The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

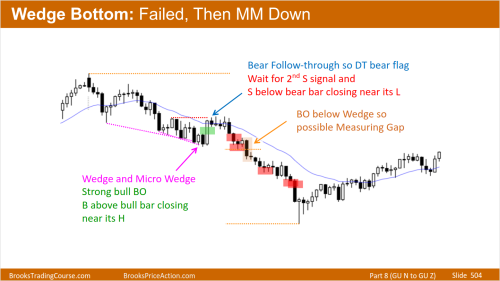

At the highlighted green, beside what’s already said on the slide, it’s a buy that’s not a very good buy because the channel down is tight and quite close to MA. Is this right?

Given that, if I did buy for a swing, when I see the next 2 bars was a big bull bar with bad follow through, is it reasonable to exit bellow this bear bar right here at the possible DT at MA, possible failed breakout out of the tight bear channel? Or it’s better wait for 2nd sell signal?

Swing trade we should hold through pullback right? So waiting for 2nd sell signal so confirm that the wedge bottom expected 2 legs sideway to up correction played out.

Also “wait for 2nd sell signal, S bellow bear bar closing near its low”. What if there was a 2nd sell signal but bad looking like with tail at bottom? Should we exit our long? Should we sell to enter short position?

At the highlighted green, beside what’s already said on the slide, it’s a buy that’s not a very good buy because the channel down is tight and quite close to MA. Is this right?

This trade is a little better than the one we discussed here:

Tight channel down but it is a lower low with perfect SB, and then micro DB, so you have room to the top of the channel and EMA while in the previous trade you were already there.

Given that, if I did buy for a swing, when I see the next 2 bars was a big bull bar with bad follow through, is it reasonable to exit bellow this bear bar right here at the possible DT at MA, possible failed breakout out of the tight bear channel? Or it’s better wait for 2nd sell signal?

Still the bear premise is valid so ok to exit, if it doesn't break first above EMA, below a bear bar closing below the mid-point (here was also a DT). I would not wait for another second entry because this is a DT and, therefore, already a second entry.

Swing trade we should hold through pullback right? So waiting for 2nd sell signal so confirm that the wedge bottom expected 2 legs sideways to up correction played out.

You ride PBs only if your premise is still valid. Here, the bear premise was stronger so holding thru the PB is a mistake.

Also “wait for 2nd sell signal, S bellow bear bar closing near its low”. What if there was a 2nd sell signal but bad looking like with tail at bottom? Should we exit our long? Should we sell to enter short position?

Second entries do not need to be as good as the first ones, if only because by being the second they are already stronger. And even less needed in trends, and that is why many DTs in bear trends with bull SB work...

That makes a lot of sense! Thanks a lot!