The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi, everyone!

I would like to use this space to share a difficulty that I have but that as the days go by, it diminishes. The first step to change is co-initiation.

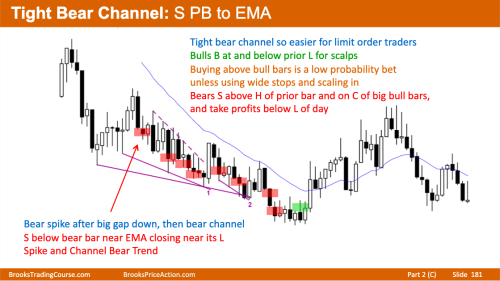

I'm reviewing the studies about micro and tight bear channel and I found here in the encyclopedia an example of something I can't go short, the context is in Part 2: 14.5 Tight Bear Channel: S PB to EMA. I print and draw in purple this chart.

In lesson 44D - Trading Tight Bear Channels (How to sell a Tight Bear Channel; Stops and taking profits; Tight Channel evolves into TR) Al informs you of several ways to go short in a tight bear channel, for example:

a. sell L1/L2;

b. sell Resistence;

c. sell above bars, especially if was bad buy signal bar;

d. sell PB 33-50%;

e. sell at ema or bear tren line

f. sell above first pb bar;

g. sell above second pb bar;

OBS: Other examples can be found in the lesson 44D - Trading Tight Bear Channels but we can see several entries from a - g in this chart.

The point is: I'm always wondering if it's a bear leg in a trend or a trading range, and especially when the market had this context from print 14.5 Tight Bear Channel: S PB to EMA, the market don't have micro gaps and negative gaps, so for my is probably leg in TR but is also a tight channel so bears are strong.

Bears trend is constantly forms wedge bottoms but they are - mostly of the time - bear flags and lead a trend resumption, but especially in this case, when dont have micro and negative gap I've bought these wedge-shaped bottoms several times, as in bar 1 and 2, but it's been a while since I've done that, the next step is to be able to go short in this context, but it's definitely a context that I'm not in the my comfort zone.

Does anyone else also have this difficulty going short in a context like this?

Att,

Does anyone else also have this difficulty going short in a context like this?

Yes, we all have selling near the low with stops in a tight channel, especially when a bear leg in a developing TR is likely. Your buys were not good neither so in a context like this it is very easy to lose money.

so for my is probably leg in TR but is also a tight channel so bears are strong.

Yes, you had a spike and channel where the channel was very tight. This means the first reversal was probably going to be minor and create a PB and, then, you could expect the major reversal leading to a TR around the start of the channel, a trend continuation or even a trend reversal.

I've bought these wedge-shaped bottoms several times, as in bar 1 and 2,

Bad trades, bar 1 is within the tight channel so bad to enter with stops and bar 2 context is better after the break of the trend line, but it is an OU bar with a huge tail above. If you buy it, you have to exit at the L2 at EMA 3 bars later.

the next step is to be able to go short in this context, but it's definitely a context that I'm not in the my comfort zone.

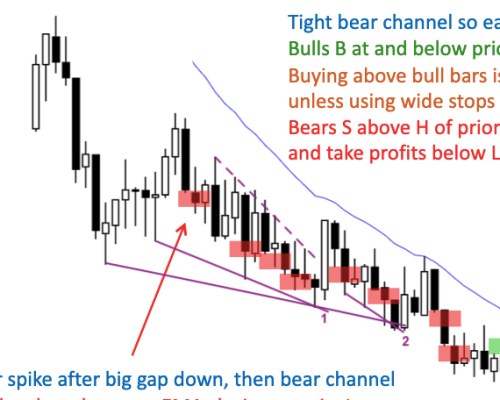

I used to think that way and now sometimes I take some shorts (mainly with limits because rarely you get a great L2 at EMA) but at the time I took a different step that was simply to prepare myself to take the swing long that would come if the "bear leg in developing TR" premise was correct. In this chart it was, and the green rectangle trade was very profitable and easy to take. Otherwise, I was worried about taking bad-looking high-risk shorts all the way down, making mistakes, losing and, more importantly, depleting my emotional stamina only to get exhausted and not taking the long when it finally came. When this happens, we all know how we feel. Very bad.

