The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

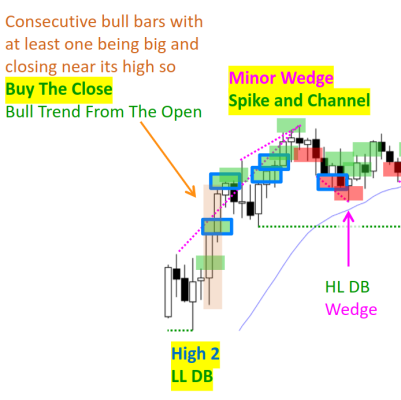

Bar 20 was marked as a best trade short. Was it because of the parabolic wedge top (however, was labeled as Minor Wedge not Parabolic Wedge)?

Al said something like "Strong attempts by the bear in strong bull trend would probably become bull flags". I don't see prior bull trend line break. The market still look Always in Long.

Therefore, I understand how this trade can be a strong swing short.

Full day chart:

Am I missing something? Can anyone help me clarify?

Thanks in advance!

As a swing stop short it has: a wedge top, DT, good follow thru, v good signal bar, plenty of room to the day's 50% pullback line (dotted). But the 50% line is only R:R 1:1.

(In hindsight it got to the 50% line,but that's all.)

Is it a 'best' trade; this is always individual judgement. 😀

This is just my opinion and I could possibly be wrong.

The pattern formed within bar 18, so still qualifying it for an early morning reversal. The risk is small and the potential reward is huge. That's a good trader's equation.

Wedge on the opening + Micro DT, room to the EMA and the hesitation on part of the bulls on the third leg up. I think it is a reasonable short. I'd obviously expect bad FT and expect to get out when the market goes sideways instead of down.

Also, since it still falls within the open of the day pattern, nothing is as bad as it looks and nothing is as good as it looks. So, despite a tight bull channel (spike on a HTF), the wedge top is a potential candidate for the HOD. As you can see, it remained the high for the next couple of hours.

Yes, as bars 16-18 often form reversals.

"Bar 20 was marked as a best trade short." My understanding is that the trades marked with a coloured box AND a blue outline are seen as good swing trades. Or should I say, trades which could potentially lead to succesful swing trades. Al says that often one starts out hoping for a successful swing but has to settle for a scalp. At the moment this is what I am taking from the course is that one often has to settle for what the market will give you, not what you hoped it might have given you.

Thanks Graeme, Gwynfor, Abir!

But the 50% line is only R:R 1:1

That was my concern as well because it seems the profit potential is limited for a swing.

Is it a 'best' trade; this is always individual judgement.

That's true but since Al marked it as best trade and I don't understand so I'd like to find out what I'm missing.

Al says that often one starts out hoping for a successful swing but has to settle for a scalp

That's right but what I was trying to get at is what triggers the "starts out hoping for a successful swing" in this case. In other word, what's the premise?

a wedge top, DT, good follow thru, v good signal bar

The pattern formed within bar 18, so still qualifying it for an early morning reversal. The risk is small and the potential reward is huge. That's a good trader's equation.

Wedge on the opening + Micro DT, room to the EMA and the hesitation on part of the bulls on the third leg up.

Good points! That makes sense.

the potential reward is huge

Hi @Abir, might I know where do you see the potential targets? I see EMA and 50P but they doesn't seem far enough for a swing? Thanks!

Hi @Abir, might I know where do you see the potential targets? I see EMA and 50P but they doesn't seem far enough for a swing? Thanks!

You would be right in thinking that 50P and EMA would be potential targets and that is how the markets turned out. That is where I think the higher probability of occurrence lied.

However, like Gwynfor mentioned, it is often about knowing and managing your expectations from a trade. If you're a trader who is interested in taking only 1-3 swing trades like Al mentioned, then this trade is probably not for you. Better odds would be to enter once you've had the BO.

In this case, if I'm entering this trade, since the pattern is in the opening third of the day (first 18 bars), and if the W top in fact turned out to be the HOD (80% odds of either the H or L ending up as the HOD/LOD), I'd expect the market to test somewhere near the low if not break below it.

Thanks @Abir,

In this case, if I'm entering this trade, since the pattern is in the opening third of the day (first 18 bars), and if the W top in fact turned out to be the HOD (80% odds of either the H or L ending up as the HOD/LOD), I'd expect the market to test somewhere near the low if not break below it.

This makes sense and made very favourable trader equation indeed.

What do you think the % odd of this trade to reach test somewhere near LOD is? Since the profit potential is big and there seem to be problem so maybe 30%?

If you're a trader who is interested in taking only 1-3 swing trades like Al mentioned, then this trade is probably not for you.

My understanding is that these blue boxed trade are recommended for beginner. Is that not really the case? So beginner should really consider 1-3 swing trades from these blue boxed trades (so just a subset of the blue boxes are good for beginner)?

What do you think the % odd of this trade to reach test somewhere near LOD is? Since the profit potential is big and there seem to be problem so maybe 30%?

If the market was post first 18 bars and had crossed the HOD, the probability of a new LOD would be 20%. Since, that is not the case here, it can be assumed that the probability isn't as low as 20%. This setup doesn't appear to be as high as 40% either(maybe it is since on the open). So, yes, 30% could be a reasonable estimate.

My understanding is that these blue boxed trade are recommended for beginner. Is that not really the case? So beginner should really consider 1-3 swing trades from these blue boxed trades (so just a subset of the blue boxes are good for beginner)?

Yes, they are absolutely beginner setups. Al himself says so. So, there's no doubt about that. However, I think these are beginner setups because they need very little management and have great trader's equation. You can see though, these blue box trades are marked more than 3 on almost all the days but Al says that a beginner should take 1-3 swing trades a day. I think it would be reasonable to conclude that there is still scope for you to filter out fairly bad setups among the blue box trades as well.

I have a habit of overtrading, and that eats into my profit. Ever since, I started waiting for only the best setups, my trading frequency has decreased but my overall profitability has increased.

That makes sense! Thanks Abir!