The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi,

I was hoping to see if my thought process made sense with respect to how I am analyzing and trading the open.

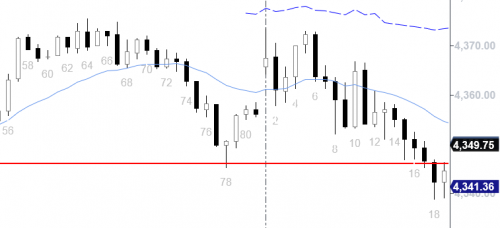

The red line is yesterdays low. I went short with a stop order below bar 6, market was selling off from prior session at that resistence. Maybe an early high of the day double top which I had suspected as an option after looking at the daily chart. On bar 10, I place a buy stop one tick above that bar, big bull reversal bar so I thought its reasonable to exit if my buy stop was hit. My stop wasn't hit and I held short until bar 19.

On bar 19, I see that we have a bull buy signal bar looking to reverse up from yesterdays low. I place move my Buy stop one tick above it. However, I can also see a scenario where traders see a tight bear micro-channel and expect a 2nd leg. Sometimes I have conflicting ideas of whether or not to hold short for a swing down (expect a 2nd leg down as it's curling away from EMA) OR trade in a manner where I'm cautious at the open (strong breakout in opening range, 50% of the time it can reverse).

Is it reasonable to sell here or would you hold short instead?

Since I had sold in 19, would it have made sense to place a sell stop order below bar 23? Or would it had made sense to trade the breakout on bar 25 because on bar 23, it was following bull bars.

Thanks again.