Instead, I wait for the swing buy not mainly for making money, which obviously is the goal, but to make it without draining my health, which is very important in the long run. And once you take the swings, you can sometimes take easy shorts only if they come.

"Bad trades, bar 1 is within the tight channel "

Bar 1 is a good size bar closing at the top and well above the dash line, isn't the dash line the channel line?

Seeing a big bar with close at the top, I always has temptation to enter at the close of this bar, should we wait for second bar or second entry?

Thanks

Bar 1 is a good size bar closing at the top and well above the dash line, isn't the dash line the channel line?

Yes!

Seeing a big bar with close at the top, I always has temptation to enter at the close of this bar, should we wait for second bar or second entry?

The big bar is the BO of the trendline but this reversal is probably minor so, yes, you need to wait for the second entry.

Instead, I wait for the swing buy not mainly for making money, which obviously is the goal, but to make it without draining my health, which is very important in the long run. And once you take the swings, you can sometimes take easy shorts only if they come

It is a great strategy, I will certainly try to apply this thought, after all a great trade is never late.

I agree with everything you said, especially about the emotional exhaustion of resistance.

We talked about it and yesterday at emini we had a very similar situation at the opening.

Thank you so much for taking the time to respond!

Bar 1 is a good size bar closing at the top and well above the dash line, isn't the dash line the channel line?

Yes, and this is the first break of that trend line so you can buy for a swing after the test down that will probably follow. Strong bull bars near EMA in bear channels are usually traps.

Seeing a big bar with close at the top, I always has temptation to enter at the close of this bar, should we wait for second bar or second entry?

As you can see in the picture above, bears sold any strong bull bar near the EMA and below the next bear bar. Strong bull bars in bear channels are many times traps, so you definitely need to wait for a second entry with room to the EMA or, alternatively, several consecutive bull bars, not just a second bar (switching to AIL), before buying with stops.

Thank you so much for taking the time to respond!

Happy to help!

Sorry to hijack your thread Filipe, but there's something I would like to ask @ludopuig regarding this if you both don't mind.

Is this a good signal bar to get long above? From my perspective, we have nested wedges (the one drawn on the chart and a wedge with the first bar of the day as well, a micro double with bar before bar 1 and second entry bar after the first breaking out above the tight bear channel, and the signal bar look extremely good tail at bottom closing in its high.

I would have definitely take this and probably suffer a loss as a result. Is this a reasonable long?

After suffering from the loss above, here I would see a strong 2 consecutive big bear bars closing on low breakout bellow bar 2 low of day. Next is a good follow through bear bar making it 3 consecutive bear bars. I would truly be hesitated to go long here. What do you think?

Thanks in advance.

I would have definitely take this and probably suffer a loss as a result. Is this a reasonable long?

With the bears selling the close of the bull bar (bar labeled 1) breaking above the channel and next bar being a bear bar, the bear channel premise is still holding and you are buying relatively high (= above the prior low with a stop).

Next is a good follow through bear bar making it 3 consecutive bear bars.

Yes, it is a breakout below a wedge, so the theory says 50% it gives a MM down and 50% it reverses, but after adapting for the chart's context, the probability favours a reversal because we have a very clear bear spike and channel pattern, so a test of the beginning of the channel is likely, and we are around the middle of the day.

I would truly be hesitated to go long here. What do you think?

The three consecutive bear bars are an attempt to increase the strength of a trend that started more than 20 bars ago, so it is climactic. Finally, you had a micro DB (2 bars before the green rectangle circle), followed by a close on the high signal bar for the wedge. When taking reversals, I always think contrarian: if I were a bear, ¿would I exit above this bar? Indeed I would run to the doors, so it is a good buy.