The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

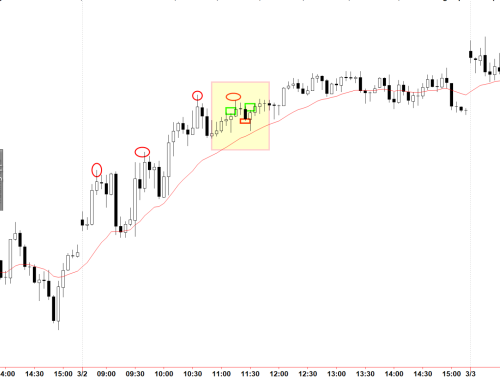

On Wednesday March 2, 2022, there was an H2 buy(in my opinion, as an amateur trader) at the close of the bar at 9:10 am PT. However, there is a bear bar at the close of the bar at 9:25 am PT, which appears to make a DT, first top being the combination of 8:35-8:45 am PT bars.

My question is, how do you trade this, or determine which signals will be more relevant? I am faced with this situation almost daily, analysis that appears to show a DT vs a DB-PB, or a DB vs. a DT-PB. Thank you so so much for your help!

Al gives his deeper bar-by-bar analysis of those bars in his other website (the Brooks Price Action website).

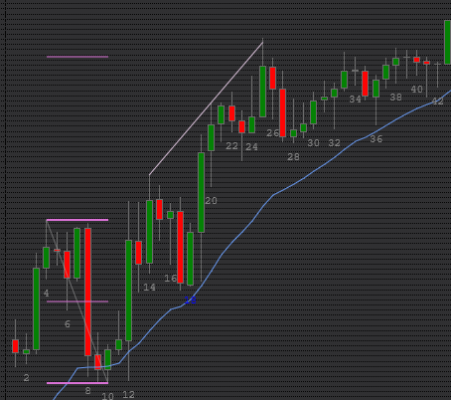

If i understand your question correctly (not quite sure), part of his analysis mentions that bar 35 was a reasonable but low probability sell swing signal, in bullish context.

I would honestly also have thought this is a good H2 buy. Yellow line is 21 EMA, Al uses 20 EMA.

This is what Al says on the other website about the signal bar and following surprise big bear bar:

7 - BLBC(Bull Bar Closing near its high), but top of TTR(Tight Trading Range, limit order market, bad for scalping with stop orders. Most traders should wait.), far above MA(Moving Average. Assume 20 bar EMA unless I say otherwise.), PS(Possibly or possible) SA(Sellers Above, or probably sellers at the high of the bar and scaling in higher), B2(Weak Trader's Equation so most should wait for higher probability, like 2nd buy signal or a couple consecutive big bull bars closing near their highs. Else need big reward to offset low probability. Some will use wide stop and scale in.). DT(Double Top, or two consecutive bars with identical highs) 4, ET(Expanding Triangle) 43 68, but BLB(Bull Body), S2(Weak Trader's Equation so most should wait for higher probability, like 2nd sell signal or a couple consecutive big bear bars closing near their lows. Else need big reward to offset low probability. Some will use wide stop and scale in.) or S(Sell or Short, depending on context) eblwo NL(NeckLine) 6. B(Buy or Long, depending on context).

8 - SBD(Surprisingly big bear bar or bars closing near their lows, so probably will get at least small a 2nd leg sideways to down) from DT(Double Top, or two consecutive bars with identical highs) and ET(Expanding Triangle), PH(Possible High of day or swing high, reasonable sell setup. Since it is a reversal trade, it is not high probability so it is a swing setup), but at 60MA(60 minute 20 bar Exponential Moving Average) and MA(Moving Average. Assume 20 bar EMA unless I say otherwise.), and near 50P(50% Pullback). PP(Probably or probable) will get 2LSD(Two Legs Sideways or Down), but TR, better to wait for breakout or 2nd signal since low probability, bad for stop entries.">BBBR(Big Bar or Bars so Big Risk. If you take the trade, trade small enough position size so that the risk of the trade is no bigger than on any other trade. If in Tight TR, better to wait for breakout or 2nd signal since low probability, bad for stop entries.).

If i understand your question correctly (not quite sure), part of his analysis mentions that bar 35 was a reasonable but low probability sell swing signal, in bullish context.

Not sure I understand neither. We are all in different time zones so it is more difficult to know what you are referring to if you use time to refer to especific bars. If you don't mind, please, use bar numbers instead so we are all on the same page!

I would honestly also have thought this is a good H2 buy. Yellow line is 21 EMA, Al uses 20 EMA.

I would recommend not buying that high on the open unless it is all perfect because on the open no matter how strong, moves reverse abruptly.

Central time. March 2, 2022

1st of all: thank you all so much for your help, even after my confusing question.

2nd: this picture doesn't look promising but I'm going to send and see if it enlarges when I click on it.

*The yellow highlighted area is what I'm wondering how to manage.

*I feel like the green boxes are buy setups and the red box is a sell, but I'm also trying to structure a swing...in the correct direction

*I guess what I questioning is, if you see a DB-PB(or H2), but then a potential DT, but then another bar that looks like a better DB-PB, what are the determining factors to stick with one or the other so you aren't getting caught switching too much...maybe the previous trend? Pushes up? But if you look at the red circle/ellipses, we have 3-4 pushes up.

*Maybe after 3-4 pushes, I should have looked for the DT, and when that failed then reverse to the upside...that would have offered very close to a 1:2 risk/reward trade.

*But my thought on this day was, by lunch time here, this is likely a trend day. Appreciative of any thoughts/feedback.

*I feel like the green boxes are buy setups and the red box is a sell

Green boxes are a ok buys in a tight bull channel but for the same token the sell is low probability: a doji SB after 7 bull bars in a trend up.

*I guess what I questioning is, if you see a DB-PB(or H2), but then a potential DT, but then another bar that looks like a better DB-PB, what are the determining factors to stick with one or the other so you aren't getting caught switching too much...maybe the previous trend? Pushes up? But if you look at the red circle/ellipses, we have 3-4 pushes up.

The whole context, refer to the attachment below. 26 was a Wedge at the MM from the opening range so bears tried for a reversal. LP because there were a lot of strong bull bars on the way up so bears would probably need a second entry. Bears needed to show up but when 26 closed it was a doji, so probably it was going to create another PB, if anything. 34 was the second entry short but bears allowed 7 bull bars in a row, and again 34 was a weak SB, so this also was a LP sell. 35 trapped bears, same thing than did 27, so bulls could buy 30H and 36H BO PB where bears would be exiting. In this context, the bull case was stronger than the bear case so you should have gone with the bulls.

Same thing on the open, you had DB 2 10 and DT 7 14 and then DB PB 18. Here abrupt swings up and down with similar strength for both but above EMA and compare bull SBs (2H, 10H, 18H) with their bear (5L, 7L, 15L) counterparts. Bulls were clearly stronger and being above the EMA after strong bear failure to break thru it made the 18H a great buy.

*Maybe after 3-4 pushes, I should have looked for the DT,

Sure, you always have to have both sides' case in your mind, so once the MKT reached the MM and created a Wedge, you had to assess but this day once you saw that the bears couldn't create a good top, you can't sell.

Thank you! That's great analysis and I really appreciate your help and knowledge.