The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Good question! First, on the open it is very important to recognize that "it is the open". What does this mean?

1. Volatility and market movement from the day before needs to be considered as well as targets.

2. There are potential important reversal times with respect to the open [ please reference Al's training]. You will often hear 50% reversal on the open, no matter how strong.

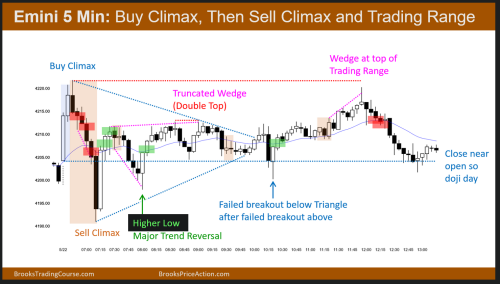

In the first graphic you need to see that the 2 bars cover a monster amount of territory. It isn't 1-2 points. Additionally, they are the largest bars on the chart at that time, by quite a bit. As such an exhaustive move has much higher potential. Also note on the 1st graphic that bar 2 has a nasty upper tail of about 1/4 of the bar. This can not be discounted. It isn't "bars completing on their highs".

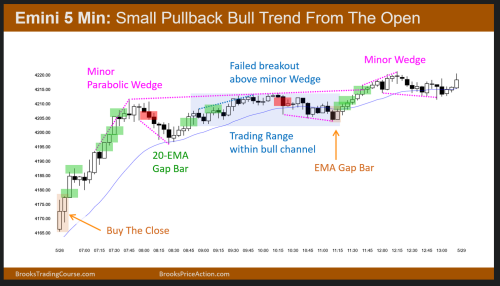

In the second graphic, note reasonable size bars, consecutive bars, the second one closing on its high and above the 1st bar.

The open is much more tricky with the higher volatility on the open so many traders may wait a few bars before taking a trade because of that. However, reviewing the above notes with the graphics, and some additional chart review, you may see how often these aspects occur to build confidence.

Hopefully helpful and good trades to you!

1. Volatility and market movement from the day before needs to be considered as well as targets.

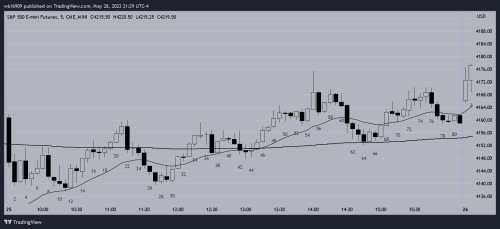

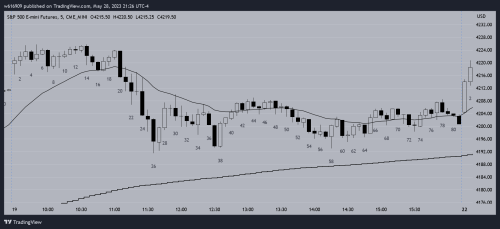

These 2 pictures show the day before + Opening 2 bars. Isn't the Open known for being volatile and having big bars? Is that a reason to avoid a trade ? The May 22 Open is testing yesterday's bar 19 Breakout Point, so with the tail it's a possible TR trap. But it seems to be breaking strongly above yesterdays TTR, prior trend maybe neutralized by that point. I don't see an obvious 1st leg for a "2nd leg trap" and it seems strong enough to have a second leg.

2. There are potential important reversal times with respect to the open [ please reference Al's training]. You will often hear 50% reversal on the open, no matter how strong.

The open is much more tricky with the higher volatility on the open so many traders may wait a few bars before taking a trade because of that.

Yes. It's difficult to figure out these opening setups regarding the "2 consecutive trend bars, one being big and closing on its end- BTC!/STC!". There's lots of examples in the markups where they don't look that great but it's marked up as "BTC/STC". Others, like May 22 above, look strong but then it's recommended not to trade it. Maybe best to have a rule not to trade until bar 6 ?

Please read my comments again reviewing 5/22 and 5/21 at the same time. You will want to look left and review the concept of last trapped traders and consider bars 13/14 & 19/20 on 5/21 against the open of 5/22 :).

If you do the same with the other set and you may note some differences.

On the open things are more volatile, and there are always other trades throughout the day, so there isn't a rush to have to trade. It is a matter of discovering what you can see and execute against, and that comes with time, seeing certain patterns again and again.

Hopefully helpful and good trades to you!

On 5/21,

I think 19 is a BTC bar, also bulls would buy the low of 13 and 19 because they are bad sell signals.

Therefore on 5/22 bar 2 and 3 indicate that Buy-the-Low bulls 19 were able to scale in lower and exit breakeven on their first trade, profit on 2nd. BTC bulls 19 and BTL 13 would still be trapped because price never went 1 tick above those entries.

In the webinars he talks a lot about trapped traders, but I don't remember specifically where in the course that is covered. It's tough to organize and remember the info in the course because it seems to be scattered around in bits and pieces.

Whether trapped traders are able to get out or not isn't the question, as sometimes they can, and sometimes they can't.

The question is, why isn't the next day open bar 2 a BTC bar?

1. Because of the tail and poor finish, especially on the 2nd bar.

2. Need to recognize the resistance immediately above from the day before. Markets have memory. Potentially very cloudy skies :).

Hopefully helpful and good trades to you!

That's way simpler than I thought, and easy to recognize. Thank you

Obviously context helps, but are the daily markups supposed to be recognized without context? And I remember in the chapter on trading the open, he says context is less important on the open. "Anything can happen on the open"

Yes and no.

Technically anything can happen at any time. However, if you are present in the trading room, with any of the presenters, one of the first things you will find is them over viewing important targets from yesterday, HOD, LOD, OOW (open of week), etc. Kind of a "first things first" :).

The increased volatility on the open, and fewer bars (if using RT hours) takes a bit more experience, and part of that experience is targets and distance to targets. 2 bars is the minimum requirement for AI[L/S] (with exception to monster single bars which are much more rare). However, you will want those two bars to be contextually situated well, and well formed to reduce ambiguity, and increase probability.

Hopefully helpful and good trades to you!

Very helpful thank you