The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

This question is about the 3rd section on sell the close bear trend that is found in video 41.

After the break out of the triangle and the market transitions into a sell the close bear trend, a trader would be short. However what makes the trader not exit after the big bull bar that comes after the sell the close bear trend?

In the section on managing loses there's a video on exiting when good trades go bad. It says that if there is 1 strong bar in the opposite direction of your trade, to not wait for stop to get hit, and instead exit early.

On video 41a section 3, Al says that beginners should just hold through the pullback. Why does the rule on exiting after 1 big bar that goes against your trade not apply here?

Thank you!

However what makes the trader not exit after the big bull bar that comes after the sell the close bear trend?

If he sold for a swing anywhere within the bear spike, he has to hold thru the PB.

It says that if there is 1 strong bar in the opposite direction of your trade, to not wait for stop to get hit, and instead exit early.

Yes, but this would be scalping.

On video 41a section 3, Al says that beginners should just hold through the pullback. Why does the rule on exiting after 1 big bar that goes against your trade not apply here?

Al assumes beginners should not scalp, and therefore he recommends to hold.

So if a trader is short and looking for a swing trade in a bear trend, then there are 3 strong bull bars that are now making the market always in long, the trader should just wait for their stop to get hit instead of getting out early?

Nop, if the MKT goes AIL your premise is wrong and you can exit but in slide 25 this didn't happen so the swing shorts stayed short.

You konw how Al says his fantasy is to buy every signal in a Buy the Close trend? Mine is "hold[ing] until either there's a reasonable sell signal or until the end of the day." Why is that so difficult for me? I desperately need to learn to rely on my stop and let my profit grow! 😭

My question is with regard to slide 2, around 1 minute into video 41A. There is a strong upside breakout. However, it has not yet cleared the price range of the previous day. And Al says something like ' it is obviously the start of a strong bull trend.' That confuses me since elsewhere, he repeatedly hammers the point that any strong move within the range of recent bars should be considered to be in a trading range. So what am I missing here?

My question is with regard to slide 2, around 1 minute into video 41A. There is a strong upside breakout....

Quite fair to be concerned about a pullback here, and that is actually what happened (slide 4). Al noted that being a breakout it had a 60% chance of success - which was the case but you had to wait on a pullback. This is very common as many would indeed be shorting on possible resistance from previous day as you note.

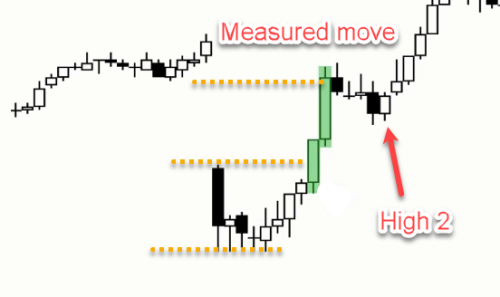

Also, many would exit longs from earlier long trades based on measured move from opening reversal - see below. The trend then continued after a strong High 2 - see below.

Al's analysis here is correct when holding a breakout premise as long as stop is far enough away. But many beginner traders would not be able to hold through the pullback.

So, you are right to challenge this view and it shows you are seeing more in the market than a simple breakout, good. See my screenshot below which shows how I would have interpreted this in real time. If the pullback had not happened you would have been left behind and kicking yourself for not getting in - which is the point of Al's slide 2 - we must buy! Such is trading! We really cannot predict 100% what will happen next. 😱

Understood sir. Thank you for clearing my doubt and I appreciate your kind attention.