The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi!

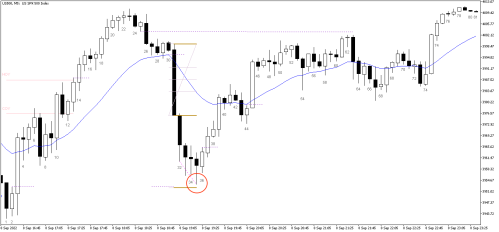

I would like to bring an observation that I had today (08/09/22) in the emini that was very similar, at least for me, against the first part of the class of this video (40D). If anyone else has any comments to make about this, I'd be happy! 🙂

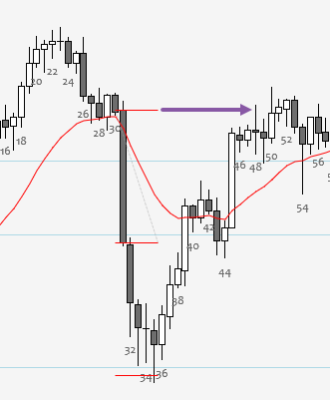

OK, let's go! The first part of the class consists of disappointed bears. On slides 2, 3 and 4, Al gives an example of an STC that has a break with a long bottom tail and then sellers will no longer enter the close (only if they scale higher).

After the slash with a huge tail sellers tried to exit with a small 2 point profit but they fail, then go up to try to make 1 point profit but aggressive buyers notice the 2 point profit failure and so enter higher too, not allowing sellers to earn a point profit. (the class is much more complete than just this short summary, this was to introduce what I saw that was similar today).

Let's look at today's chart, we had a huge bearish bar (bar 31), I considered it to be a surprise bar that had continuity and ended up forming an STC, but see how at 33 we already had a huge shadow, at 34 and 35 too . In this example, unlike slides 2, 3, and 4, the market has dropped below the first break bar BUT look at how the market has not reached the projected move from bar 31.

Aggressive buyers did not allow the projected move and protected the microgap from the bar 2 high. They protect also low of day (bar 1).