper way to deal with pullback.

like 5 risk reward (now I think 5 RR is too high should not more then 4) trade required I have more patient to wait for 2nd leg or higher time frame MM target.

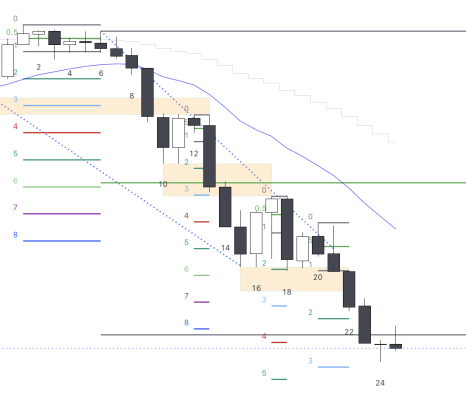

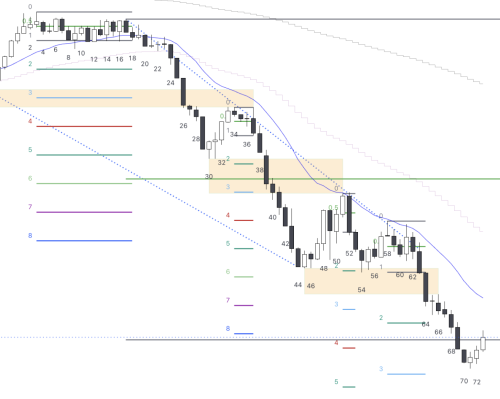

Here's a sample of 5m and 15m. most of 5m sell signal were only 3-4 RR. if I try to ignore the bull bar pull back signal then I need to wait for 6-8 bars to get and trend resumption and new low.

Hi Yang,

why is the RR so important for you when you can assume that even with a RR of 1:1 and a WR of 55%-60% you are profitable in the long run?

If you are able to trade like you wrote

Here's a sample of 5m and 15m. most of 5m sell signal were only 3-4 RR.

with this stats and you have a WR like a coin flip of 50% you will be always far ahead of your losers.

I'm really curious?

After 7 consecutive bull bars and a breakout it was more likely the reversal was minor. While it was okay to get out with a stop below, the stops never got filled. Plus, you had that measured move about which the market was still attempting to reach. I remember al saying once, if you get out of a trade early and find yourself wishing you were still in it, just hit buy at market. You could have just got back in above 32. Either way killer trade man! keep up the good work.

why is the RR so important for you when you can assume that even with a RR of 1:1 and a WR of 55%-60% you are profitable in the long run?

I'm still a beginner right now taking funded trader test. It's my 2nd month taking the challenge. last one was failed😂. But I studied trading for 2 years. I found my last failure mostly because my position management and Don't have enough patient to wait for a swing.

I found most of swing start from tight TR.and I usually trade Forex on Asian Europe US.

I think they are having some kind of connection , try to understand we can have very good swing.

Can I profitable in the long run? I'm not sure yet, but my last week's trade had been stable profiting so I think I have the ability now. but still not good at finding and managing a swing trade.

Now I trying to catch more swing as I can, and swing trade can offset lots of my error that's why it makes me so fascinated.

Thanks Jeffrey, 32 is definitely a entry. but I don't the probability of the market hitting MA. Maybe that's the question I should look into.

Can we say 34 35 a BO of MM target?

I don't remember have Al mention any of it? hope I can find my answer soon.

After 7 consecutive bull bars and a breakout it was more likely the reversal was minor. While it was okay to get out with a stop below, the stops never got filled. Plus, you had that measured move about which the market was still attempting to reach. I remember al saying once, if you get out of a trade early and find yourself wishing you were still in it, just hit buy at market. You could have just got back in above 32. Either way killer trade man! keep up the good work.

I found my dilemma was looking for high RR trade and couldn't find a proper way to deal with pullback.

I can feel you. In swing trade, one the one hand, we're supposed to hold through pullback. On the other hand, we're supposed to get out when our premise is wrong.

If we hold too much, there is a risk that our wide stop get hit. If we get out too early, we miss all the potential profit to make the swing work in long term.

To add to that, every situation is different and we're under more stress holding an open position.

Not sure if this can help you but here is one way to look at it: a high RR trade is more like a swing than a scalp. In a swing, we must hold through pullbacks. Second of all, if you think it's a high RR trade, the probability would be low so expect to loss more often than win. It's because a perfect trade with high RR and high probability can't exist. Smart people would grab them all before they are birthed, and there would be nobody on the other side of the trade.