The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

vid 40b slide 11, around 13:30, talks about how you can scale-in when disappointed and get out breakeven on the entire position, or if you are lucky, you could get out with breakeven on the 1st entry and a profit on the 2nd entry. The part I struggle with, is that when trading real-time, and setting limit entries to exit, you have to pick a price for your orders. The only way to exit at your first entry, is to NOT take the breakeven exit for your entire position as it first moves through that price. So that means you are sitting with a limit order at your first entry, and sometimes the price will go to your breakeven on entire position and then reverse, leaving you in the dust. So it would not be fair to use hindsight and say that you could have exited breakeven on the entire position, when real-time you are trying to get back to breakeven on the first entry (or vice versa).

Later on in the video Al does mention that you could have your order ready at the original entry price and if the market comes close to that price but then reverses, then you take the breakeven exit. So I think that case is reasonable, but sometimes this seems difficult trying to judge whether or not the market has completed its attempt down with all the back and forth wiggling the market tends to do and you might miss the breakeven exit completely, or take the breakeven exit when the market intended to come all the way to your first entry.

So, how do you all suggest managing the trade?

Hi Dan,

As always context makes all the difference. For example, today was a good example of trapped bulls at B68 close (A). If they then scaled in above 70 or 72 their BE was at around (B) and you can see what happened. Why were they not willing to hold for BE on the first position too? My guess is there was only 30mins left to session. They probably wanted out immediately and weren't willing to sit through a deeper PB into EOD and have time run out on them.

Regarding your question about close enough, consider trapped bulls on 8C. If they scaled in above 18 or 22 their BE midpoint was fulfilled easily. Yet when it came close to 8C there was hesitation and profit taking before touching it. My guess is, they were already quite in profit after passing BE some distance below so that even if they took a small loss on their first position it wouldn't offset their ultimate win by much. Many probably continued holding for BE on the first position anyways because the move up was a micro channel so can expect first break to be MRV.

So in general, the question of whether to continue holding for BE on the first position comes down to what can a trader reasonably expect given the context. It's intricate and different for every situation. If you have more question feel free to post here and I'll be happy to give feedback.

Hope this helped and let me know if you'd like to discuss more.

Sincerely,

CH

That makes sense, that you have to make a judgement call based on the situation as to what to target.

So let's talk about managing it once you decided on what to target. And I know again even after you set your exit orders, the management will still probably vary based on the scenario. Let's say you decided that looking for the breakeven on first entry was appropriate, and the market went a few ticks above the breakeven on entire position. At this point, is it reasonable to move your stop loss to breakeven on the 2nd entry? This way, if it does turn against you again before reaching your take profit orders, you don't risk too much?

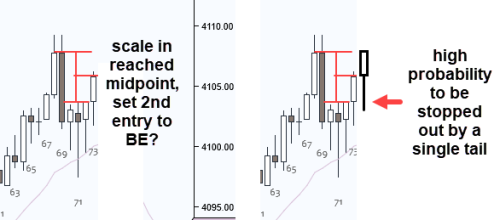

I think the decision whether to move 2nd entry to BE is partly affected by volatility and distance.

For example, bulls who scaled in above 72 reached their midpoint. Do they set 2nd entry to BE now? It's pretty tight overall in this pattern. So tight that a single bar covers a lot of range inside this formation. It would be a shame to get stopped out by an errant tail with nothing having changed in the market yet. Things also get especially volatile around midpoints as many traders are exiting for BE while others entering for scalps to capitalize off the trap. So it's a high chance of bars bouncing up and down. I wouldn't want my stop to be sitting too close to the fire in that case.