The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Before expecting a major reversal, Al says to look for buying or selling pressure in a minor reversal.

He says that 5 bull bars in a bear trend is a good sign of buying pressure. Do those bull bars have to be consecutive? I've always just looked for consecutive.

Also he says that 10 bars in a pullback are also good signs of pressure. are these bars allowed to not have a pullback between the previous bar?

Thank you.

There are many ways the pressure can build up but you will get 5 CC bull bars only in the strongest minor reversals. They could be weaker or non-consecutive bars but in a microchannel, or many other forms... and the PB from the minor reversal that last 10 or more bars can also have many different patterns (Wedge or any other).

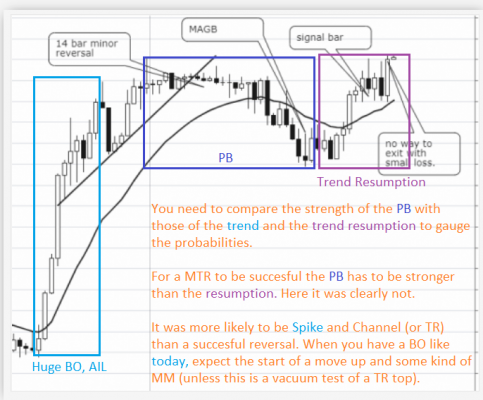

The 5 CC bull bars were strong enough to make the MTR very LP. It was AIL and more likely that the trend was resuming up so there were buyers both below your SB and the second entry two bars later.

MTRs will fail when the break of the trendline is weaker than the attempt to resume up, like here. Add to that that the initial BO (bottom left of the screenshoot) was really strong (7 CC bull bars, some of the very good) and you have to conclude that the 14 bar minor reversal was more likely to be a PB than the minor reversal that precedes a major one. Therefore, at best, bears can get a TR, not a succesful MTR, until they start getting more pressure.

MTRs will fail when the break of the trendline is weaker than the attempt to resume up

This is very good information, thank you for sharing.

I'm curious about different ways that we can see a weaker attempt to resume up. I think one would be a strong break of trendline, then a wedge on the attempt to resume up. Do you know of any others?

Thank you for taking the time to respond as always 👍

I'm curious about different ways that we can see a weaker attempt to resume up. I think one would be a strong break of trendline, then a wedge on the attempt to resume up

Yes, this is a very common occurrence.

Do you know of any others?

A DT would also do, the thing is in the details and this is when the encyclopedia becomes handy... many MTRs there to study!

encyclopedia becomes handy... many MTRs there to study!

Does it include forex slides? Also how many conventional MTR slides does it include. I'm looking into buying it.

About MTRs, a little less than 200 slides (in encyclopedia only EMINI examples)

Are those 200 slides applicable to forex trading as well?

Yes, I find infinitely more useful the encyclopedia if you trade the emini but same PA concepts apply to forex.

Yes, I find infinitely more useful the encyclopedia if you trade the emini but same PA concepts apply to forex.

Yes. Al creates the vast majority of slides (near all) without any reference to market or timeframe as the PA concepts do in fact apply to all instruments. Forex trading ranges will often be much tighter than the Emini, but again, same concepts for breakout, etc, apply.